The shares of Cosmo First surged 1.29% to INR 756.05 a piece after the board announced buyback worth INR 108 Crore at a price not exceeding INR 1,070 each. The company planned indicative maximum number of equity shares to be bought back under the buyback scheme would be 10,09,345 equity shares (representing approximately 3.70%, which is less than 25% of the existing paid-up equity share capital of the company).

The maximum buyback size represents 9.95% and 9.22% of the aggregate of the total paid-up equity share capital and free reserves of the company. As on 14 January 2023, promoters and promoter group held 44.27% in the company.

Assuming the buyback of maximum buyback shares, promoter group holding will increase to 44.40%. The shares of Cosmo First jumped 4.09% to INR 746.45 on the BSE. The maximum buyback price is 43.35% premium to the ruling market price.

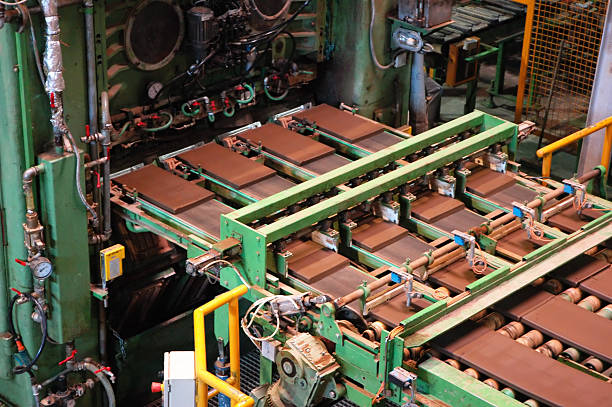

Cosmo First is a global leader in specialty films for packaging, lamination, labeling and synthetic paper. The company is strategically expanding beyond films into specialty chemicals & polymers as well as pet care business.

To know more about the company please click on the link