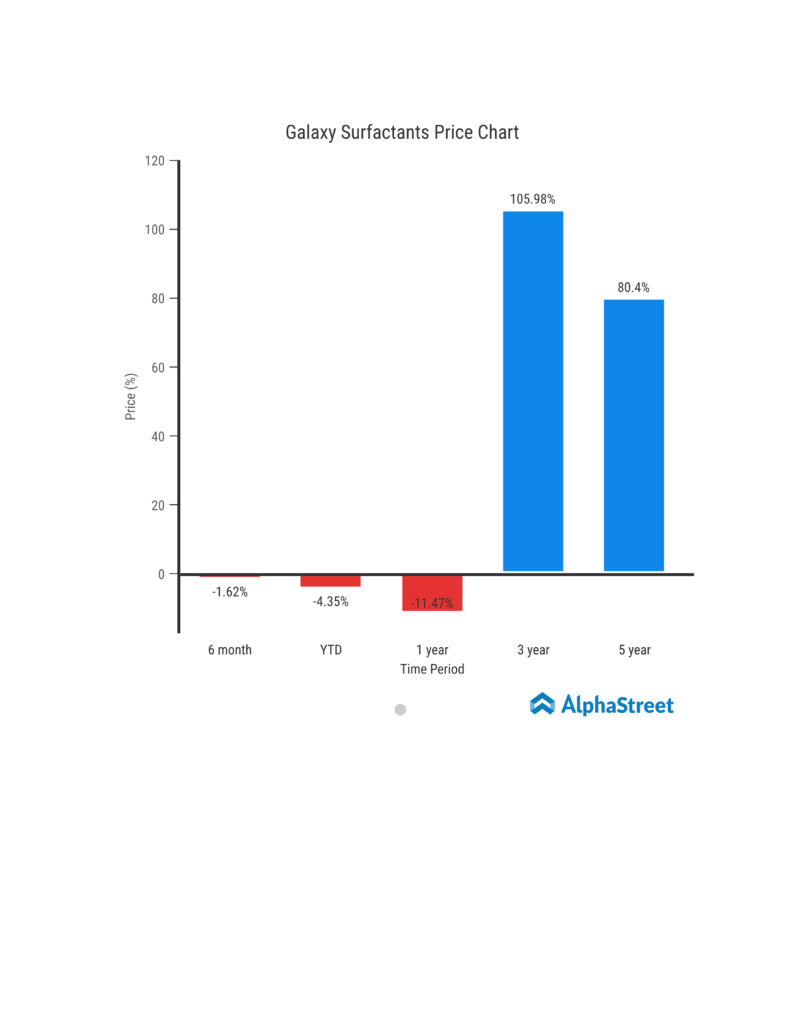

With Galaxy Surfactants Limited (NSE: GALAXYSURF) providing above 100% return over the past three years, strong fundamentals, and rising demand in India’s specialty chemicals market, investors can build a position in the stock at current levels for long-term gains.

Interestingly, the stock outperformed the 3-year Nifty Midcap 100 return of 99.64%.

Galaxy Surfactants is one of the top players in the world of Surfactants and Specialty Care Ingredients. It exclusively serves clients in the Home and Personal Care Industry. With a market cap of Rs 10,654.15 crore, the stock is listed on both NSE and BSE.

Factors to Consider

Heightened volatility in the market due to macroeconomic challenges resulted in a slowdown in various sectors like infrastructure, automotive, and other industries. Therefore, like other mid-cap companies, Galaxy stock is also not untouched.

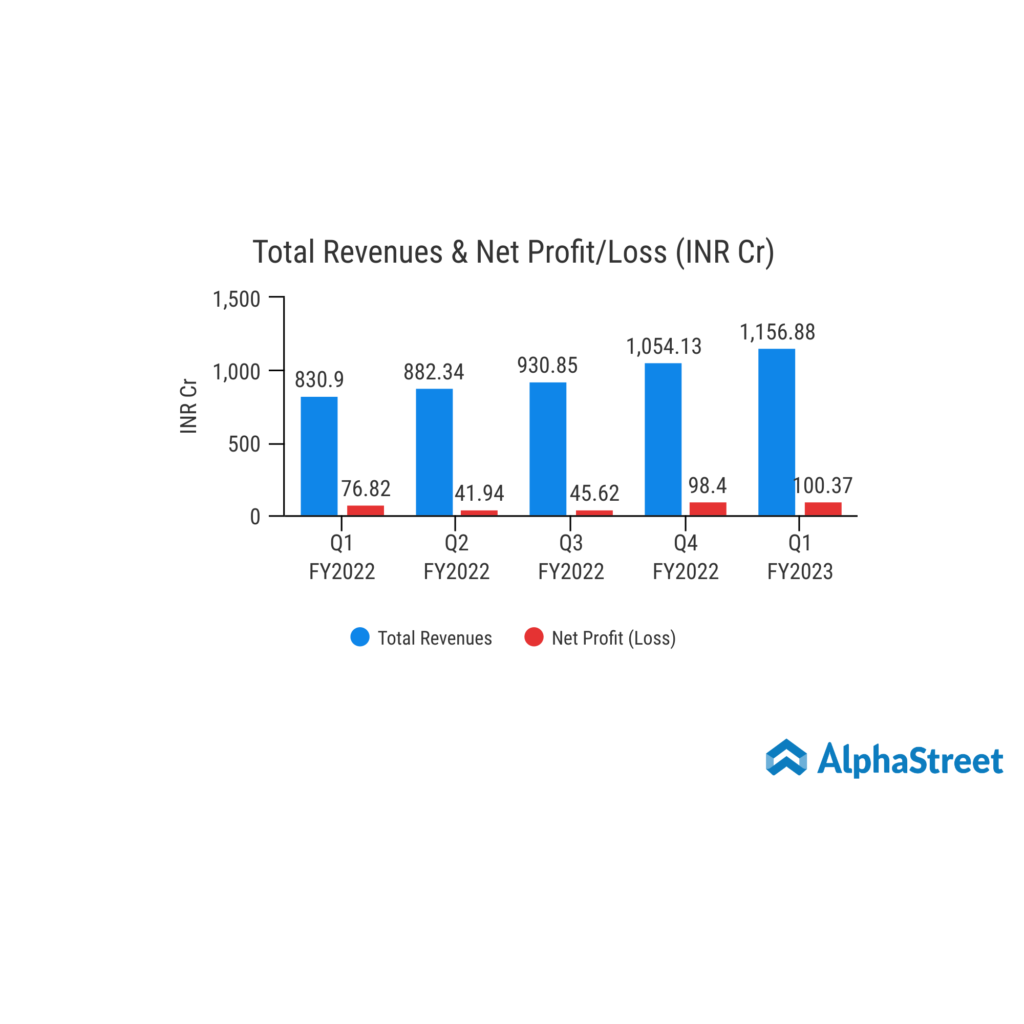

Supply challenges like timely feedstock unavailability, delays in shipment, escalating freight costs, and feedstock prices hampered the company’s services to cater to the underlying demand. Nevertheless, the company rebounded in Q4 FY2021 and thereafter with strong volumes in the Indian market.

Due to global hues, volumes in exports including Africa, the Middle East, Turkey, and the Rest of the World suffered. Though global growth is expected to be subdued due to volatile commodity and currency markets, along with political uncertainties, the domestic chemicals sector’s small and medium firms are likely to record 18%-23% revenue growth in 2022. The growth is expected to ride on improved domestic demand and higher realization due to escalated prices of chemicals.

India’s specialty chemicals companies are building their capacities to meet a spur in domestic and overseas demand. Remarkably, the demand for specialty chemicals is forecast to record a four-year CAGR of 12% in 2022. Interestingly, specialty chemicals form 22% of the total chemicals and petrochemicals market in India.

Consistent sales growth, growing EBITDA, and steady profits have supported the financials of the company over the past few years. Additionally, consistent double-digit return on capital employed (ROCE) and low debt level, indicate financial stability. However, rising expenses remain a concern.

From the perspective of income-oriented investors, the company seems attractive as it offers consistently increasing dividends. With an annual dividend yield of 0.60%, the company has more than doubled its dividend per share from Rs 7 to Rs 18 in FY2022.

Though the company experienced margin contraction over the past couple of years on escalating costs, its leadership position in the industry and technological advancement remains key to success.

Our View

In the current era of digitization, the company depicts strong business momentum with technological advancement, innovation, and financial stability. Therefore, investors might consider the stock as an attractive investment opportunity based on its strong fundamentals and industry prospects. Also, the company’s TTM P/E and P/B ratios stand at 37.03 and 6.33, respectively, much lower than most of its industry peers. It indicates that the stock is undervalued at the current level.