Stock Data:

| Ticker | NSE: DODLA |

| Exchange | NSE |

| Industry | DAIRY |

Price Performance:

| Last 5 Days | -9.33 % |

| YTD | +35.49 % |

| Last 12 Months | +31.35% |

Company Description:

Dodla Dairy is a prominent player in the dairy industry, known for its unwavering commitment to quality and innovation. With a diversified product range that includes value-added dairy products and fat-based offerings, the company caters to a wide range of consumer preferences. Dodla Dairy has established a robust presence across various aspects of the dairy value chain, from procurement and processing to distribution and cattle feed. This comprehensive approach ensures a consistent supply of high-quality dairy products to meet growing market demands. The company’s emphasis on adaptability, sustainability, and adherence to ESG practices underscores its commitment to long-term success and responsible business practices.

Critical Success Factors:

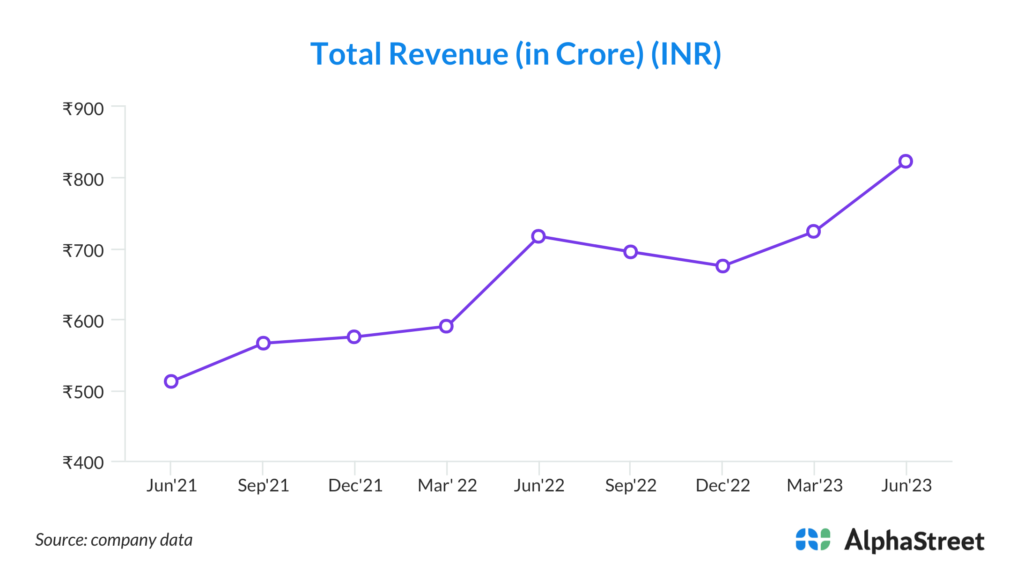

1. Impressive Revenue Growth: Dodla Dairy’s achievement of surpassing the INR 8,000 million quarterly revenue milestone in Q1 FY ’24 is a testament to its financial strength and market competitiveness. This level of revenue demonstrates the company’s ability to attract and retain customers, expand its market presence, and effectively manage its operations.

2. Consistent Year-on-Year Growth: The 14.8% year-on-year growth in revenue from Q1 FY ’23 to Q1 FY ’24 is a remarkable accomplishment. This consistent growth indicates that Dodla Dairy is not only capable of achieving impressive financial results but also sustaining and building upon them over time. It suggests effective strategic planning and execution within the company.

3. Strong Sales of Value-Added Products (VAP): The growth of VAP and fat-based product sales by 12.9% year-on-year to INR 2,586 million is a significant strength. This demonstrates Dodla Dairy’s ability to offer products that cater to evolving consumer preferences and market demands. VAP sales contribute substantially to overall revenue, showcasing the company’s capacity to add value to its offerings.

4. Diversified Product Portfolio: Dodla Dairy’s success is partly attributed to its diversified product portfolio. The ability to adapt to different market conditions, such as the extended summer season, highlights the company’s agility in responding to consumer needs. A diverse product range can help mitigate risks associated with fluctuations in demand for specific products.

5. Strategic Focus on Quality: Dodla Dairy’s emphasis on quality and innovation is crucial for building and maintaining consumer trust. By adopting a pharma-centric approach, the company positions itself as a provider of safe and high-quality dairy products. This commitment to quality can lead to brand loyalty and positive customer reviews.

6. Capacity Expansion Plans: Dodla’s commitment to regular capacity expansion is a strategic move to meet growing market demands. This forward-looking approach ensures that the company can scale its operations efficiently, avoiding potential supply shortages during periods of high demand.

7. Adaptability to Market Dynamics: Dodla Dairy’s ability to adapt to evolving market dynamics is a key strength. The mention of benefits from the upcoming flush season and the company’s readiness to capitalize on this opportunity demonstrates its agility and responsiveness to changes in the dairy industry. This adaptability is crucial for maintaining a competitive edge.

Key Challenges:

1. Market Volatility: Despite Dodla Dairy’s impressive revenue growth, there is inherent risk in the dairy industry due to market volatility. The company’s dependence on factors like seasonal changes and consumer preferences could impact its financial performance. For example, while the extended summer season boosted sales, a sudden shift in weather patterns or consumer trends could lead to fluctuations in demand.

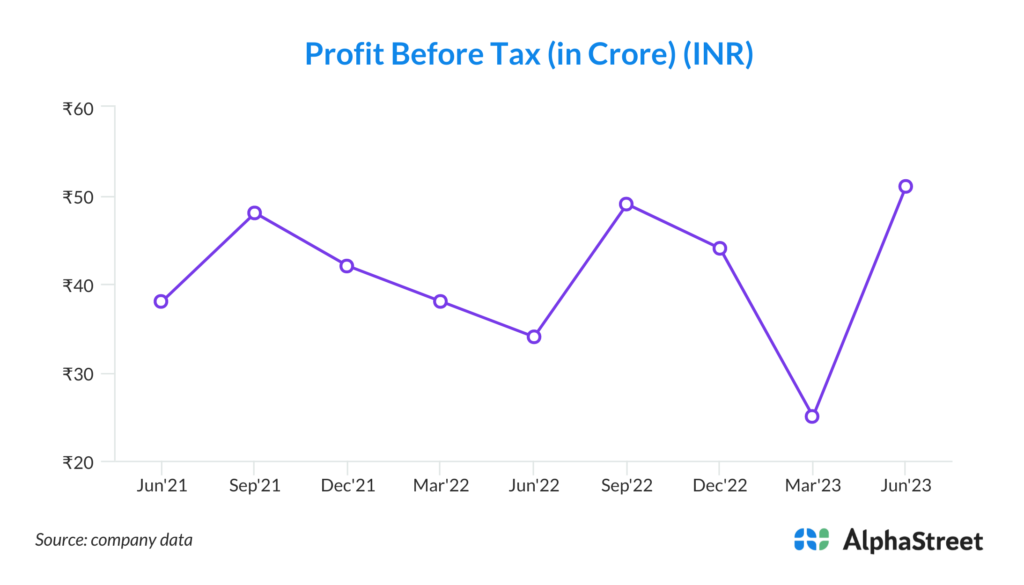

2. Commodity Price Fluctuations: Dodla Dairy’s profitability is sensitive to fluctuations in commodity prices, particularly the cost of raw materials like milk. While the company benefited from lower raw material prices in the past, it remains exposed to future price increases, which could squeeze profit margins.

3. International Business: The relatively modest revenue from international business (INR 606 million in Q1 FY ’24) poses a risk. The company may face challenges in expanding and diversifying its international operations. Economic and geopolitical factors can also impact its ability to maintain a stable international revenue stream.

4. Rising Employee Expenses: The increase in employee expenses by 29 bps year-on-year in Q1 FY ’24 is a concern. This upward trend in labor costs could erode profitability over time, especially if it continues without corresponding increases in productivity or efficiency gains.

5. Profit Margin Pressures: Although Dodla Dairy has shown strong profit growth, there’s a risk that the company might face pressure on profit margins. As the business grows, maintaining or expanding profit margins becomes challenging, especially in a competitive industry with price-sensitive consumers.

6. Dependency on Milk Procurement: Dodla Dairy’s ability to maintain its operational efficiency relies heavily on milk procurement. A 7.4% year-on-year growth in milk procurement is positive, but any disruptions in the procurement process, such as supply chain issues or difficulties with dairy farmers, could impact production and sales.

7. Regulatory and Environmental Factors: The dairy industry is subject to various regulations related to food safety and environmental sustainability. Compliance with evolving regulations can be costly and time-consuming. Additionally, concerns over environmental impact and animal welfare could lead to changing consumer preferences, affecting the dairy industry as a whole.