Company Description:

Titagarh Rail Systems is a premier supplier of passenger rolling stock, including metro coaches, and a variety of railway wagons. The company’s extensive product range includes electric propulsion equipment such as traction motors and vehicle control systems, as well as specialized wagons like container flats, grain hoppers, cement wagons, clinker wagons, and tank wagons. TRS operates through four key divisions: Railway Freight, Railway Transit, Engineering, and Shipbuilding.

Financial Performance in Q4FY24:

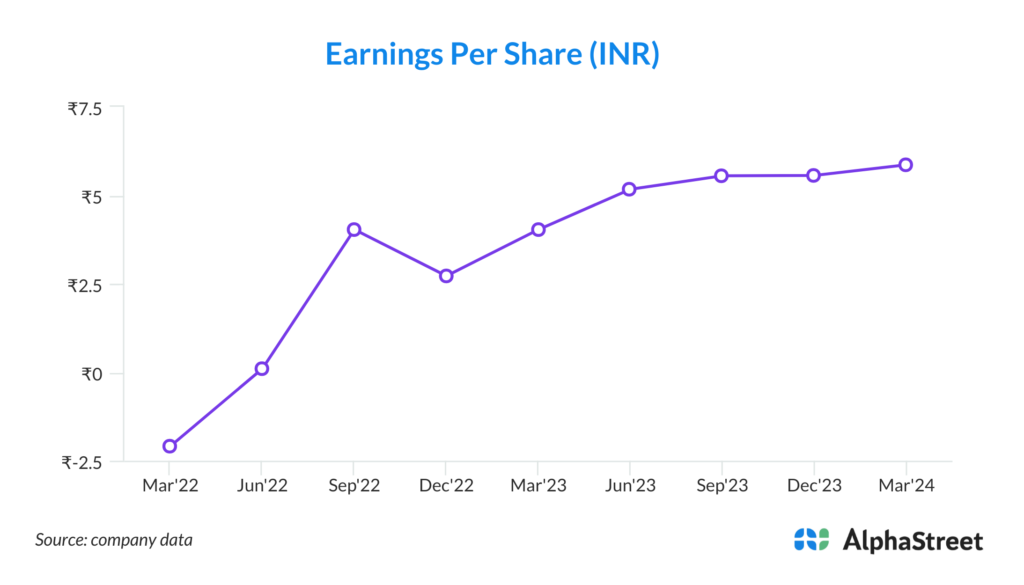

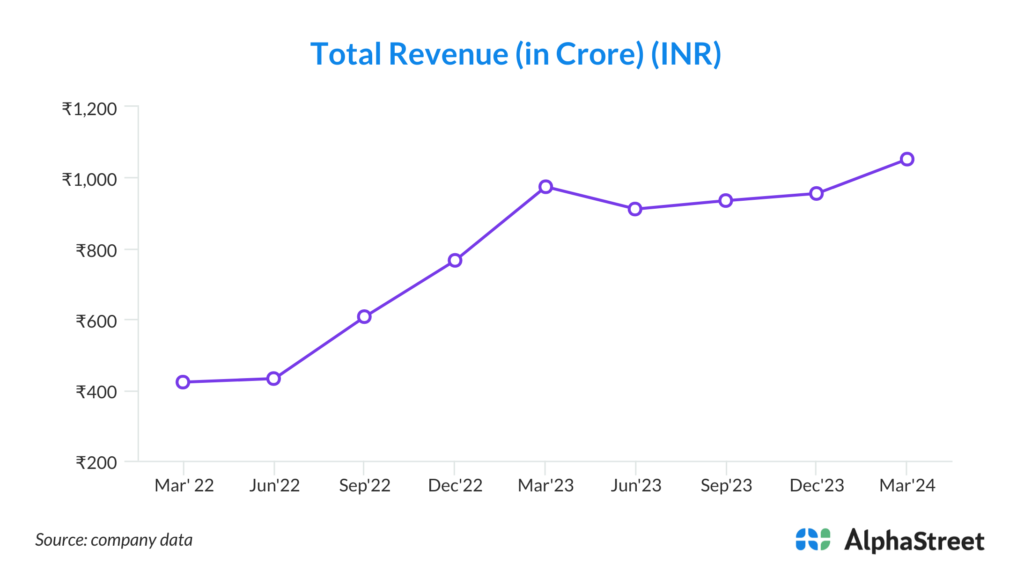

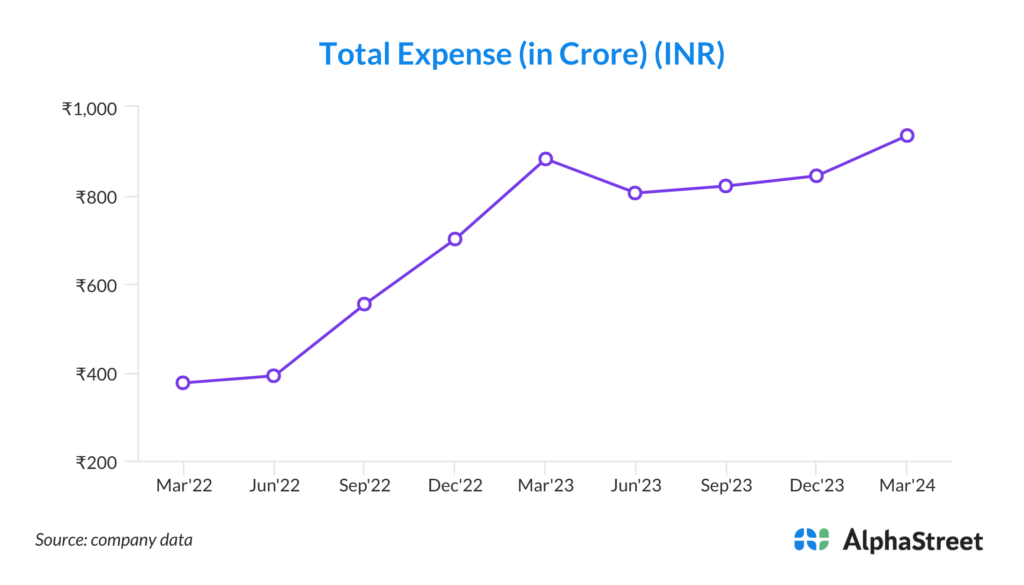

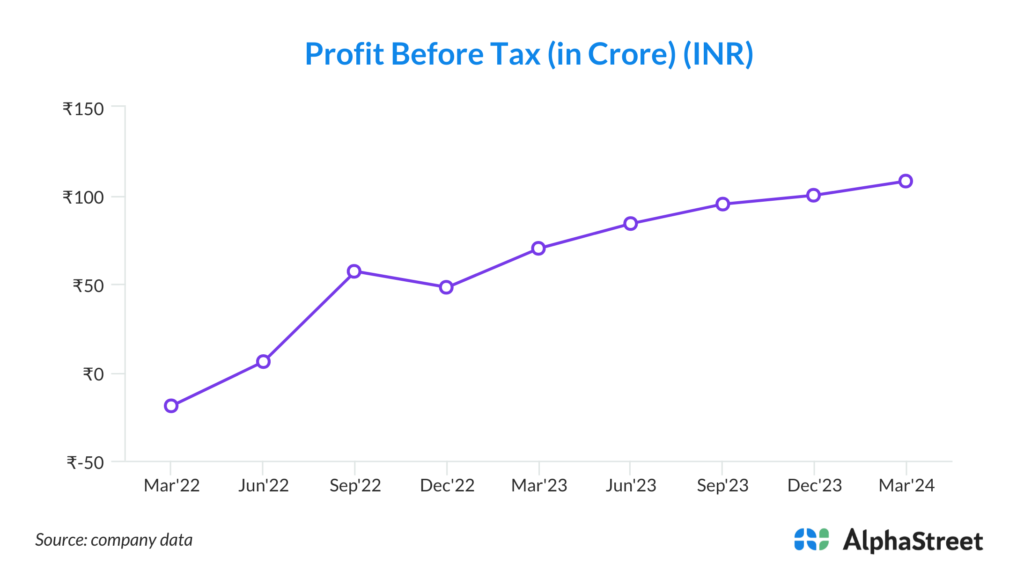

In Q4 FY24, TRS achieved a remarkable financial performance, recording its highest-ever quarterly turnover of INR 1052 crores. This milestone significantly contributed to the company’s annual turnover of INR 3853 crores for FY24. The company’s profitability saw substantial improvement, driven by enhanced production efficiencies and strategic cost management. TRS’s segment-wise performance was notable, particularly in the Freight Wagons division, where it produced 2700 wagons in the quarter, with an impressive record of 1089 wagons in March 2024 alone. The Passenger Rail Systems division also performed well, with a steady increase in production capacity. The company’s strong order book, valued at INR 14750 crores, underscores its competitive market position and revenue visibility. With ongoing capacity expansions and strategic initiatives, TRS is well positioned to sustain its growth trajectory and enhance shareholder value in the coming years.

Key Strengths of the Company:

1. Robust Order Book: Titagarh Rail Systems boasts a formidable order book valued at INR 14750 crores, providing strong revenue visibility and a stable financial outlook. This extensive backlog of orders highlights the company’s competitive positioning and trusted relationships with its clients. The substantial order book also enables TRS to plan and optimize its production processes effectively, ensuring sustained operations and steady growth. The presence of significant contracts in diverse segments, including freight wagons and metro coaches, reflects the company’s capability to meet varied customer demands and its strong market presence.

2. Record-Breaking Production: TRS achieved an industry-high production milestone by manufacturing 1089 wagons in March 2024, and a total of 2700 wagons in Q4 FY24. This exceptional production capability demonstrates the company’s operational efficiency and ability to scale its manufacturing processes to meet growing demand. Such record-breaking achievements underscore TRS’s robust infrastructure and adept workforce. This high level of productivity not only meets current demand but also positions the company to take on larger and more complex orders in the future, enhancing its market leadership and operational credibility.

3. Diversified Product Portfolio: TRS offers a wide range of products, including metro coaches, freight wagons, and electric propulsion equipment such as traction motors and vehicle control systems. The company’s diversified portfolio reduces dependency on a single revenue stream and mitigates risk by catering to multiple segments of the rail industry. This broad product range allows TRS to leverage cross-segment opportunities and provides resilience against market fluctuations. Additionally, the company’s ability to design and manufacture specialized wagons like container flats, grain hoppers, and tank wagons further strengthens its market position.

4. Strategic Capacity Expansion: The company is undertaking significant capacity expansion initiatives, targeting an output of 72 metro and Vande Bharat coaches per month by the end of FY25. This proactive approach to increasing production capacity is driven by the rising demand for urban transit solutions and government initiatives to enhance railway infrastructure. By expanding its production capabilities, TRS aims to meet future demand effectively and capitalize on new market opportunities. This strategic expansion not only positions the company for higher revenue growth but also demonstrates its commitment to scaling operations in line with market needs.

5. Backward Integration: TRS’s focus on backward integration enhances its control over supply chains and improves profit margins by reducing dependency on external suppliers. The development of in-house capabilities for critical components like traction converters and propulsion systems, supported by strategic partnerships with companies such as ABB, exemplifies this approach. Backward integration allows TRS to streamline its production processes, ensure the quality of key components, and mitigate supply chain disruptions. This strategic initiative not only bolsters the company’s operational efficiency but also contributes to cost savings and competitive pricing.

6. Strong Financial Performance: The company’s financial performance in FY24, highlighted by a record annual turnover of INR 3853 crores and the highest-ever quarterly turnover of INR 1052 crores in Q4 FY24, showcases its robust financial health. This strong financial performance reflects TRS’s effective cost management, operational efficiencies, and ability to secure and execute large-scale contracts. Consistent revenue growth and profitability improvements provide a solid foundation for future investments and strategic initiatives. The company’s financial strength also enhances investor confidence and supports its long-term growth objectives.

7. Innovation and Quality Focus: TRS’s commitment to innovation and quality is evident in its advanced product designs and manufacturing processes. The company continuously invests in research and development to introduce cutting-edge technologies and improve existing products. This focus on innovation ensures that TRS remains competitive in a rapidly evolving market and meets the high standards required by its customers. Quality assurance processes and certifications further reinforce the company’s reputation for reliability and excellence.

Key Risks and Concerns for the Company:

1. Supply Chain Disruptions: TRS relies heavily on a complex supply chain for raw materials and components. Any disruptions, such as geopolitical tensions, trade restrictions, or global shortages, could impact production schedules and operational efficiency. These disruptions may lead to delays, increased costs, and potential revenue loss. Although TRS is focusing on backward integration to mitigate some risks, unforeseen supply chain issues could still pose significant challenges. Ensuring robust supplier relationships and diversifying sourcing strategies are critical to mitigating these risks and maintaining steady production flows.

2. Regulatory Changes: The railway sector is subject to stringent government regulations and policies, which can change frequently. Any adverse regulatory changes, such as new safety standards, environmental regulations, or shifts in government procurement policies, could increase operational costs or delay project approvals. Compliance with evolving regulations requires continuous investment in technology and processes, which may strain financial resources. Staying abreast of regulatory developments and maintaining flexibility in operations are essential to navigating this risk effectively.

3. Economic Volatility: Economic downturns or fluctuations in the global economy can affect the demand for railway products and services. Factors such as reduced government spending on infrastructure, lower industrial output, and declining investment in urban transit can negatively impact TRS’s order book and revenue. Economic volatility also affects currency exchange rates, which can influence costs and profitability, especially for international contracts. Developing a resilient business model and maintaining a diverse customer base are crucial strategies to withstand economic uncertainties.

4. Intense Competition: The railway manufacturing sector is highly competitive, with numerous domestic and international players vying for market share. Increased competition can lead to price wars, reduced margins, and loss of market share. Competitors with advanced technology, better financial resources, or more attractive pricing could pose significant threats to TRS. Continuous innovation, maintaining high-quality standards, and strategic pricing are essential to staying ahead of competitors. Investing in marketing and customer relationships can also help differentiate TRS in a crowded market.

5. Project Execution Risks: Large-scale projects, such as metro coach and Vande Bharat contracts, involve complex logistics, stringent timelines, and significant resource allocation. Any delays, cost overruns, or technical challenges in executing these projects can adversely affect TRS’s financial performance and reputation. Effective project management, skilled workforce, and contingency planning are critical to mitigating these risks. Ensuring timely delivery and maintaining quality standards are paramount to securing future contracts and sustaining client trust.

6. Technological Changes: Rapid advancements in technology pose a risk if TRS fails to keep pace with innovations in the railway sector. Emerging technologies, such as autonomous trains, advanced propulsion systems, and smart rail infrastructure, require continuous investment in research and development. Falling behind in technology adoption can make TRS’s products less competitive and reduce market appeal. To mitigate this risk, TRS must prioritize R&D, foster partnerships with technology leaders, and stay updated on industry trends to integrate cutting-edge solutions into its offerings.

7. Financial Management: Effective financial management is crucial for sustaining growth, especially given TRS’s significant capex plans and operational scale. Poor financial management can lead to liquidity issues, increased debt, and financial instability. Managing cash flows, maintaining a healthy balance sheet, and securing favorable financing terms are essential to supporting expansion initiatives and operational needs. Financial missteps or misallocations can severely impact the company’s ability to execute its strategic plans and meet investor expectations. Regular financial audits, prudent investment decisions, and robust financial controls are necessary to ensure fiscal health.