Asian Paints Limited (NSE: ASIANPAINTS) is India’s market leader in paints which is driven by its strong consumer-focus and innovative spirit. The company produces a variety of paints for both decorative and industrial use in addition to wall coverings, adhesives, and services. The business offers kitchen and bathroom products and is also active in the home improvement and décor market. The company expanded its portfolio by adding lighting, furniture, and accessories. Asian Paints offers a variety of sanitizers and surface disinfectants in the health and hygiene segment.

Q2 Earnings

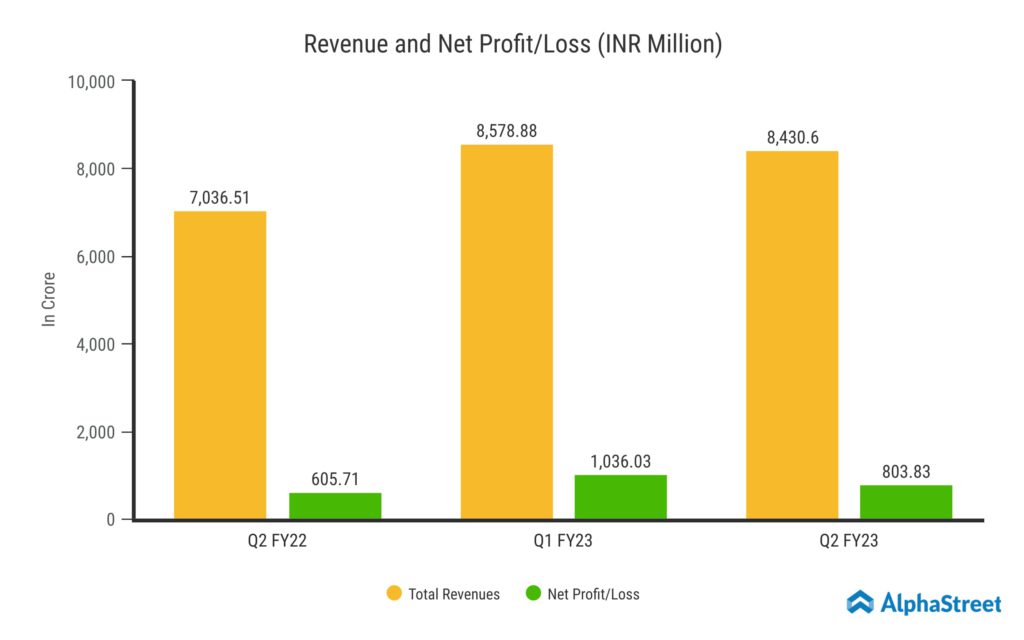

Asian Paints Limited reported a Revenue from Operations of ₹8,430.6 Crores, a significant boost of 19.8% growth from the previous year. Despite extended monsoons till October, across the country, the company posted logged in a double digit Revenue growth. The Consolidated Net Profit for the business increased by 32.8% year over year, to ₹803.83 Crore from ₹605.17 Crore. The Net Profit margin is at 9.5%, expanded by 93 basis points year on year. Earnings per Share is ₹8.16 for this quarter.

Double Digit Growth in Decorative Business

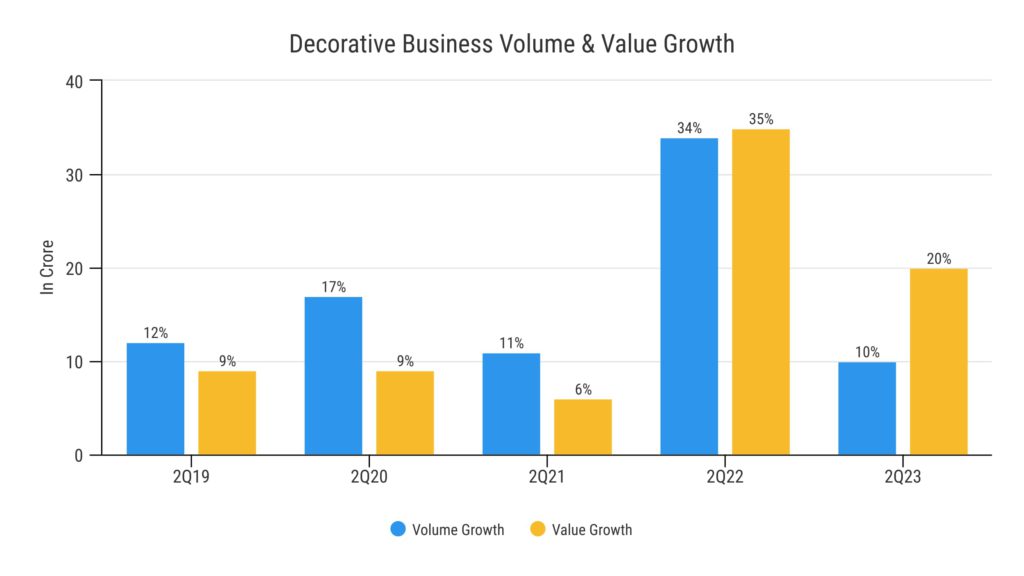

Due to increased sales of premium and luxury goods, the Volume and Value numbers of the decorative business climbed by 10% and 20%, respectively, in Q2 FY23. The T3 and T4 regions, which lagged behind in the last fiscal year, have seen an improvement in growth. Overall, the economic emulsions, which to some extent were the undercoats, predominated the product mix in Q2. However, due to the significant price increase over the past six months, we saw considerable downtrading in terms of Luxury, Premium, and certain Economy products. Additionally, it included a number of high-end and luxury goods that were expanding at a decent rate.

Overall, the Decorative Business has posted industry-beating growth with consistent market share gains.

Introduction of New Products in Q2

This quarter, the company unveiled 4 new products. First up is “Glitz Ultra Matt,” an elite product with self-healing capabilities. After the enormous success of “Royale Glitz” ultra shine, this product was introduced. The second product is “Tile Coat,” a premium product that expands the field of tile water proofing. The third product, “Ace Power+,” will assist in moving customers from an economy-level to a premium-level category. The final product is “Tractor Sparc,” an enamel product with new technology that should have a significant impact on people’s decision to switch from an unorganized brand to an organized brand.

Expansion of Retailing Stores & Services

Asian Paints’ investment in retailing ensures that customers all over the country can easily access the company’s products, setting it apart from the rest of its competitors. This year, the company has already added about 8000 new retail locations. Apart from retailing, Asian Paints has the largest painting service in the world today, with a presence in over 628 towns in India. This painting company has performed well, expanding almost at a rate of 100%.

Asian Paints has also created a house renovating brand which is named as ‘Beautiful Homes’ service which have more than about 60 to 80 Lac people who keep on coming on to this platform. Last year, the company had about 29 Stores of it and added 7 more stores this year. The stores are a one-stop Décor shop where the customer is going through a combination of physical plus a digital experience. The beautiful homes house all the categories like lighting, furniture, Rugs and floorings. Moreover, the platform is coupled with ‘Beautiful Homes Service’ a personalized Interior design execution service which helps people to convert what they are thinking, their choices into the actual home.

Updates in Home Improvement Business

The Home Improvement category has two segments, one is Kitchen solutions and other is Bath solutions. As of Q2, in terms of top line the Kitchen solution segment has posted a growth of 14% and overall growth of about 35% in H1. Whereas, the Bath business has also grown by 11% in this quarter and 51% in H1.

The components business, which makes up a sizeable portion of the overall kitchen business, did not perform well enough to significantly impact the bottom line. As a result, there is a small loss that is apparent in the overall bottom line of the kitchen business. The management is optimistic that things will get better as we move forward in the second half of FY23. The bath business overall in Q2 had a break-even, but at half year level there is a profit of ₹5 Crores.

Asian Paints’ International Business

The company’s International Business has increased by 15.5% with performing well in all the geographies. The performance of Africa and Middle East stands out while the Sri Lanka’s condition pulls some of the growth. The International Business reported a significant increase in PBT of ₹43.5 crores compared to a loss of ₹16.7 crores last year. The PBT is about ₹81.4 at the H1 level compared to a loss of ₹28 Crores the previous year.

Asian Paints looking at a backward integration by getting into the manufacturing of white cement with an investment of ₹550 Crores in Fujairah, UAE. The company is putting up a Joint Venture with 60% majority ownership by Asian Paints to put up almost 2.65 lac MT, per annum capacity of a white cement and white cement clinker plant. This white cement is a key ingredient which almost makes 19-20% of the putty.

Other Investments & Acquisitions of Asian Paints

Asian Paints is investing ₹2100 Crores over the next 3-4 years for setting up an installed capacity of 1.5 Lac tones per annum for the Vinyl Acetate Ethylene Emulsion and 1 Lac tones for the Vinyl Acetate Monomer which is the key ingredient for Vinyl Acetate Emulsion. A multibillion dollar US company named Kellogg Brown & Root LLC is strategically collaborating with the company to help them build this plant. This technology is not widely available in India and is only held by three to four players globally and this would be a game changer in the market.

The company is , acquiring a 51% stake of ₹12.75 Crores in Harind, specialty chemicals company that has a NexGen nanotechnology as its core. An additional stake of 39% in this company should be acquired over the next five years. Moreover, 2 companies – ‘White Teak’ and ‘Weatherseal’ has also been acquired recently. ‘White Teak’ was a complete lighting solution in terms of the decorative lighting, like chandlers, pendants and other lights. Weatherseal is a pioneer in manufacturing of Best uPVC Windows and Door systems. Both these acquisitions combined will created a strong synergies for ‘Beautiful Homes stores’ and ‘Beautiful Homes Service’.

Our Viewpoint:

Despite the challenges posed by the prolonged monsoon, Asian Paints has demonstrated strong performance across all boards. The company introduces brand-new, cutting-edge products every three months that are of the highest caliber. Additionally, the efforts to expand retail have led to a massive network presence across the country. The business is also diversifying into vertical integration, such as the production of Vinyl Acetate Emulsion and White Cement. The strategic acquisition of Harind will help with their R&D while the acquisition of Weather seal & White Teak will provide synergies for ‘Beautiful Homes stores’ and ‘Beautiful Homes Service’. All of these initiatives will lay a solid foundation for the business’ growth in the years to come.