Arvind Fashions Limited (NSE: ARVINDFASN) is flagship company of the Lalbhai Group. Through its brand portfolio, which includes US Polo, Arrow, Calvin Klein, Tommy Hilfiger, Flying Machine, and Sephora, the company is supporting India’s booming fashion aspirations. The company has a strong presence in India, with 1300 stand-alone stores and 5000 departmental and multi-brand stores in over 192 cities and towns. The company’s dominance in the fashion industry is supported by a very effective warehousing and distribution system. Arvind Fashion has developed top-of-the-line capabilities in retail operations spanning formats due to its well-established experience of retailing.

Q2 Earnings

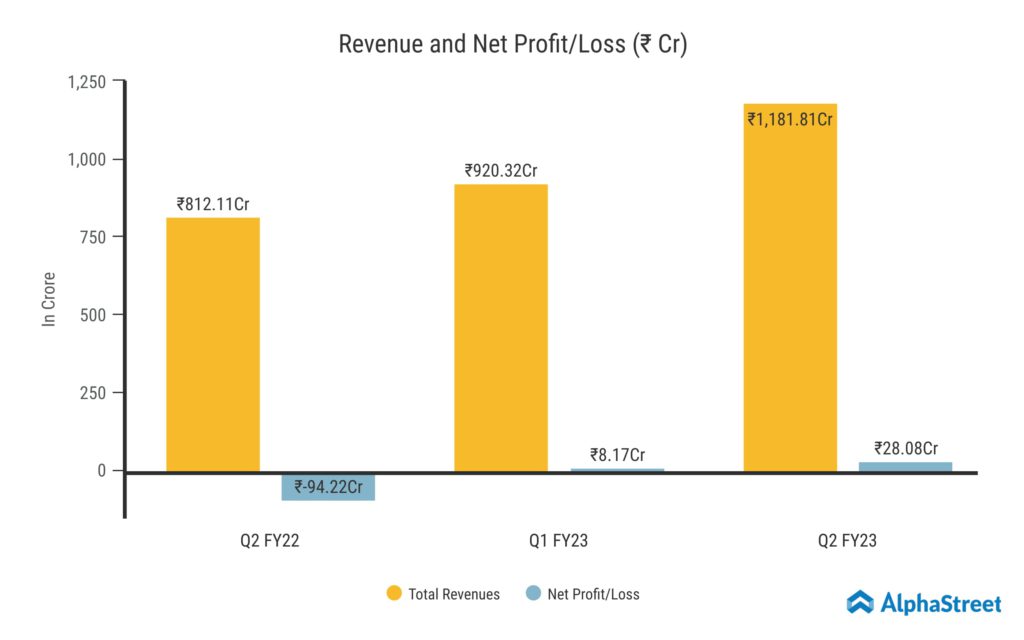

Arvind Fashions Limited reported Revenue from Operations for Q2 FY23 of ₹1,181.81 Crore, up from ₹812.11 Crore last year, a growth of 45.5%. The Revenue was driven by Power Brands segment which surged by 48% up to ₹998 Crore. Consolidated Net Profit was ₹28.08 Crore, compared to a loss of ₹94.22 Crore in the same quarter of the previous year. The company’s strong execution helped in achieving this record Revenue as well as profitability. The Earnings per Share is ₹1.37 for this quarter.

Arvind Fashions South Expansion

The company has focused on the southern markets, and this Diwali saw a vibrant expansion of business in this key market. Arvind Fashions has also strengthened its largest brand, US Polo, in this market. Bangalore City has five stores that opened in the same week. Additionally, the business opened a US Polo store in Express Avenue, arguably the largest and most significant mall in the South. The company has risen to become the third-largest brand store in that mall in terms of Revenue.

As per the management, “When we want to go even stronger in southern markets, I think U.S. Polo will be the first brand that will take us into that leadership or the strength position in South.”

Developments in US Polo & Other Brands

The company’s largest brand, US Polo Association, crossed the ₹1000 Crore Net Sales Value threshold at the end of October and has firmly established its dominance in the casual market. There are various adjacent categories to U.S. Polo. The company recently won an award for the best footwear brand in this category from Myntra. This adjacent category did strong business, with double the pre-COVID numbers and a growth of more than 50% in Q2. Arvind Fashions portfolio of footwear business where US Polo is has major part is likely to cross ₹250 Crores Net Sales Value market this year with healthy profitability and market leading position. The company is also introducing additional accessories for this brand, such as belt, wallet, and women’s shoe line. The business anticipates that the US Polo adjacent category’s Net Sales Value will surpass ₹300 Crore this season and reach ₹500 Crore in the following two to three years.

One of the brands in the company’s portfolio that is expanding the fastest is Arrow. It is picking up steam and grew by 50% in Q2 while achieving a positive EBITDA. In the first half, it has doubled the Net Sales Value. The brand has been getting a lot of demand from the trade to open more stores. As a result, the management is targeting to open the next 100 stores for Arrow in 2 years.

Meanwhile, Arvind Fashions in-house label Flying Machine is getting close to the ₹500 Crore mark. In the next one to two years, the company will develop new adjacent categories such as footwear, innerwear, and children’s wear while maintaining a strong focus on jeans. The management eyes to grow the brand to ₹1,000 Crore with new categories in the next 3 years, and is also looking at some regions and channels where it can grow faster.

Arvind Fashions Focus on Profitability

Arvind Fashions has prioritised profitability. Higher productivity, lower discounting, and operating leverage contributed to this quarter’s positive bottom line. The ROCE for the current quarter was elevated to 15%, and the company has set a medium-term goal of exceeding 20% ROCE. Through effective execution and stringent controls, Arvind Fashions has kept inventory under control and the inventory days have decreased by 6 days right at the start of the season.

EBITDA for the company was reported at ₹136 crores this quarter, up 90% from the same quarter last year. Over the previous year, the EBITDA margins increased by 2.7%. This increase in EBITDA is the result of lower discounting, greater sell-through, higher inventory freshness, and operating leverage. The company has produced a Profit Before Tax of ₹45 Crores with excellent cash flow. As a result, there has been a net reduction in debt of ₹383 crores.

As per the management, “Our focus will be to further improve EBITDA margin and ROCE through profitable scale buildup, sharp execution of brand activities in the market, tight control on trade policies and de-leveraging of balance sheet.”