We are already into business for segments like Personal Loans, Education Loans, Auto Loans, Commercial Vehicle etc SME & Corporate focus will continue with due caution. Boosting the fee income is in the top priority list. A new transaction banking vertical has been set up towards focusing on the trade and forex income. Bank has launched two new trade forex current account variants as well. With all these falling in place, we look forward to improve upon our performance in both the topline as well as bottom line parameters in the coming quarters. – Mr. Pralay Mondal, Managing Director & CEO

Stock Data:

| Ticker | NSE: CSBBANK | BSE: 542867 |

| Exchange | NSE & BSE |

| Industry | BANKING |

Price Performance:

| Last 5 Days | -1.56% |

| YTD | +15.04% |

| Last 12 Months | +30.72% |

Company Description:

CSB Bank is a private sector bank in India that has been around for over a century and has a strong presence in Southern India. In October 2018, the bank was taken over by new promoters, the Toronto-based Fairfax group, and a real transformation began. This included creating a new brand image, funding capital for growth, strengthening the top management team by bringing in experienced professionals, and implementing a product-based lending approach. After achieving critical transformation, the bank has continued to focus on growth. The changes made have allowed the bank to develop a clear strategy for growth, which includes expanding its presence in existing markets and entering new markets, increasing its customer base, and expanding its product range. With a focus on customer service and a strong commitment to growth, the CSB Bank is well-positioned to continue its success in the Indian banking sector.

Critical Success Factors:

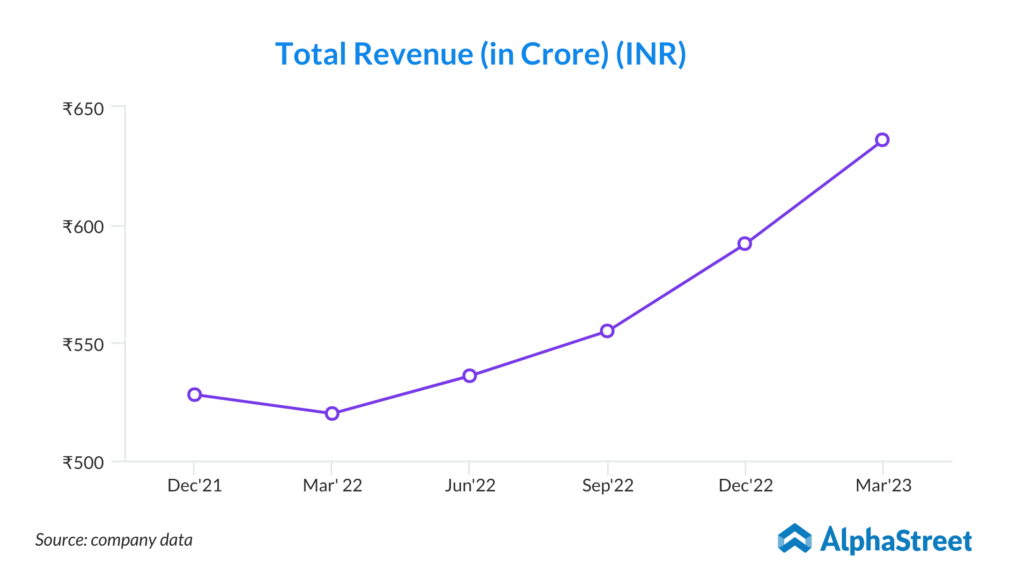

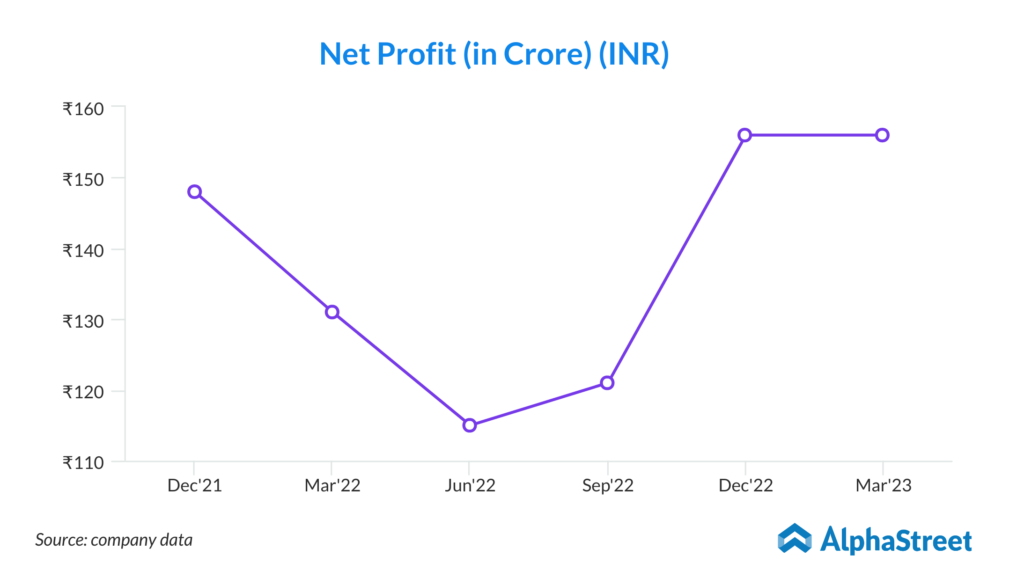

- CSB Bank has delivered a robust performance in Q3FY23, registering a growth momentum across its operations. The bank’s net interest income surged 15% YoY, supported by a 39bps YoY improvement in NIMs at 5.8%, while other income rose 65% YoY, mainly driven by processing and other fees. The bank’s loan book grew by 26% YoY and 6% sequentially, supported by impressive growth in the gold loan book of 51% YoY. Moreover, the bank’s yield on advances was at 11.02%. These impressive numbers suggest that the bank is poised for strong growth in the coming quarters.

- CSB Bank’s capital adequacy ratio stood at 25.78%, well above the regulatory requirement of 12%, which is an encouraging sign. The bank’s loan book is tilted towards gold loans, resulting in lower risk-weighted assets, which has helped it maintain a healthy asset quality. The bank’s GNPA and NNPA improved by 20bps and 15bps QoQ to 1.45% and 0.42%, respectively, while its contingency provisions accounted for 1.36 times its NNPA, providing a cushion to the bank’s balance sheet. The bank aims to maintain gross and net NPA below 2% and below 1% over the long-term period, which bodes well for its asset quality.

- CSB Bank’s deposit base has remained sticky, and it has created a brand name among NRIs in the South region, which has provided a steady inflow and stability to its deposit base. The bank also benefits substantially from a sticky and large NRI deposit base that has remained stable, and its deposit renewal rate over the past five years has remained above 90%. Although the bank’s CASA ratio remains lower compared to its peers, it has been putting in a lot of efforts to set up technology and products to garner more CASA. In this regard, the bank is actively expanding into newer geographies, which will help it increase deposits and meet its growth potential in credits.

- CSB Bank’s gold loan book has been the driving force behind its loan book growth, accounting for 77% of the incremental YoY credit growth. With impressive tonnage growth coming from existing as well as new customers, the bank’s loan book is expected to continue to grow in the coming quarters. The bank’s operating expenses have increased due to new branch openings and high recruitment of working personnel, but its pre-provision operating profit still stood at Rs.193.44 crores, up 31% YoY, which is an encouraging sign. Overall, CSB Bank has several strengths, including its robust capital base, improving asset quality, sticky deposit base, and focus on gold loans, which should help it sustain its growth momentum in the future.

Key Challenges:

- CSB Bank faces several risks and concerns, starting with regulatory changes that could impact the bank’s earnings outlook. Any unfavorable change in rules and regulatory policies can have a negative impact on the bank’s financial performance, eroding value for shareholders. Additionally, failure to execute the management strategy or delay in doing so could impact financial performance, leading to losses for shareholders.

- Another concern is the gradual reduction of promoter group’s stake in the bank, as mandated by the RBI over a period of 15 years from the completion of their investment in the Bank in 2018. The RBI had also mandated the promoter group to not sell any holding in the first five years of investment. If the promoters do not sell their stake, the bank could go for FPO to bring the stake of Fairfax down. However, a partial exit for Fairfax in the secondary market over the medium term is also possible.

- The bank’s low CASA Ratio at ~31.44% as of Dec-22 is also a concern, especially in times when liquidity is tight in the system. The bank is investing heavily in manpower and technology to garner CASA deposits, retail & wholesale loans, and to open 100 new branches each year going forward. However, these investments are leading to rising opex and capex, along with the rising interest rates, impacting the bank’s costs. In such a situation, the yield on advances becomes very important for the bank to manage.

- Finally, the bank’s high concentration both product offering wise as well as geographical presence wise is also a risk. Kerala, Tamil Nadu, Maharashtra, Andhra Pradesh and Karnataka together contribute 85% of Advances, and gold loan is ~45% of the total loan book as of Q3FY23. Any adverse developments in these geographies/segment could cast a significant negative impact on the bank’s performance.