Stock Data:

| Ticker | NSE: SYRMA |

| Exchange | NSE |

| Industry | MANUFACTURING |

Price Performance:

| Last 5 Days | +10.63 % |

| YTD | +129.37 % |

| Last 12 Months | +123.74 % |

Company Description:

Syrma SGS Technology Ltd is a dynamic player in the electronics manufacturing services (EMS) industry, renowned for its cutting-edge solutions and robust growth. With a diversified portfolio spanning automotive, consumer, industrial, and healthcare sectors, the company excels in delivering innovative electronic manufacturing solutions.

Critical Success Factors:

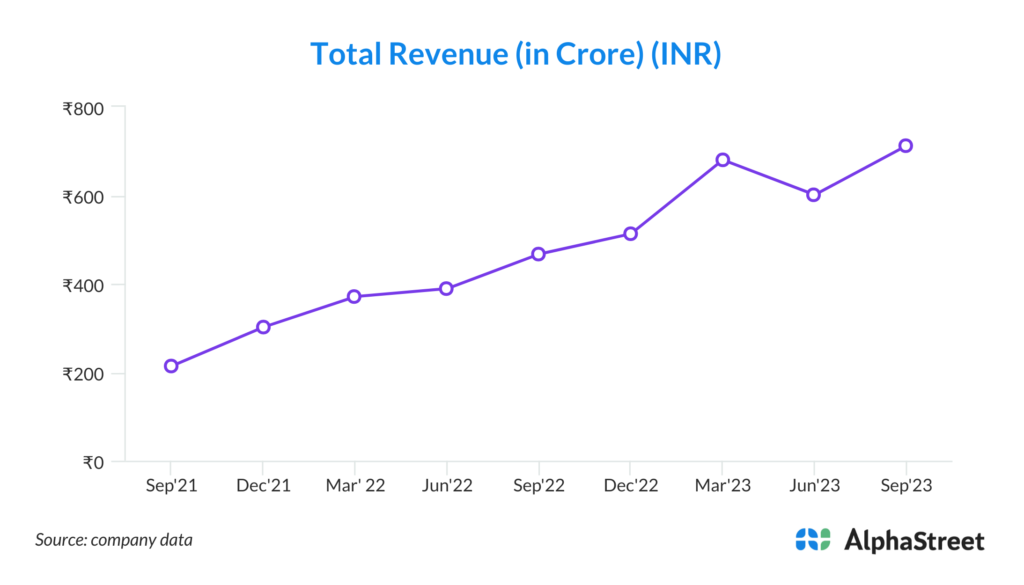

1. Consistent and Impressive Revenue Growth: Syrma SGS Technology Ltd has demonstrated a remarkable growth trajectory, consistently achieving a scorching pace of 45%-50% plus year-on-year basis over the last several quarters. The company’s turnover has grown by an impressive 52% in the current quarter and 55% in the half-year ended September 2023. This sustained growth is a testament to the company’s ability to capture market share and effectively navigate dynamic market conditions.

2. Diversified Revenue Streams and Customer Base: The company boasts a diversified revenue stream, with significant contributions from automotive, consumer, industrial, and healthcare sectors. This diversification helps mitigate risks associated with dependency on a single sector and ensures a stable and balanced income. Additionally, the acquisition of JDHL expands the customer base, contributing to a more robust and resilient business model.

3. Strategic Focus on Exports: With 26% of sales coming from exports, Syrma SGS Technology Ltd has strategically positioned itself in the global market. The company’s ability to tap into international markets is evident in the 12% quarter-on-quarter and 9% year-on-year growth in exports. This positions the company to benefit from the increasing demand for its products on a global scale.

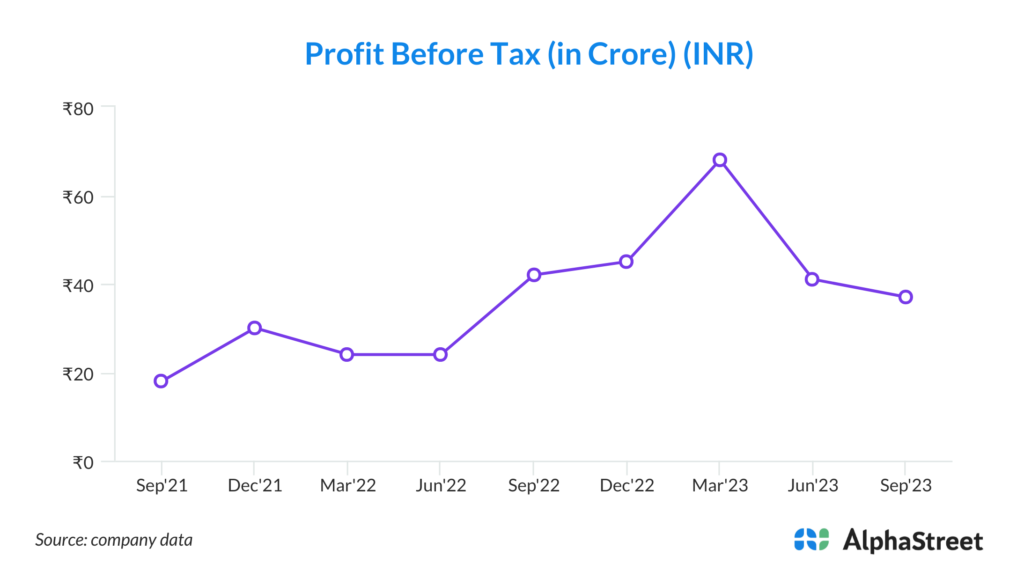

4. Operational Efficiency and Cost Management: The company has showcased strong operating efficiency, reducing overheads as a percentage of revenue by almost 4% to 4.5%. Despite one-time expenses related to the JDHL acquisition, the EBITDA margin stands at 8% this quarter. The focus on operational efficiency bodes well for sustained profitability and effective cost management.

5. Strategic Investments in Design and Engineering: Syrma SGS Technology Ltd has made strategic investments in a separate design and engineering center, particularly in the US and UK. This initiative, though in the early stages, is expected to contribute significantly to the growth of Original Design Manufacturer (ODM) services, enhancing EBITDA and profit margins. The company’s commitment to this venture reflects a forward-looking approach to technology and innovation.

6. Financial Strength and Debt Management: The company maintains a robust financial position, evident in the net cash position of approximately INR125 crores as of September 2023. Despite a debt position of INR420 crores, the company’s working capital and total treasury of INR545 crores showcase effective debt management. This financial strength positions Syrma SGS Technology Ltd for future strategic investments and growth initiatives.

7. Strategic Partnerships and IoT Expansion: Syrma SGS Technology Ltd has signed up with one of the largest IoT manufacturers globally, demonstrating a commitment to staying at the forefront of technological advancements. The successful testing and production of IoT applications for various sectors, including engineering, telecom, and energy metering, position the company for a significant uptick in this high-potential market, contributing to future revenue growth.

Key Challenges:

1. Market Dependency and Cyclical Trends: Syrma SGS Technology Ltd’s significant exposure to the automotive, consumer, industrial, and healthcare sectors makes it susceptible to market fluctuations and cyclical trends. Economic downturns or disruptions in specific industries could adversely impact demand for the company’s products, potentially leading to revenue volatility and decreased profitability.

2. Global Economic Uncertainty: Given the company’s reliance on exports, it is exposed to geopolitical tensions, trade disputes, and global economic uncertainties. Changes in international trade policies, tariffs, or currency fluctuations may impact the competitiveness of Syrma SGS, affecting its export-driven revenue and profit margins.

3. Supply Chain Disruptions: The electronics manufacturing industry is vulnerable to supply chain disruptions, particularly in the current climate of global logistics challenges and semiconductor shortages. Any interruption in the supply chain could lead to production delays, increased costs, and potential customer dissatisfaction, adversely affecting the company’s operational efficiency.

4. Intense Competition and Pricing Pressure: The electronics manufacturing services (EMS) industry is highly competitive, and Syrma SGS faces the risk of pricing pressure from competitors. Intense competition may lead to reduced profit margins, making it challenging to maintain or improve overall financial performance.

5. Dependency on Key Customers: Syrma SGS’s revenue stream could be adversely affected if it experiences a loss of key customers. A concentration of a significant portion of revenue from a few clients poses a risk, especially if these clients face financial difficulties, shift suppliers, or experience changes in demand for their products.

6. Technological Obsolescence: Rapid technological advancements in the electronics industry pose a risk of products becoming obsolete. Syrma SGS needs to continually invest in research and development to stay ahead of technological trends. Failure to do so may result in a loss of market share, as competitors with more innovative solutions could attract customers away from Syrma SGS.

7. Project Execution and Integration Risks: The successful execution of the JDHL acquisition and the ongoing capex projects is crucial for Syrma SGS’s future growth. Integration challenges, unforeseen expenses, or delays in the commissioning of new facilities may impact the anticipated benefits. Any hiccups in project execution could lead to financial strain, operational disruptions, and potential challenges in meeting customer demands.