Stock Data:

| Ticker | NSE: APLAPOLLO |

| Exchange | NSE |

| Industry | PIPES |

Price Performance:

| Last 5 Days | +7.54% |

| YTD | +10.91% |

| Last 12 Months | +30.15% |

Company Description:

APL Apollo Tubes Limited is the biggest tubes manufacturer in India, with about half of the market share. They have consistently increased their production capacity, going from 53,000 tons per annum in 2006 to 2.5 million tons per annum in 2020, using both internal growth and acquisitions. APL has factories in different parts of India and has a strong distribution network with 800 distributors and over 50,000 retailers. They serve various industries, with building materials accounting for 48% of their sales, followed by commercial building materials at 26%, infrastructure at 21%, and industrial and agricultural sectors at 5%.

Critical Success Factors:

- APL is totally killing it in the Indian structural tubes market, owning a massive 50% of the pie. This gives them a huge advantage and puts them in a prime spot to make bank on the growing demand for structural steel.

- APL has been ramping up their production like crazy, hitting a whopping 2.5 million tons per annum in FY2020. They’ve been going all out with their growth strategies, both by expanding on their own and scooping up other companies, all to keep up with the skyrocketing demand for structural tubes in India.

- APL is basically everywhere in India, with factories spread out across different regions. This means they can serve their customers like champs and make sure their products reach every nook and cranny of the country.

- APL has a ginormous customer base, including 800 distributors and over 50,000 retailers. They’ve got a whole mix of customers in their pocket, which helps them stay on the safe side and not rely too much on just one type of customer. It keeps their revenue streams nice and steady.

- APL’s volume growth has been off the charts, showing a crazy 16% compound annual growth rate from FY2017 to FY2023. With their strong market position and the ever-increasing demand for structural steel in housing and infrastructure projects, they’re set to keep crushing it and growing like there’s no tomorrow.

Key Challenges:

- APL’s got some tough competition from big-shot steel companies. If these guys come charging in with aggressive marketing or low prices, it could mess with APL’s growth and mess up their cash flow too.

- A big chunk of APL’s business depends on the construction and infrastructure folks. If these sectors hit a snag or slow down, it could throw a wrench in APL’s plans and mess with their moolah.

Financial Results:

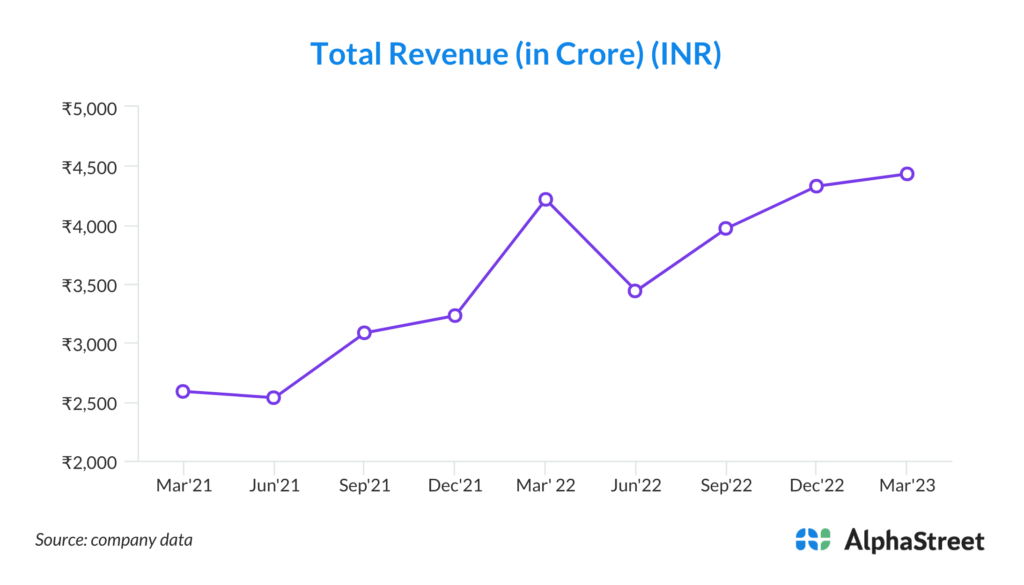

In Q4FY23, APL reported a consolidated operating profit of Rs. 323 crore, reflecting an 18% q-o-q growth. This performance was primarily driven by strong volume growth (7% q-o-q) and margin expansion. The sales volume increased by 18% y-o-y and 7.4% q-o-q to 650 kt. The EBITDA margin improved by 10% q-o-q to Rs. 4,970/tonne, driven by improved performance of the Raipur plant and the removal of discounts as channel destocking halted.

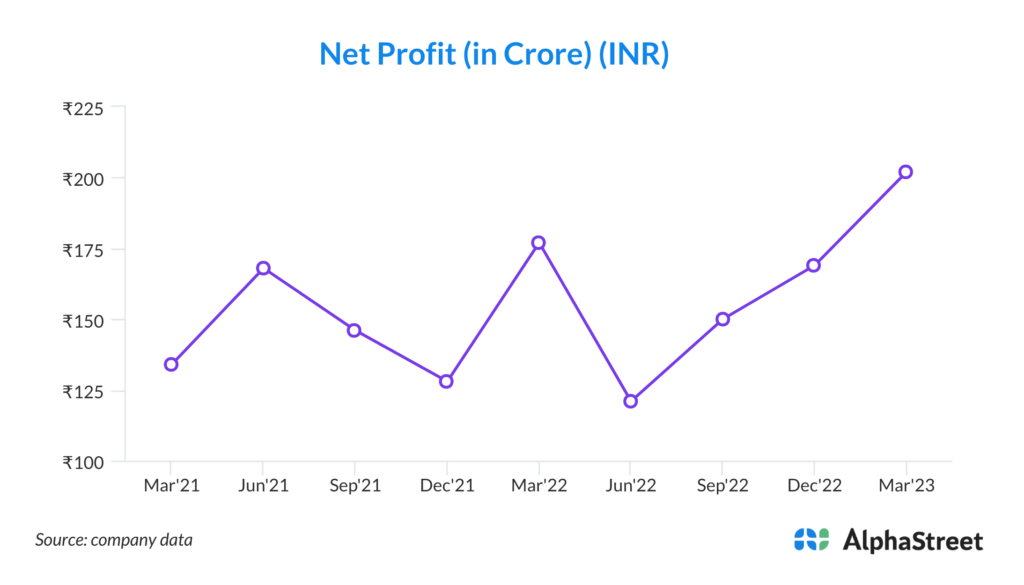

Despite the strong operating performance, the consolidated PAT of Rs. 202 crore was 4% below estimates. This shortfall was mainly due to a steep rise of 34% and 36% in interest and depreciation costs, respectively, resulting from the commissioning of the new Raipur plant. However, higher other income (up 93% q-o-q) partially offset this impact.

Conclusion:

APL Apollo Tubes Limited has been doing really well, with their sales and profits growing steadily. They’ve got a strong position in the market, and they keep expanding their production capacity and getting more customers. The company’s management is confident about their sales and profits going forward, which is a good sign.

But hey, investors need to be careful too.

There might be some tough competition and unpredictable changes in demand and costs. Other steel companies could give APL a run for their money, and the construction and infrastructure sectors might throw some curveballs. Still, with their solid foundation, top market position, and potential for growth, APL Apollo Tubes Limited seems like a winner in the long run. Investors just gotta keep an eye on what’s happening in the industry and with the company itself before making any investment moves.