Hey, would you like to play cricket at noon? Now you might be wondering what a crazy person I might be.. Huh? Like why play cricket in this scorching heat when you can just lay on a couch peacefully with AC running on 18 degrees. To make this moment more pleasurable, how about you have some chilled soft drink?

But these AC’s, refrigerators or even electricity require something very important to run. Do you know what that is? If you have not got it by now, let me drop the curtains for you. We are talking about the air compressor and today the company we will be unveiling is the global player in this niche.

Tada… and the company’s name is Elgi Equipments.

Established in 1960 and headquartered in Coimbatore, Elgi Equipments is among the leading players in compressed air technology in India. The company has a presence across more than 120 countries with a product portfolio of 400+ compressed air systems and has 2 million+ installations all over the world.

Let’s take a look at the business verticals and major countries it operates in:

Elgi Equipments manufactures a wide range of air compressors and automotive equipment. It is more of a global player, with almost 50% of revenue coming from outside India. Elgi is further expanding in new international markets to drive long term incremental growth. Recently, the company has inaugurated a new office and training centre in Turin, Italy. It further inaugurated a new office and warehouse in Angelholm, Sweden.

The key markets of focus for Elgi continue to be the USA, Europe, and Australia.

Australia:

The strategic acquisition of F.R.Pulford & Son Pty Ltd, an independent distributor, to gain customer access in key markets has served the company very well. Even in a pandemic situation, the team at Pulford delivered a commendable performance wherein the company registered more than 20% sales growth in Australia, including sales to various distributors.

Elgi operates under three brands in Australia namely- Pulford, Advanced air compressor and altitude training systems.

Elgi holds a double digit market share in oil lubricated screw compressors in Australia.

USA:

With the addition of Michigan Air Solutions, LLC to its portfolio of businesses, the region’s revenue increased by over 10%. The region made further progress by entering into key strategic Distributor Served Areas. Besides expanding the independent distributor base, Elgi also launched three new joint ventures with local partners as part of their Go-To-Market program strategy. Furthermore, Elgi gained traction in Oil-Free product installations in several key market segments, thus, positioning them for future growth in this attractive product category.

Europe:

The team created important reference installations within key customer segments and successfully introduced ELGi’s oil-free AB series screw technology throughout Europe thereby helping their customers realize dramatic reductions in the total cost of ownership, improved reliability, and a reduction of their environmental impact.

So what’s theTraction like:

With ~22% market share, Elgi is the second largest player in the Indian air compressor market and among the top eight players globally. With an employee base of more than 2000 employees, the company has strengthened its pipeline with 150+ distributors worldwide.

Before further delay let’s understand the Air compressor industry:

The air compressors are used widely in nearly all industrial & manufacturing facilities and majority of process and service industries that includes a variety of end-markets like construction, transportation, infrastructure, chemical processing and food and beverage packaging. For industrial processes, compressed air is needed in Energy, Pharmaceutical, Oil and Gas, Electronics, Semiconductors and Textile industries.

Compressed air is also used in robots, to power industrial tools and in applications as diverse as snow making, hospitals, fish farming, wastewater treatment, high-speed trains and conveying. Now having understood its usage, let’s take a look at global compressor market share by end uses.

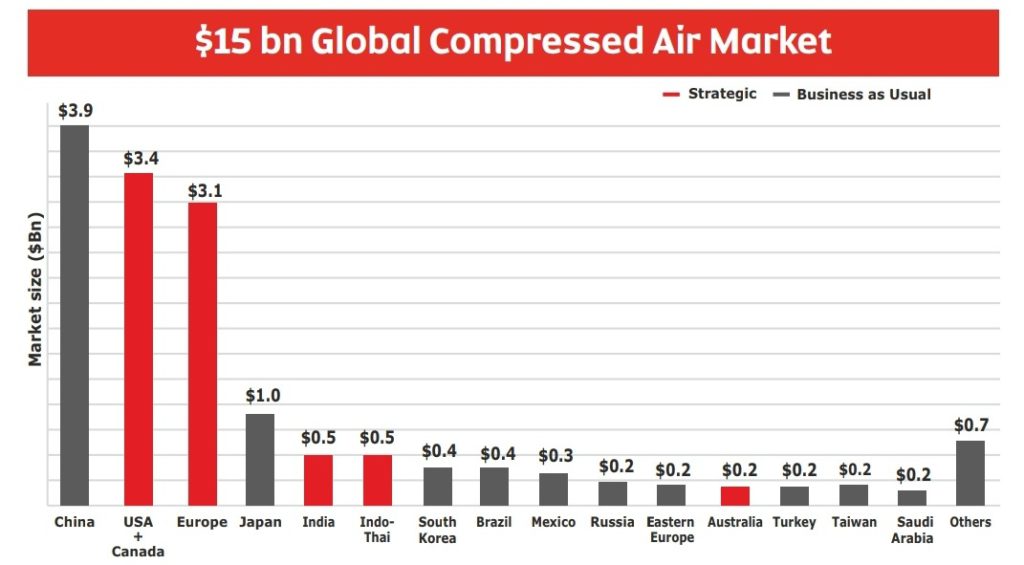

As of March 2022, the market size of the air compressor industry was 15 billion USD. Though, the Indian market size comparatively is only a little over 3 percent of the total global pie. The global market is expected to grow at 3% CAGR while the Indian Market is expected to grow at 7% CAGR over the next 5 years. The Indian counterpart’s growth along with the possibility of gaining market share overseas and entering new markets makes Elgi a key player in this niche.

Interestingly, the nature of the air-compressor industry is that it is a diversified revenue source without any dependence on any specific industry vertical. Secondly, the geographical opportunity reduces the risk of dependence on any one economy and its business cycle for Elgi.

Elgi’s primary focus is on North America, Australia, South East Asia and Europe which accounts for more than 50% of the global opportunity. Below are the countries with a large market in the air-compressor industry.

The most promising part of this industry is the aftermarket or recurring revenue it generates. So, for every dollar of equipment sold, the aftermarket generates 1.2 US dollars over the stretch of next 10 years in aftermarket sales. Further, the aftermarket parts gross margins are almost 2-3 times of the original equipment. In total, the recurring revenue is anywhere from 30-50 percent of the total revenue.

The aftermarket growth is outpacing the growth in units in India due to a higher installed base. As the installed base increases in India and in other countries, the certainty of recurring revenue is almost given.

Indigenous Technology, Focus on quality and R&D –

To fare strongly against the deep pockets of many multinational brands, Elgi Equipments has built its own indigenous technology for compressors. Further, the company offers the longest warranty of any equipment in the world at the minimum price possible.

The sheer focus on indigenous technology and quality has helped Elgi build a strong brand in India and overseas. Being a global brand, Elgi has R&D capabilities to innovate in order to stay relevant. The R&D capabilities can be seen by technology relating to oil-free compressors Currently, oil-lubricated compressors and oil-free compressors exist as two separate categories. Both in terms of product offerings and end-use applications. Oil-lubricated compressors are more efficient and less expensive than oil-free compressors. However, in applications that cannot tolerate oil in the air, customers do not have a choice but to buy oil-free compressors, and they pay the penalty of a high upfront price as well as higher running cost. Elgi has managed to develop a technology that converges these two categories so that all compressors are oil-free with low upfront cost and comparable running cost.

Competitive intensity –

While the capital cost of setting up a compressor manufacturing unit is not high but due to the assembly nature of operations, technology plays a major role and acts as an entry barrier. Most large domestic players are subsidiaries of established international companies or have technical collaborations with global players which makes the air-compression industry tougher to thrive.

The merger between Ingersoll Rand and Garden Denver, the second and the third largest air-compressor companies, have created a very strong number 2 air-compressor industry further consolidating the space. And yet Elgi has managed to set itself among the leading players of the space speaks about the competitive nature of the industry itself.

What about the financials and future outlook?

Elgi’s standalone air compressor (domestic & direct exports compressor) grew 16.1% YoY to Rs. 456 crore (~63% of consolidated topline). The compressor business’ performance in the domestic market exceeded expectations as demand was strong. Barring West Asian countries, Africa, Australia and South-East Asian countries that were affected by Covid lockdowns, Europe & America also saw high demand and Australia is recovering from a low base in FY22.

FY22 growth was primarily led two-third by volume and one-third by price. Road, construction, mining, textiles, dam construction did well in FY22. Elgi is planning to launch a product related to water well, which will be the best in the world.

Elgi will make decisions on prices to fully recover the high raw material and freight costs. Geographically India was an excellent niche of compressors for oxygen which was strong in the middle of Q3FY22. Elgi is tapping PLI opportunity and touching base with those who have applied for it. It is too early to say how big the opportunity is.However, Europe was way ahead of estimates and planned losses were lower. These planned losses will remain two more years but the same

will be lower. In the US, portable compressors are used in the construction industry and have grown very strong in the US markets. In Europe and US inquiry levels are pretty strong with order conversion while in Australia it is slowly picking up. Further, Elgi has done a capex Rs 35 crore in FY22, largely for machining capabilities.