Being one of the world’s largest and fastest-growing digital analytics companies, Latent View Analytics Limited (NSE: LATENTVIEW) aids clients in their business transformation. The company’s recent earnings report reflects robust profits and revenues, rising demand, and a robust cash position. Also, higher margins reflect operational efficiency. Additionally, to cater to the changing dynamics of the sector, LatentView is striving to help clients with innovative products and services in the IT sector. Though competitive pressure and macro uncertainties loom, the company is focused on capitalizing on growing industry opportunities through client acquisition and geographical expansion. Therefore, based on the company’s strong fundamentals, high returns, and long-term growth prospects, investors may build a position in the stock at the current level, which launched its IPO in November 2021.

Overview

India-based LatentView Analytics, a global digital analytics consulting and solutions firm, is a Mid Cap company that operates in the Information Technology sector. Established in 2006, the company operates its business through a globally distributed workforce of more than 1050 employees in 6 countries across 3 continents.

LatentView helps businesses to transform digitally through the power of data and analytics. It provides analytics services including data and analytics consulting, business analytics & insights, advanced predictive analytics, data engineering, and digital solutions.

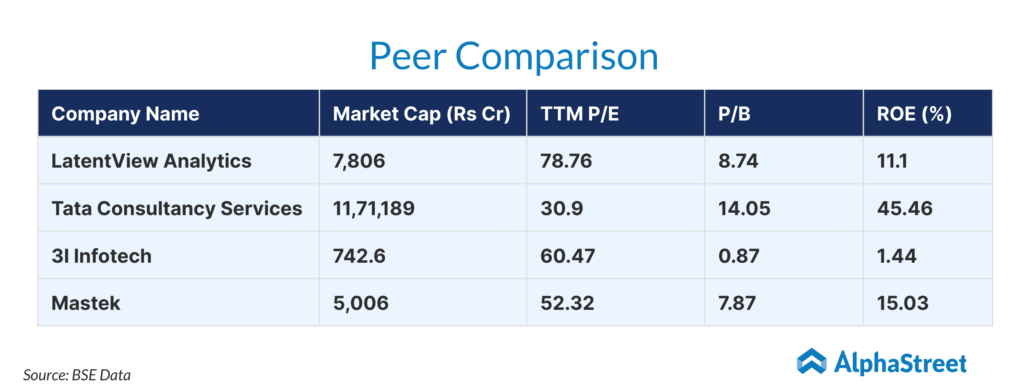

With a market capitalization of about Rs 7,806 crore, LatentView serves blue-chip companies in Technology, Banking, financial services and insurance (BFSI), CPG & Retail, Industrials, and other industry domains. It is listed both on the BSE (Bombay Stock Exchange) and the NSE (National Stock Exchange) in India.

Recent Share Price Insights

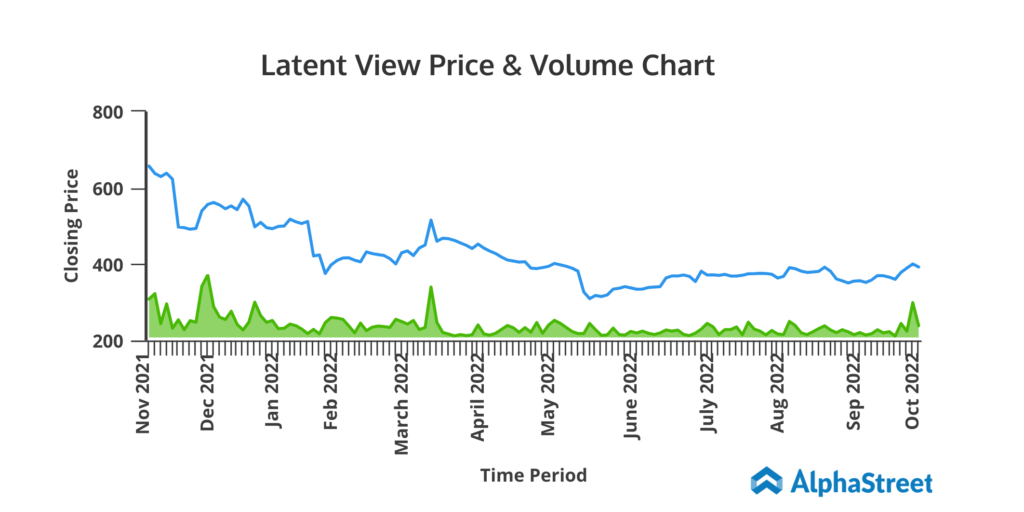

- With the current price of Rs 396.05 (as of November 2), LatentView depicts an upside potential of more than 90% compared to the high of its 52-week range of Rs 305.25 – Rs 754.90.

- The stock recorded a return of 11.43% in the past month and 6.29% in the past three months, after recording losses of more than 30% year-to-date.

Financial Snapshot

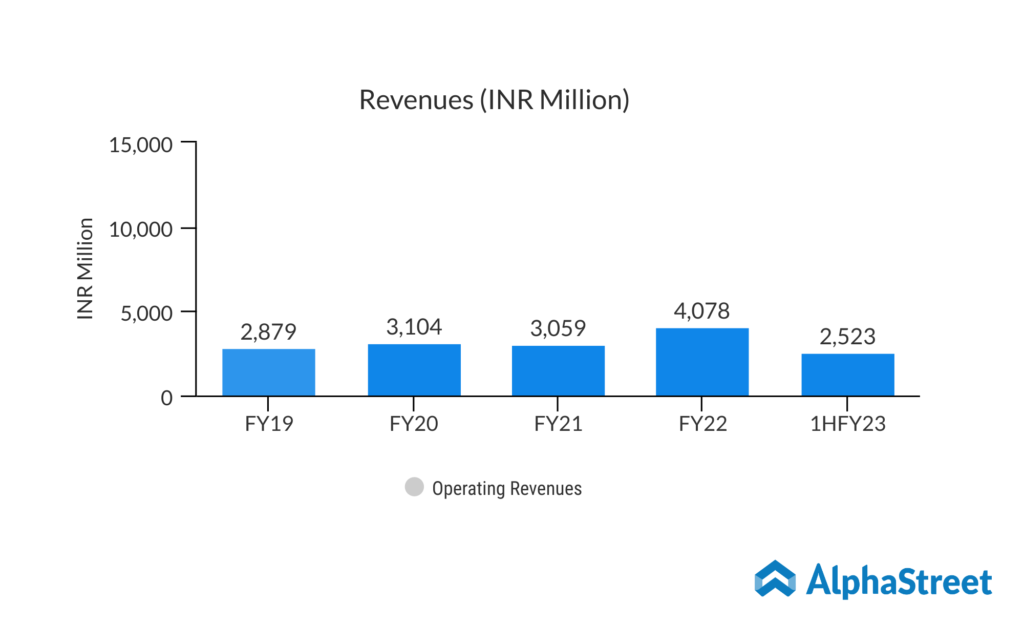

Recently, LatentView reported operating revenues of Rs 1,324 million in Q2 FY2023 (ended September 30), up 39.7% YoY driven by broad-based growth in all verticals.

Profit after tax (PAT) came in at Rs 373 million, up 71.7% on a YoY basis. Additionally, earnings per share (EPS) were Rs 1.80, up 50% from the prior-year quarter.

Total expenses stood at Rs 979, up 37.9% YoY. The company depicted strong margins with EBITDA at Rs 373 million, up 41.1% YoY and the margin stood at 28.2%.

As of September 30, 2022, total assets stood at Rs 11,621 million compared to Rs 11,000 million as of March 31, 2022. Cash and cash equivalents including investments were Rs 6,870 million. Operating cash flow came in at Rs 489 million.

Commenting on the strong quarterly results, Rajan Sethuraman, Chief Executive Officer of LatentView Analytics said, “We are happy to report yet another strong quarter performance, with revenue growth of 10% on a QoQ basis corresponding to ₹1,324 million, as well as 40% growth on YoY basis. Our performance was broad based, led by growth across our key verticals. Despite the global macroeconomic concerns, we are seeing robust demand for our services across a range of business segments…LatentView remains fully committed to growth primarily, with strong focus on profitability.”

Factors to Consider

Revenue Growth: Grabbing a high market share, LatentView recorded strong revenue growth over the past four years with a CAGR of 9.09% in FY2022. The uptrend continued in the first six months of FY2023 reflecting 38.2% YoY growth, which is expected to trend higher based on long-term contracts.

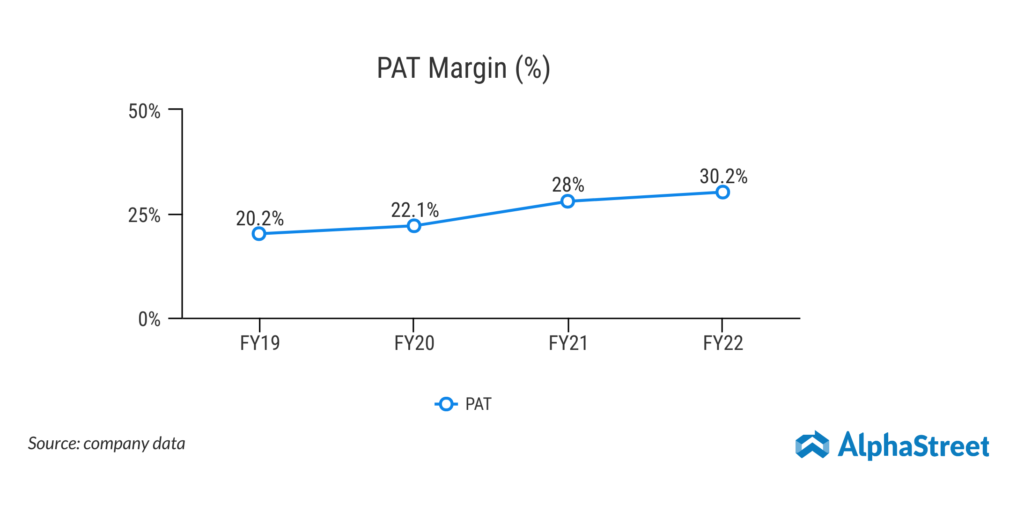

Earnings Growth: Profits after tax reflected an uptrend over the past four years riding on strong revenues. PAT margin increased from 20.2% in FY2019 to 30.2% in FY2022. The rising trend continued in the first six months of FY2023, depicting 230 basis points expansion on a year-over-year basis. Continuation of such a trend will help the company to withstand economic downturns and macro uncertainties.

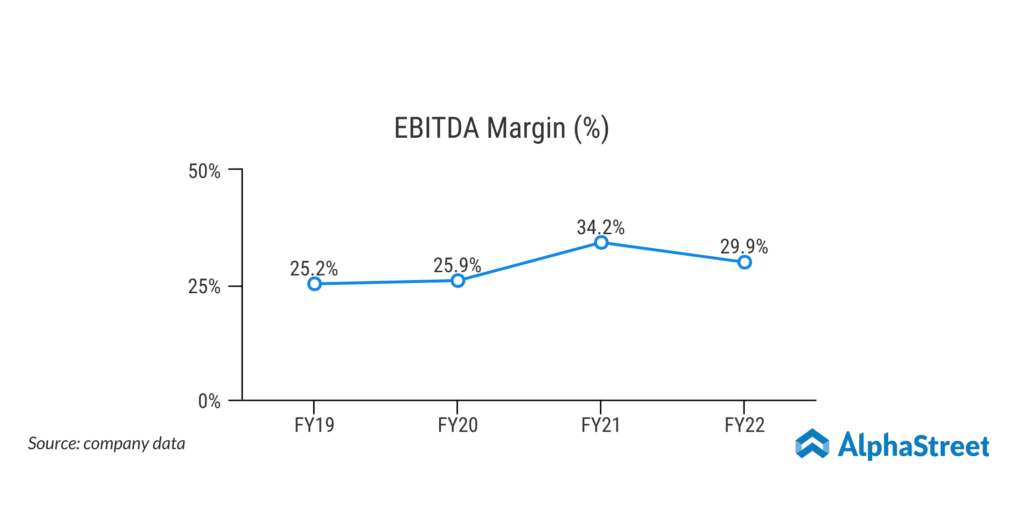

Margin Expansion: LatentView’s margin remained strong over the past few years. It reaped the benefit of operating leverage gained from elevated contribution margins from consulting services’ incremental revenue. EBITDA margin rose to 29.9% in FY2022 from 25.2% in FY2019. It decreased slightly to 28.6% in the first half of FY2023 due to high costs but remained at elevated levels.

Strong Client Base: LatentView earns a substantial portion of revenues from big clients. As of September 30, 2022, it earns 36.9% of operating revenues from clients with exposure to over Rs 500 million and 34% from clients with exposure to between Rs 100 million and Rs 500 million.

Innovation: Technology advancement is the key to success. The company is striving to provide clients with innovative products and services to help them with digital transformation.

Competition: Though competitive pressure exists in the industry, LatentView is in an advantageous position with a very low amount of debt, reflecting strong capital and liquidity position.

Industry Analysis

The booming IT industry contributed 8% to India’s GDP in 2020, which is expected to contribute 10% by 2025. The pandemic has pushed the generation towards digital transformation. In the current digital era, firms across industries are making significant investments in digital technologies mainly Data & Analytics (D&A) to fuel growth, be competitive, and become prepared for the future. On rising demand for talent and skill, top industry players in this well-diversified sector across retail, telecom, and BFSI, have created job opportunities in the sector to a high level. Remarkably, Indian IT firms, who have delivery centres internationally, are increasing strategic alliances between domestic and global players to serve clients with their solutions worldwide. Though supply chain disruption is acting as a headwind to benefit from the industry’s growth opportunities, India’s IT and business services market is expected to reach $19.93 billion by 2025.

Peer Comparison

In terms of market capitalization, LatentView ranks decently among its peers but from a valuation perspective, the stock seems stretched. Based on strong fundamentals, conventional returns, and long-term growth prospects, investors can consider the stock as a long-term bet.