Stock Data:

| Ticker | NSE: CUB |

| Exchange | NSE |

| Industry | BANKING |

Price Performance:

| Last 5 Days | +1.00% |

| YTD | -30.29% |

| Last 12 Months | -7.24% |

Company Description:

City Union Bank is a leading private sector bank in India, founded in October 1904 and headquartered in Kumbakonam, Tamil Nadu. The bank operates with a focus on lending to Micro, Small, and Medium Enterprises (MSME) and the retail/wholesale trade sector. CUB has a strong presence in South India, with approximately 88% of its branches located in the region, and around 74% of its business originating from Tamil Nadu. The bank specializes in working capital financing to MSMEs and traders and also provides short-term and long-term loans to the agricultural sector.

Critical Success Factors:

a. Niche Focus: CUB’s specialization in working capital financing to MSMEs and traders allows it to focus on a specific segment of the market, leveraging its expertise and understanding of the needs of these businesses. This targeted approach helps CUB build strong customer relationships and enables tailored product offerings.

b. Strong Regional Presence: The bank’s significant presence in South India, particularly Tamil Nadu, provides a stable customer base and local market knowledge. This regional focus allows CUB to implement targeted growth strategies and adapt to the specific needs and preferences of customers in the region.

c. Granular Asset Profile: CUB’s asset portfolio consists of a diversified mix of short-term and long-term loans, including loans to the agricultural sector. This granular asset profile helps mitigate risks associated with concentration and enhances overall portfolio quality. It also provides CUB with opportunities for cross-selling and expanding its product offerings to customers.

d. Comfortable Capital Position: CUB maintains a robust capital position, with a CRAR of 22.34% and Tier-1 capital constituting 21.27%. This capital strength not only ensures regulatory compliance but also provides a solid foundation for future growth and expansion opportunities.

e. Business Re-engineering Partnership: CUB’s tie-up with The Boston Consulting Group (BCG) is expected to enhance risk measurement, portfolio modeling, digital lending, sanction processes, and customer experience. This partnership positions the bank for improved operational efficiency and competitive advantage in an increasingly digital banking landscape.

Key Challenges:

a. Margin Pressure: CUB’s Net Interest Margin (NIM) declined by 23 basis points quarter-on-quarter (q-o-q) to 3.65%. The bank faces margin compression due to non-recognition of interest subvention income on agri gold loans and higher repricing of deposits. This margin pressure could impact profitability and hinder the bank’s ability to generate sustainable earnings.

b. Subdued Credit Growth: CUB’s credit growth has been below system growth, with advances growing at a muted rate of 7% year-on-year (y-o-y) and remaining flat q-o-q. The subdued credit growth, especially in the first half of FY2024, may limit the bank’s ability to meet its growth targets and achieve desired economies of scale.

c. Weak CASA Franchise: CUB’s Current Account and Savings Account (CASA) deposits grew by only 1% y-o-y and 7% q-o-q, respectively, resulting in a lower CASA ratio of 30% compared to the previous year. The bank needs to focus on improving its CASA deposits to enhance its low-cost funding base and reduce dependence on costlier sources of funding.

d. Asset Quality Concerns: While there has been a decline in Gross Non-Performing Assets (GNPA) and Net Non-Performing Assets (NNPA) ratios, with GNPA at 4.37% and NNPA at 2.36%, the restructured book still accounts for 2.9% of advances. This poses asset quality risks that need to be closely monitored. Any significant deterioration in asset quality could lead to higher provisioning requirements and impact profitability.

e. Regulatory and Compliance Risks: CUB operates in a heavily regulated environment, and any failure to comply with regulatory requirements or changes in regulations could result in penalties, reputational damage, or operational disruptions. The bank must remain vigilant and adapt to regulatory changes effectively.

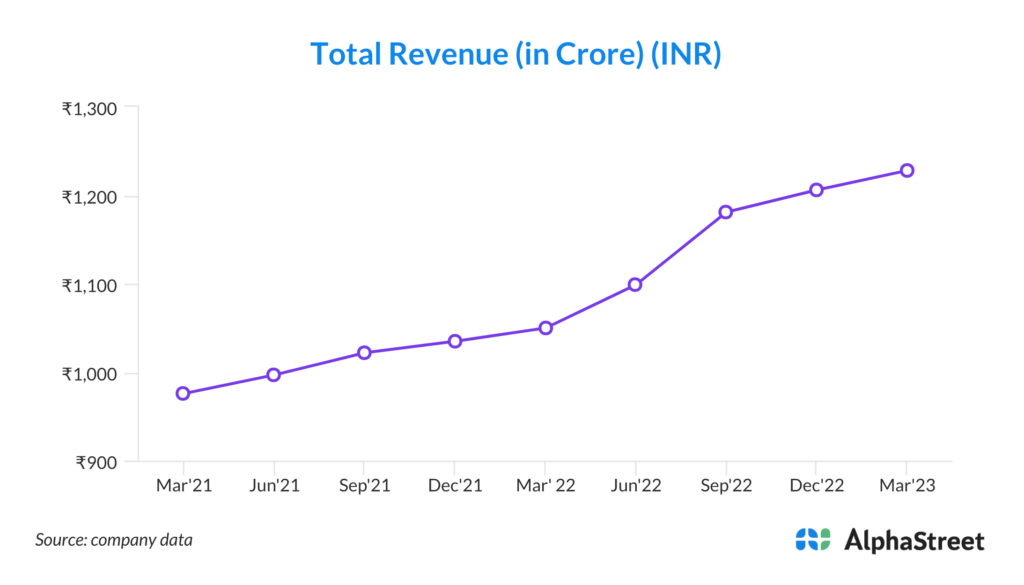

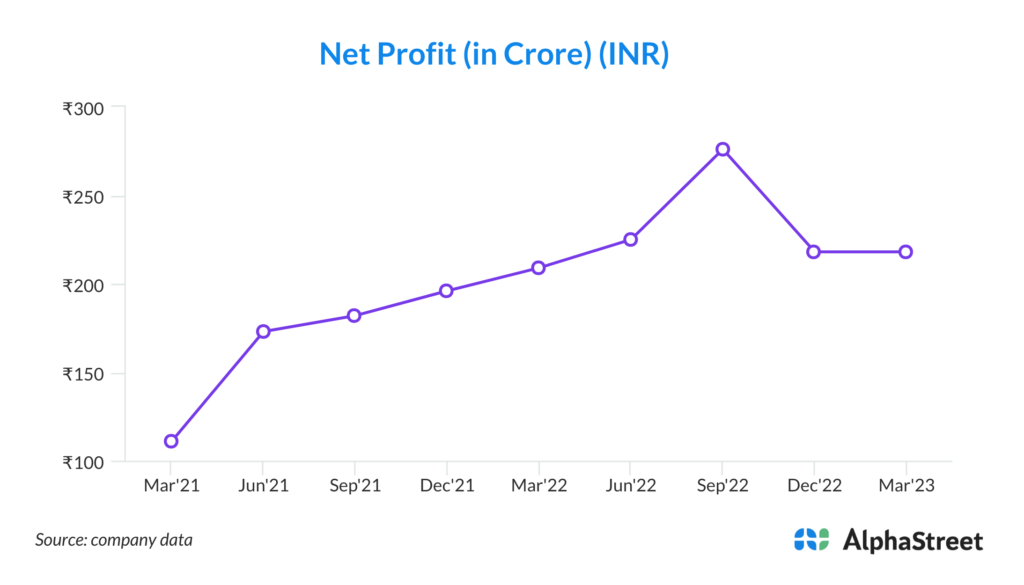

Financial Results:

In Q4FY2023, CUB reported muted growth in Net Interest Income (NII), which increased by 3% y-o-y but declined by 7% q-o-q to INR 400 crore. NIM stood at 3.65%, showing a decline of 23 basis points q-o-q. The decline in NII and NIM was primarily driven by non-recognition of interest subvention income on agri gold loans and higher repricing of deposits. However, the bank’s operating profit grew by 11% q-o-q to INR 280 crore due to lower provisioning and operating expenses. CUB’s Asset Quality improved with GNPA at 4.37% (down 47 basis points q-o-q) and NNPA at 2.36% (down 39 basis points q-o-q). The bank’s Provision Coverage Ratio (PCR) improved to 69.9% in Q4FY2023.

Conclusion:

City Union Bank’s focused approach on lending to MSMEs and traders, strong regional presence, granular asset profile, comfortable capital position, and business re-engineering partnership with BCG position it for potential growth. However, the bank faces challenges such as margin pressure, subdued credit growth, weak CASA franchise, asset quality concerns, and regulatory risks. Investors should closely monitor the bank’s progress in addressing these concerns and its ability to sustain profitability and asset quality. Despite the risks, CUB’s strong regional presence and niche focus provide a solid foundation for long-term growth, making it an interesting candidate for investment consideration.