Company Overview

Refex Industries Ltd., incorporated in 2002, is a diversified company with business interests across multiple sectors, including refrigerant gases, coal trading, solar power generation, and ash management. Initially focused on refrigerant gases, the company expanded into other sectors, such as power generation and environmental management, to capitalize on emerging opportunities in India’s fast-growing energy and industrial sectors. The company’s coal trading and solar power ventures have gained significant traction over the last few years, making Refex a more diversified business. Refex’s ash management division, in particular, has seen notable growth, as the Indian government’s focus on environmental sustainability and waste management aligns with its operations.

Business Verticals

1) Ash & Coal Handling Business (93% in Q1 FY25 vs 72% in FY22):

The company entered the ash and coal handling business in 2018, offering services for the processing and disposal of ash and coal. It is the largest organized player in ash handling in India, managing 50,000 MT of ash daily. In FY24, it received significant tenders from NTPC and State Run Power plants for the ash disposal requirements. Other clients include Ultra Tech Cement, Adani, ACC, etc. It caters to 19+ power plants operates across MP, Karnataka, Chhattisgarh, Bihar, Maharashtra, etc.

2) Power Trading (1% in Q1 FY25 vs Nil in FY22):

The company ventured into Power Trading in 2022. It provides power trading solutions, including power exchange, bilateral agreements, power banking & swapping, and group captive models.

It holds the 6th position among the top power industry players by volume of electricity traded bilaterally in the country. With its Category-I license for interstate Power Trading, the company is capable of transacting over 7,000 Million Units of electricity across India. It has collaborated with major suppliers such as DBPL, Adani Power, Jindal, etc and DISCOMS including Haryana, Punjab, Himachal Pradesh, and Tamil Nadu.

3) Refrigerant Gas (4% in Q1 FY25 vs ~9% in FY22):

The company is a prominent supplier of HFC refrigerant gases in India and specializes in procuring these sustainable alternatives to banned CFCs and HCFCs from both China and India. It was the first to introduce disposable cans and provide 450 ml refilling cans. The company supplies refrigerants to OEMs such as Carrier, TVS Mobility, LG, and Voltas. It has a manufacturing facility in Thiruporur, Tamil Nadu, with an installed capacity of 3,000 MT. The company has a network of over 450 dealers and distributors who dispatched 2,264 MT of HFC gases in FY24, which is 45% higher than in FY23.

4) Green Mobility & Others (2% in FY24 vs 19% in FY22):

Refex Green Mobility Limited (RGML), a WOS commenced Green Mobility operations in Bengaluru in March 2023. It offers 100% electric 4-wheeled vehicles, trained and background-verified drivers, a technology platform, and support teams. The company expanded its operations in Chennai during FY24, increasing its vehicle count from 24 in FY23 to over 530 in Q1 FY25. Key customers include TCS, Grant Thornton, Lumina Datamatics, and others. This Segment also includes Solar Power Generation and related activities.

Recent Financial Performance

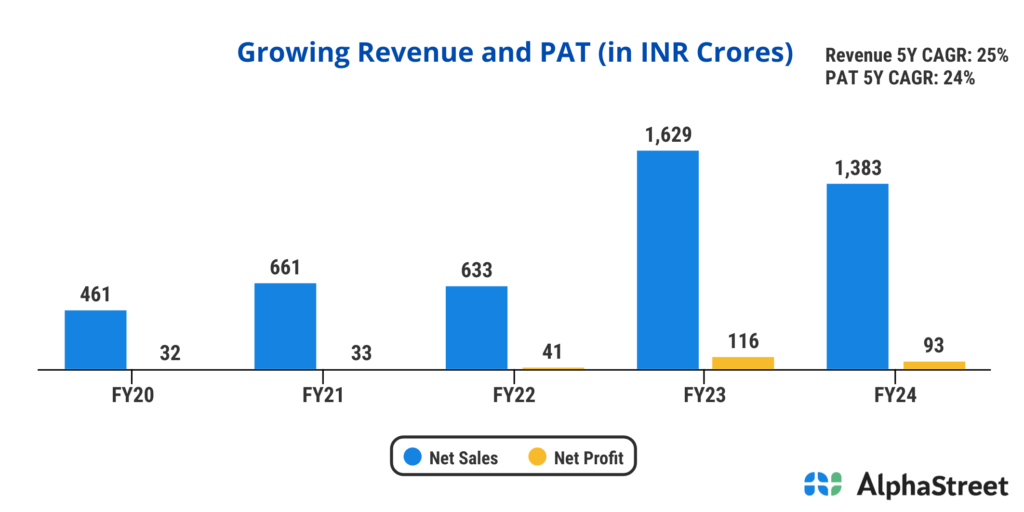

Refex Industries has demonstrated robust financial performance in recent years, driven by its diversification strategy and entry into high-growth sectors such as solar energy and ash management. For Q1FY25, the company posted consolidated revenue of INR 595 crore, reflecting a 56% increase compared to the INR 383 crore reported in Q1FY24. The company’s EBITDA stood at INR 48 crore, up from INR 36 crore in the previous year, representing a YoY growth of 33%. This was driven by strong growth in the solar power and ash management divisions, which contributed significantly to overall profitability.

However, net profit for Q1FY25 was INR 29 crore, a 38% increase from INR 21 crore in Q1FY24, indicating margin pressure due to increased costs in the refrigerant and coal trading businesses. However, the annual revenue took a hit due to cyclical nature of the business.

- Annual Revenue (FY2024): INR 1,339 crore (-18% YoY)

- Annual EBITDA (FY2024): INR 149 crore (-15% YoY)

- Net Profit (FY2024): INR 101 crore (-13% YoY)

Moat and Key Strengths

- Diversified Revenue Streams:

Refex Industries’ diversified business model, which spans refrigerant gases, coal trading, solar power generation, and ash management, provides the company with multiple revenue streams. This diversification has helped the company mitigate risks associated with a downturn in any one segment. For instance, while refrigerant gases and coal trading are subject to cyclical market trends, the solar power and ash management businesses are positioned in high-growth sectors. - First-Mover Advantage in Ash Management:

Refex is one of the first movers in ash management services, which focuses on handling and processing fly ash, a byproduct of thermal power plants. The company’s strategic contracts with several thermal power plants across India give it a competitive advantage. In Q1FY25, the ash management division contributed 93% of total revenues and is expected to grow rapidly as environmental regulations become stricter, and thermal plants are required to manage their waste sustainably. - Strong Growth in Solar Energy:

Refex’s entry into the renewable energy sector, particularly solar power, has positioned the company to benefit from the rapid growth in India’s solar energy market. As India continues to push for renewable energy adoption, Refex is well-positioned to capitalize on these favorable policy trends. - Operational Efficiency:

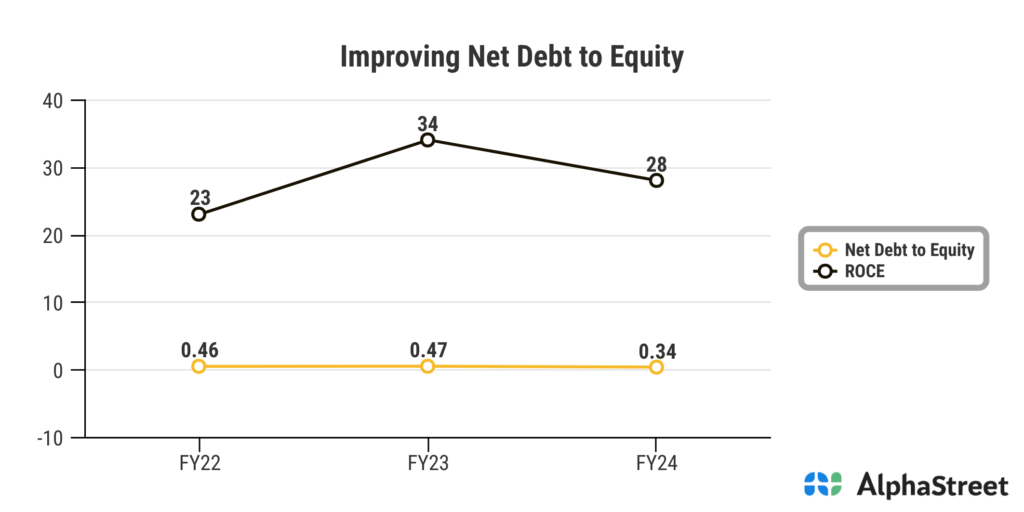

Refex has consistently improved its operational efficiency, resulting in higher margins in the solar power and ash management divisions. The company’s focus on cost management and optimization has led to an EBITDA margin of 10.8% in FY24, compared to 10.6% in FY23.

Key Risks or Concerns

- Cyclical Nature of Refrigerant and Coal Trading:

While Refex has diversified its operations, a significant portion of its revenue still comes from the trading of refrigerant gases and coal, both of which are cyclical and highly dependent on market conditions. In Q1FY25, coal trading accounted for more than 90% of the company’s revenue, up from 72% in FY22, primarily due to fluctuations in demand and pricing volatility. The company faces risks from any downturn in these markets, which could impact overall revenue and profitability. - Dependence on Government Policies:

The solar energy and ash management businesses, which are key growth drivers for Refex, are heavily dependent on government policies and regulations. Changes in government incentives or delays in policy implementation could slow down the growth in these segments. Additionally, while the Indian government has been pushing for increased solar energy adoption, any change in focus or reduced budget allocations for renewable energy could impact Refex’s growth prospects. - Execution Risks in Solar Expansion:

While the solar energy business has been a major growth driver, Refex’s plans for expansion come with execution risks. Expanding capacity requires significant capital investment, and any delays or cost overruns could affect the company’s profitability. Furthermore, the solar power industry is highly competitive, with numerous players vying for market share, potentially putting pressure on margins. - Environmental and Regulatory Risks:

As Refex operates in sectors such as refrigerant gases and coal trading, the company is exposed to environmental and regulatory risks. Stricter regulations on refrigerant gases, particularly with global moves toward phasing out harmful hydrofluorocarbons (HFCs), could impact the company’s refrigerant business. Similarly, tighter regulations on coal usage could reduce demand for Refex’s coal trading operations.

Industry Overview

The Indian renewable energy sector, particularly solar power, is experiencing rapid growth, driven by favorable government policies, including the goal to reach 500 GW of non-fossil fuel energy by 2030. The solar industry is expected to grow at a CAGR of 15% over the next five years, making it one of the fastest-growing sectors in India’s energy space. Refex, with its established solar power business, is well-positioned to capture a share of this expanding market.

The coal trading sector, however, faces challenges due to increasing global pressure to shift away from fossil fuels. Although coal remains a significant energy source in India, the long-term outlook suggests a gradual transition toward cleaner energy sources, which could impact the coal trading business.

Additionally, ash management services are becoming increasingly relevant, given India’s focus on environmental sustainability. The Indian government’s mandates for thermal power plants to manage fly ash have created a growing market for companies like Refex that offer ash management solutions.

Future Events:

Ash & Coal Handling- The company is doubling its capacity for ash collection, transportation, and disposal to accommodate larger volumes of ash and coal. It is expanding into 10 additional states to tap into new markets, aiming for revenue growth of two times through these strategic initiatives.

Refrigerant Gases- It plans to expand geographically by partnering with large OEMs for bulk orders and to focus further on Tier 2 and Tier 3 cities.

Green Mobility- It is exploring an organic expansion strategy to deploy more vehicles, supporting the increased use of four-wheeler EVs for personal mobility. The company aims to grow its fleet to 5,000 EVs by the end of FY27.

Analysis

Refex Industries Ltd.’s diversification strategy has enabled the company to mitigate risks associated with cyclical markets like refrigerants and coal while capitalizing on the rapid growth in renewable energy and environmental services. The company’s strong revenue growth in FY2024, driven by solar energy and ash management, highlights the success of this strategy. However, execution risks in the solar power expansion and regulatory challenges in the refrigerant business must be monitored closely.

Refex’s ability to maintain its operational efficiency while scaling up its solar power capacity and securing more contracts in ash management will be crucial for sustaining its growth trajectory. If the company successfully executes its expansion plans and navigates the competitive landscape, it could emerge as a leading player in the Indian renewable energy and environmental services sectors.

Conclusion

Refex Industries Ltd. is well-positioned to capitalize on India’s renewable energy and environmental sustainability initiatives. The company’s diversified business model, with strong growth in solar power and ash management, offers significant upside potential. However, cyclical risks in refrigerants and coal, as well as execution risks in solar expansion, require careful attention. Overall, Refex Industries presents an attractive growth story with long-term potential in India’s evolving energy landscape.