Stock Data:

| Ticker | NSE: ADANIGREEN |

| Exchange | NSE |

| Industry | RENEWABLE ENERGY |

Price Performance:

| Last 5 Days | -3.86 % |

| YTD | -48.46 % |

| Last 12 Months | -60.04% |

Company Description:

Adani Green Energy Limited is a global leader in renewable energy, driving the shift to sustainability through solar, wind, and hybrid solutions. With the largest operational capacity in India, AGEL pioneers operational excellence, technological innovation, and ESG principles, aiming to achieve 45 GW of renewable energy capacity by 2030.

Critical Success Factors:

- Strategic Positioning in a Global Macro Shift: AGEL operates in a context where the energy sector is undergoing a profound transformation towards sustainable practices. The demand for clean energy solutions is on the rise worldwide, with governments, businesses, and consumers recognizing the significance of reducing carbon emissions. AGEL’s operations align with this shift, positioning the company at the forefront of an industry that is vital for a sustainable future.

- Leading Capacity in India: AGEL boasts the largest operational renewable energy capacity in India, with a current operational capacity of 8,316 MW. This leadership status showcases AGEL’s ability to scale up renewable energy production, contributing significantly to the country’s renewable energy landscape.

- Robust Growth Trajectory: The company’s growth trajectory is characterized by its locked-in portfolio of over 20 GW, which provides a clear roadmap for near-term expansion. AGEL’s historical compound annual growth rate (CAGR) of 33% in renewable energy capacity over the last five years outpaces the overall growth in the sector, underscoring its commitment to expansion and innovation.

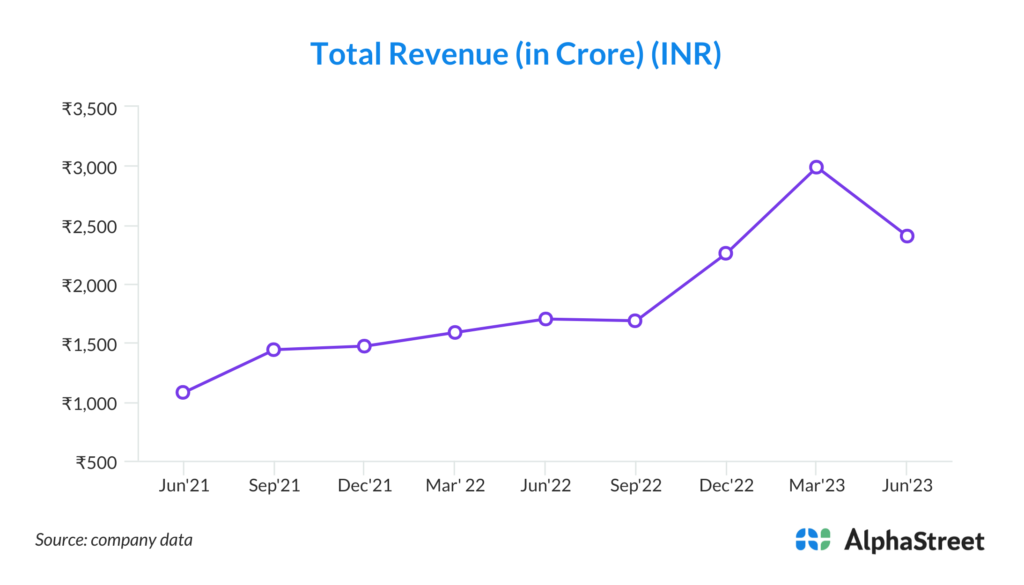

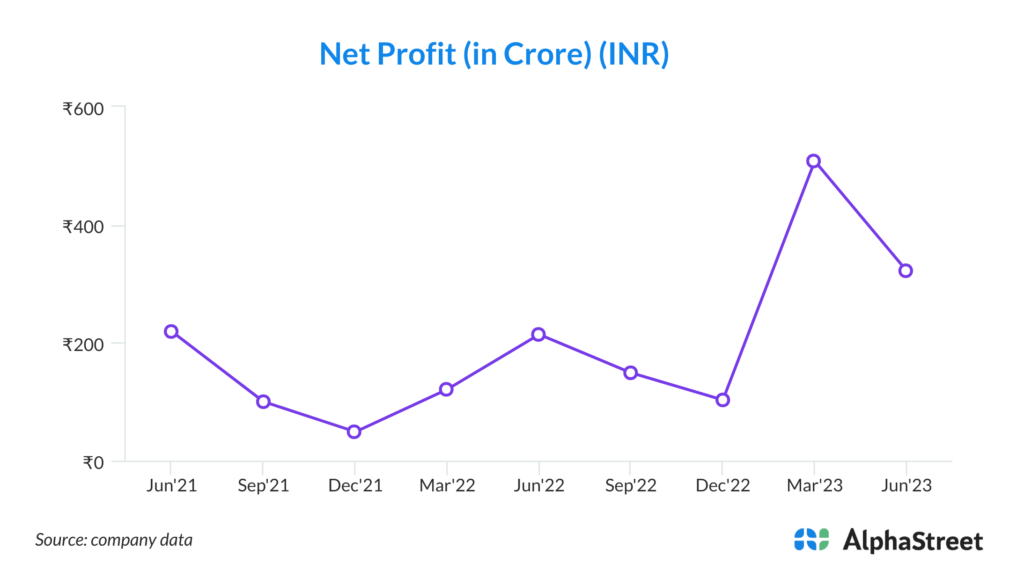

- Strong Financial Performance: AGEL’s Q1 financial results reflect its strong financial health. With operational capacity growing by 43% YoY, the company added 2,516 MW of new capacity in various renewable energy segments. The increase in energy sales by 70% and the growth in revenue from power supply underscore AGEL’s revenue-generating prowess.

- Impressive Operational Excellence: AGEL’s commitment to operational excellence is evident in its high plant availability rate, which consistently exceeds 99%. This dedication to safety, security, and sustainability is achieved through the adoption of cutting-edge technologies like artificial intelligence and digitization, ensuring optimal plant performance.

- ESG Leadership: AGEL places sustainability at the core of its operations. The company’s commitment to reducing carbon footprints extends to achieving water positivity for its operating plants and embracing decarbonization initiatives. AGEL’s ESG goals encompass not only its internal operations but also extend to its suppliers, reflecting a comprehensive approach to sustainability.

- Local Community Engagement: AGEL recognizes the importance of local socioeconomic development and actively supports the communities in which it operates. Through job creation, healthcare initiatives, education, and community infrastructure development, AGEL contributes to the overall well-being of the regions it serves.

- Recognition from Global Institutions: AGEL’s ESG efforts are acknowledged by global institutions, with accolades such as being ranked first in Asia and among the top 10 companies globally in the renewable energy sector by ISS, ESG. Its inclusion in indices like the FTSE4Good index reflects its commitment to robust governance practices.

- Technology-Driven Innovation: AGEL’s focus on leveraging digital and artificial intelligence-based solutions for driving innovation and performance underscores its adaptability in a rapidly evolving energy landscape. This emphasis positions the company to optimize operations and maintain a competitive edge.

- Ambitious Future Targets: AGEL’s commitment to achieving a renewable energy capacity of 45 GW by 2030 is a testament to its vision for the future. This target signifies the company’s dedication to widespread adoption of solar, wind, solar-hybrid, and storage solutions, thereby contributing significantly to India’s renewable energy objectives.

Key Challenges:

- Regulatory and Policy Risks: The renewable energy sector is subject to regulatory changes and policy shifts that could impact project timelines, incentives, and profitability. AGEL’s growth plans are contingent on a favorable regulatory environment, and any unexpected shifts in government policies could affect its expansion and financial performance.

- Market Volatility and Competition: The renewable energy market is becoming increasingly competitive, with new players entering the field and established companies expanding their capacities. Market volatility and aggressive competition could impact AGEL’s ability to secure projects, maintain competitive pricing, and secure market share.

- Execution and Project Delays: AGEL’s ambitious growth plans depend on the timely execution of projects. Delays in obtaining permits, land acquisition, equipment availability, and other logistical challenges could lead to project delays, impacting revenue streams and financial projections.

- Technological Changes and Innovation: The renewable energy sector is rapidly evolving, with advancements in technology driving efficiency improvements and cost reductions. AGEL needs to continuously invest in research and development to stay ahead of technological trends and ensure its projects remain competitive.

- Counterparty and Offtaker Risks: AGEL’s revenue is dependent on the sale of energy to various off-takers, including government agencies and private entities. Financial distress of off-takers or delays in payments could impact AGEL’s cash flow and profitability.

- Supply Chain Disruptions: The renewable energy sector relies on a complex global supply chain for equipment and components. Disruptions in the supply chain due to factors like geopolitical tensions, trade disputes, or logistical challenges could affect project timelines and costs.

- Environmental Risks and Climate Variability: The impact of climate change, including extreme weather events and variability in renewable energy resources, could affect the efficiency and performance of AGEL’s projects. Climate-related risks could lead to lower energy generation and potential financial losses.

- Geopolitical and Social Risks: AGEL operates in regions with varying geopolitical and social dynamics. Political instability, regulatory changes, community opposition, or social unrest could disrupt operations and hinder project development.

- Debt and Leverage: AGEL’s growth strategy involves leveraging its balance sheet to fund expansion. While manageable debt can fuel growth, high levels of debt could expose the company to financial stress in case of adverse market conditions or changes in interest rates.