Gland Pharma Limited (NSE: GLAND) is a major player in the Indian pharmaceutical market, specialising in the production and sale of generic injectable pharmaceuticals. It was founded in 1978 and went public in November 2020. The company’s products are used in a wide range of therapeutic areas, including oncology, critical care, cardiology, and ophthalmology, and it has a diverse product portfolio of over 300 products.

The majority of the company’s revenue comes from the USA, Europe, Canada, Australia, and New Zealand. Moreover, Gland Pharma also has a well-established distribution network all over India and is one of the largest suppliers of generic injectables to the Indian healthcare system. The company has a strong research and development track record, with a focus on producing high-quality and cost-effective drugs. Gland Pharma has a robust pipeline of products in various stages of development, including complex and biosimilar drugs, which is expected to drive future growth.

Gland Pharma’s Financial Performance In Q3 FY23

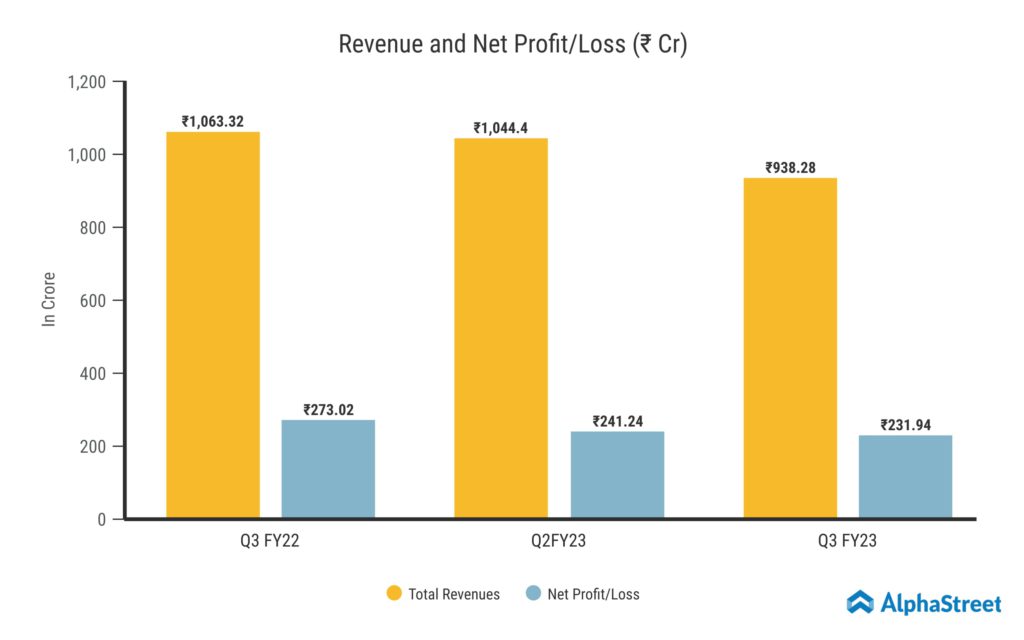

Gland Pharma Limited reported Revenue from Operations for Q3 FY23 of ₹938.28 Crore down from ₹1,063.32 Crore year on year, a decline of 12%. The performance has remained weak due to ongoing supply disruptions, some production-related delays and softer US demand for some of our key products. The Consolidated Net Profit of ₹231.94 Crore, a contract of 15% from ₹273.02 Crore in the same quarter of the previous year. The Profit were impacted due to a higher depreciation expense on the company’s newly capitalized assets. The Earnings per Share is ₹14.08 for this quarter.

The third quarter’s Other Income totalled ₹61.5 Crore and consisted of gains on operations and interest on fixed deposits. The company’s EBITDA margin stood at 35% & Net Profit margin at 23% in the same period. It has been able to maintain a strong cash position in balance sheet, with a Cash & Bank balance of ₹3,829 Crore as of December 31, 2022. This should provide the company a financial flexibility to invest in future growth opportunities. The company has also generated ₹39.8 Crore of cash flow from operations in Q3 FY23.

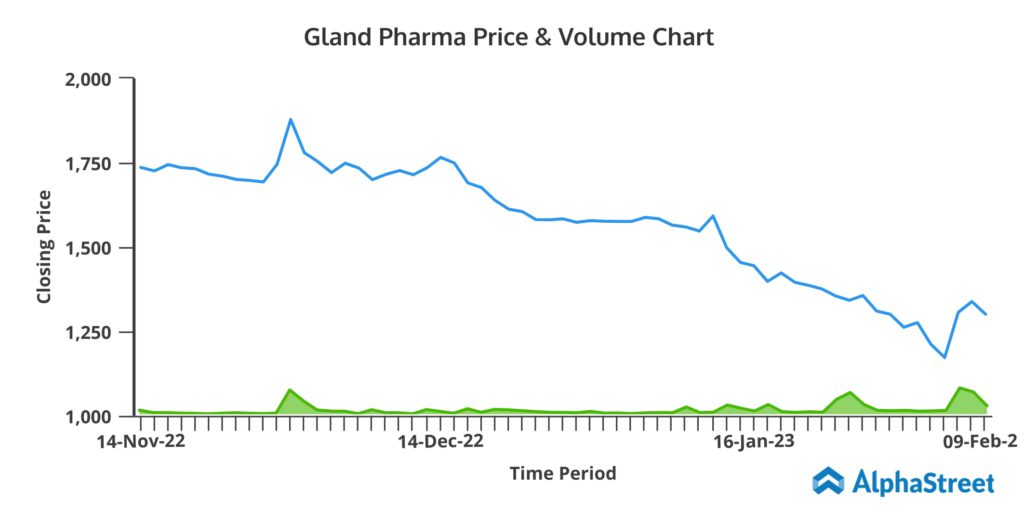

Gland Pharma’s Share Price Performance

As of February 9 2023, the stock price of Gland Pharma closed at ₹1,301, down from its listing price of ₹1,710 on NSE. The share price declined 15% in the last one month. Over the last six months, the stock is down by almost 43% and by 62% over the past year. It also touched an all-time high of ₹4,287 in August 2021.

Developments In Marketwise Segments

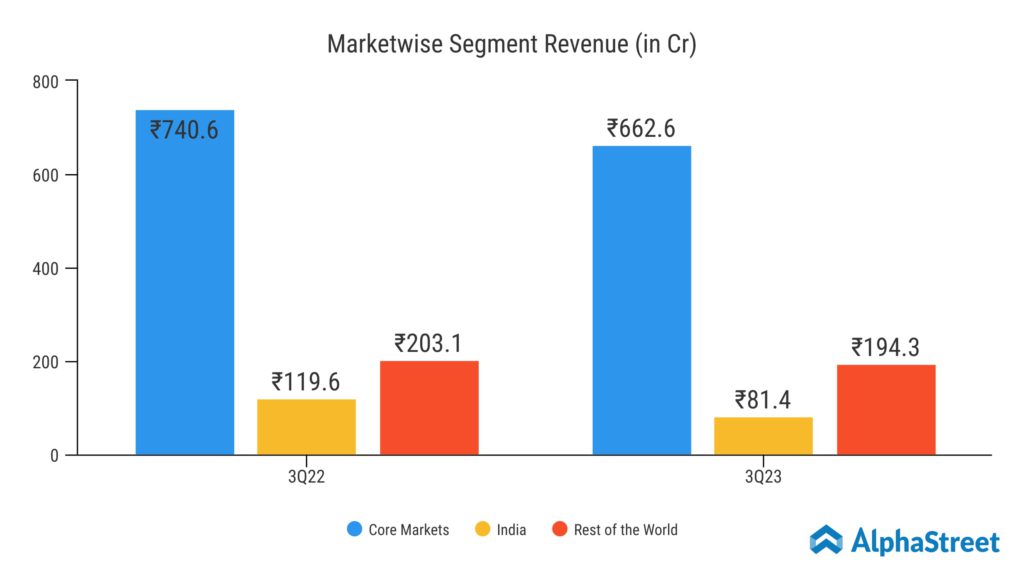

Gland Pharma’s core markets (US, Canada, Europe, Australia and New Zealand) generated a Revenue of ₹662.6 Crore which accounts for 70% of the Total Revenue. The core market segment saw a dip of 11% year on year down to ₹740.6 Crore. The supply chain problems impacted this segment. The management is working to improve material availability and resolve any production delays.

India market accounts for 9% of the Q3 FY23 Revenue. The domestic market contributed a total of ₹81.4 Crore, a sharp decline of 32% from the same quarter previous year. The steep price drop announced for key products such as Heparin, as well as the newly published NLEM list, has had an impact on the India business’s sales and margins. The remaining 21% of the total Revenue was reported by the Rest of the World market, which posted revenue of ₹194.3 Crore. China continues to be a key geographic focus from this market and the management anticipates to start receiving approvals soon.

Gland Pharma’s Acquisition Of Cenexi

A share purchase agreement has been signed by Gland Pharma International PTE and FPCI Sino French Midcap Fund to acquire the entire stake in Cenexi, a leading pharmaceutical company in Europe. The agreement was signed for up to EUR 120 million, or approximately 1,015 crore. This acquisition is aimed at expanding Gland Pharma’s presence in the Europe, where it is currently not a significant player in the CDMO (Contract Development and Manufacturing Organization) market. This move is expected to provide a significant boost to Gland Pharma’s international growth and help the company achieve its long-term goals.

Therefore, we should anticipate that this partnership will significantly increase Gland Pharma’s revenue and profits in the upcoming years. Also, benefiting shareholders by driving growth and creating value for them.

Enoxaparin’s Declining Market Share

Enoxaparin, manufactured by Gland Pharma, is a well-known medication for treating blood clotting disorders because it is both affordable and of the highest quality. Consequently, both patients and healthcare professionals favour it. The drug’s sales in the US market generate an estimated $50 million in revenue each year. With $5 million in Q3, sales for the first nine months of this fiscal year totalled $44 million. However, the company reported a decline in this drug’s market share.

As per the management, “I think it’s a timing issue for the particular product. And also, what we have seen is maybe because of the high fed rate, people are rationalizing the inventories. People were holding seven to eight months inventory earlier. Now I think they are cutting down on the inventory levels. We have seen a substantial shift in that. So the offtake has been softer to be fair. And the replacement of those what we lost on a couple of big products, that couldn’t get replaced by some of the big launches what we mentioned in the last quarter also. But so offtake has been softer.”

In conclusion, Gland Pharma is a well-established player in the Indian pharmaceutical market with a strong product portfolio, distribution network, and financial performance. The company’s acquisition of Cenexi has positioned itself well for future growth opportunities in the European CDMO market, makes it an attractive investment option for long-term investors. However, the company’s declining market share for it’s lead products like Enoxaparin is concerning.