Stock Data

Ticker: IGL

Exchange :NSE and BSE

Industry: Natural Gas

The share price of IGL increased by 1.21% as on 24 Aug, 2022, 01:46 PM IST based onthe previous closing price of Rs 406.85.The share has reached Rs 602.05 in 52 Week high and Rs 321.00 in 52 week low. The shares are traded on a high P/E ratio of 19.71. The debt equity ratio stood at zero. The dividend yield is 1.32 %.

Price Performance

IGL share price moved down by 5.46% in last 1 week . It moved up by 10.15% in last 1 month. In last 3 Month it moved up by 6.70%. IGL share price moved up by 12.89% in last 6 months.

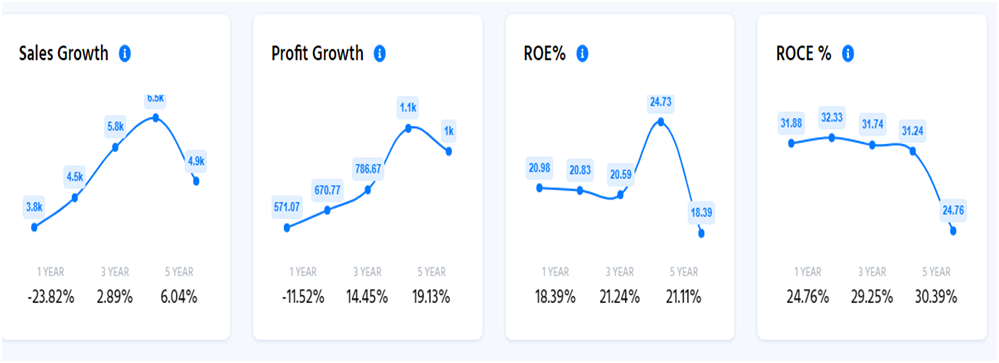

Performance Highlights

The sales growth has declined by 23.82% in last 1 year. The profit growth has declined by 11.52%. The company has attained ROE of 18.39% in last 1 year compared to 21.24% in last 3 years. The company has attained ROCE of 24.76% in last 1 year and 29.25% in last 3 years.

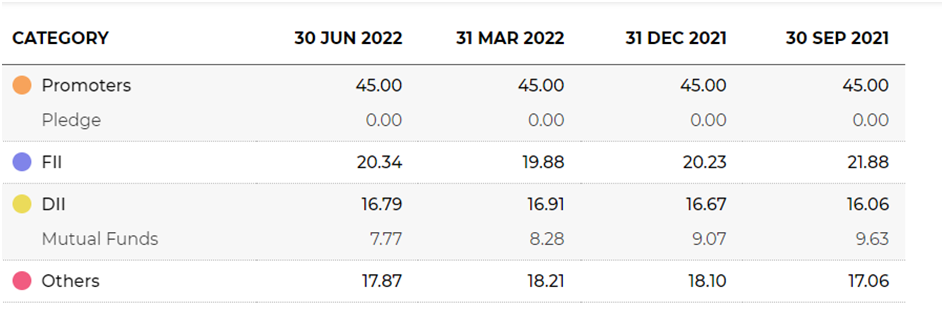

Shareholding

There is no change in Promoters holding. The promoter holds a zero pledge. The Domestic Institutional Investors holding has decreased from 16.91% to 16.79% as on 30 Jun 2022. The Foreign Institutional Investors holding has gone up from 19.88% to 20.34%. Other investor holding has gone down from 18.21% to 17.87% as on 30 Jun 2022.

Financial Snapshots– IGL reported 72% hike in consolidated net profit to Rs 420.86 crore. There is 155% increase in net revenue from operations to Rs 3,193.85 crore in Q1 FY23. There is an improvement in EBIDTA by 62% to Rs 617.51 crore. The total volume increased by 48% to 717.84 million. The CNG sales volume stood at 539.80 SCM million. It increased by 63% YoY. The PNG sales volume stood at 178.04 SCM million. It improved by 17% YoY.

Company Description-Indraprastha Gas Limited is an Indian natural gas distribution company. It mainly supplies natural gas as cooking and vehicular fuel. The company was incorporated in 1998. It was a Joint Venture of GAIL and BPCL. Govt. of NCT of Delhi. It mainly provides convenient and reliable natural gas supply to its customers in the domestic and commercial sectors. The product portfolio includes PNG, CNG and commercial uses. The board members include Arun Kumar Singh, Chairman and A K Jana, Managing Director. The areas of operation mainly include Delhi, Noida and Ghaziabad.

Business Outlook– The company targets to see a strong volume growth by increasing CNG production for cars. Not only Delhi it also wants to expand its geographical coverage.

Growth Strategies-As per the research firm ICICI Direct “IGL will continue to benefit from stricter environmental regulations in NCR and India’s aim to increase the share of natural gas in the energy mix. On account of competitive advantage against traditional auto fuels, IGL has potential for further sales volume growth in NCR and other CGD areas”. IGL is continuously focusing on the infrastructure to meet the increasing demand of CNG. The main reason behind this increasing demand is car manufacturers coming up with CNG variants. The Delhi Government’s directive made it mandatory for all LCVs operating in Delhi to run on CNG. The company has already started operating with PNG in the residents of the areas of NCT of Delhi. The Company has further plans for providing new PNG connection to 60,000 domestic households every year in Delhi ,NCR towns of Noida, Greater Noida and Ghaziabad.

Industry Analysis– The oil and gas sector is among the eight core industries in India. It plays an important role in decision making for the economy. According to the Research of International Energy Agency the consumption of natural gas in India is expected to grow by 25 BCM with an annual growth of 9% until 2024.Even the government has taken measures to improve the increasing demand. It has allowed 100% Foreign Direct Investment (FDI) in natural gas, petroleum products and refineries sectors. The India oil and gas market is expected to register a CAGR of more than 3% between 2022-2027.

Inherent Strengths-IndraprasthaGas has a strong brand recognition in the Natural Gas industry. It enjoys a strong market leadership position. The company has diversification of product. The company has ventured into various businesses outside the Utilities sector.

Key Risks– The major risk of this sector includes future expansion activities solely dependent on the ability to secure additional gas supplies. Geo-political situation may lead to volatility in gas prices. The impact of currency depreciation may hamper profitability.