Stock Data:

| Ticker | NSE: MASTEK |

| Exchange | NSE |

| Industry | IT CONSULTING & SOFTWARE |

Price Performance:

| Last 5 Days | +0.48% |

| YTD | +14.08% |

| Last 12 Months | -8.48% |

Company Description:

Mastek is an IT software company specializing in enterprise digital and cloud transformation services. Their clientele includes the Government/public sector, health and life science, retail, and financial service sectors. Their service portfolio encompasses Application Development, Oracle Suite & Cloud Migration, Digital Commerce, Application Support & Maintenance, BI & Analytics, Assurance & Testing, and Agile Consulting. Mastek owns two subsidiaries: Evosys, known for its expertise in digital transformation and Oracle Cloud solutions, and MST Solutions, focused on Salesforce consulting. The company’s key service lines involve digital application engineering, application development, cloud native development, DevSecOps, and implementation of Oracle cloud and enterprise applications.

Critical Success Factors:

1. Strong deal momentum and order intake growth: Mastek experienced a consistent increase in order intake and order backlog, indicating a positive growth trajectory. The addition of new clients and larger client sizes further contribute to revenue visibility and future growth potential.

2. Diverse growth opportunities: Mastek is engaged in various sectors such as government/public sector, health and life science, retail, and financial services. The company’s participation in large frameworks, such as border security, immigration, trade-related services, police protection, and pension schemes, opens avenues for sustained growth and market share expansion.

3. Stable demand across geographies: Despite the volatile environment in the UK, Mastek’s core public sector services remain resilient. The company’s strategic involvement in key areas like border security and immigration, as well as its growth in the Middle East market, ensures stable demand and mitigates potential slowdowns.

4. MST Solutions acquisition: The acquisition of MST Solutions, a Salesforce consulting and system integration partner, strengthens Mastek’s customer experience service line and expands its global market presence. The synergies between the two entities create growth opportunities and enhance the digital transformation journey for customers.

5. Margin stability through operational efficiencies: Mastek’s focus on cost rationalization, favorable currency movement, utilization trends, and digital technology traction contributes to margin improvement. The company’s EBIT margin is expected to maintain stability, supported by operational efficiencies and moderate subcontractor costs.

6. Strong fundamentals and healthy debt protection metrics: Mastek has demonstrated stable revenue growth and strong profitability over the years. The company’s minimal debt, substantial net worth, and healthy debt-to-equity ratio ensure robust debt protection metrics. Additionally, the company maintains a significant cash position, providing financial stability and liquidity.

Key Challenges:

1. Currency and pricing pressures: The appreciation of the Indian rupee against the USD, along with pricing pressures, can adversely impact Mastek’s profitability. Fluctuations in exchange rates and the need to remain competitive in pricing pose risks to the company’s financial performance.

2. Dependency on the UK and EU markets: Mastek generates a significant portion of its operating revenue from the UK and EU markets, particularly from the UK’s public and healthcare sectors. Any changes in the UK Government’s policies on IT spending could pose a risk to Mastek’s revenue generation.

3. Margin vulnerability to wage inflation: Mastek’s profit margins are susceptible to pricing pressures and wage inflation. As wage costs increase, it can impact the company’s margins, especially considering a significant portion of its revenues and margins are exposed to currency risk.

4. Talent retention and attrition: High attrition rates above 20% remain a concern for Mastek, driven by intense competition and demand for skilled talent. The company aims to reduce attrition through wage hikes, but the overall situation in the IT hiring landscape can impact their efforts.

5. Debt-funded capex or acquisitions: Any unexpected higher levels of debt-funded capital expenditures or acquisitions could lead to a deterioration in profitability and cash generation for Mastek. Managing debt levels and maintaining a healthy financial position are important for sustaining the company’s operations.

6. Contract renewals and competition intensity: Non-renewal of contracts or higher discounts due to aggressive competition can impact the sustainability and scalability of Mastek’s client base. A slackening pace of new large deals could also impact growth visibility and hinder the company’s expansion efforts.

Financial Result:

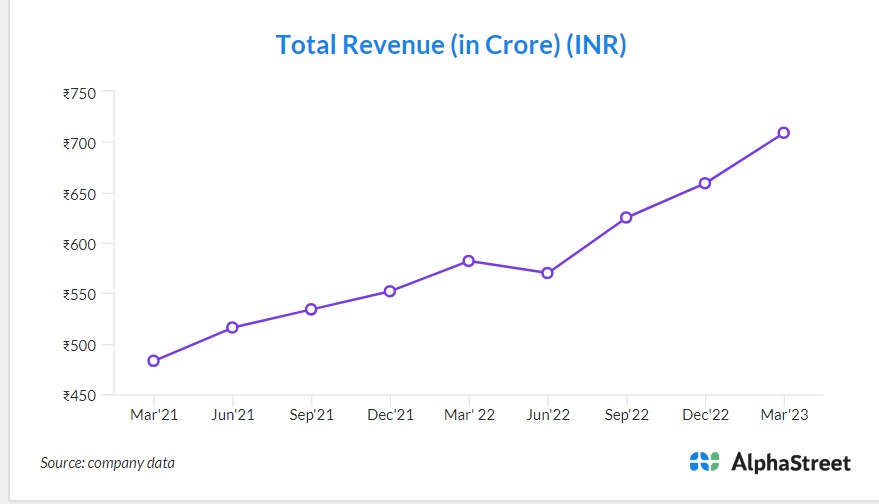

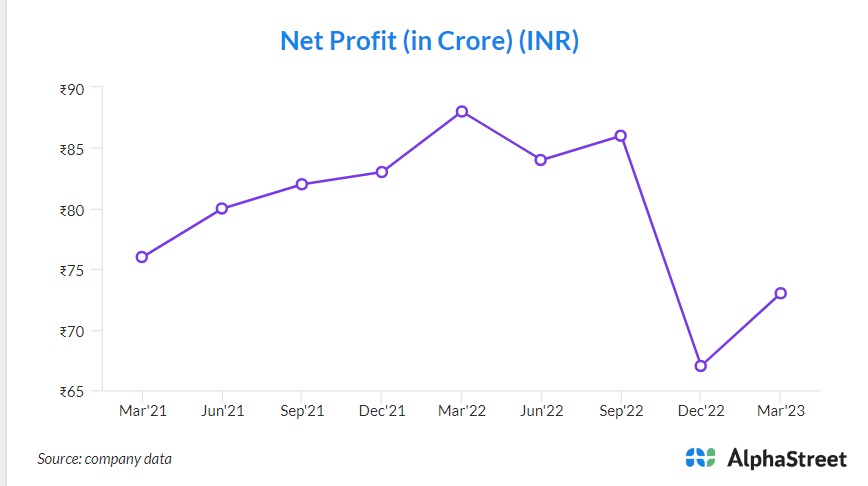

Mastek’s Q4FY23 results exceeded expectations, driven by strong execution and demand for Digital Engineering and Cloud Transformation services. The company achieved consolidated revenue growth of 7.7% QoQ and 22% YoY, amounting to Rs 709 crore in Rupee terms. The EBIT increased by 12.5% QoQ but declined by 2.4% YoY, with an EBIT margin of 14.9% in Q4FY23. Net profit grew by 8.1% QoQ but fell by 17.8% YoY to Rs 72.6 crore. In FY23, the company recorded a consolidated revenue growth of 17.4% YoY, reaching Rs 2563 crore, while net profit decreased by 7% to Rs 310 crore.

During Q4FY23, Mastek added 28 new clients, bringing the total active clients to 464. The 12-month order backlog stood at Rs 1,794 crore ($218.3mn) as of March 31, 2023. The company had a total of 5,622 employees, with 4,036 based offshore in India and the rest at various onsite locations. The attrition rate for the last twelve months was 21.0% in Q4FY23, compared to 23.3% in Q3FY23.