Bhageria Industries Ltd, incorporated in 1989, operates in chemicals and solar power generation and distribution. The company has diversified its portfolio to include organic and inorganic chemicals, solar power projects, pharmaceuticals, and trading & EPC services.

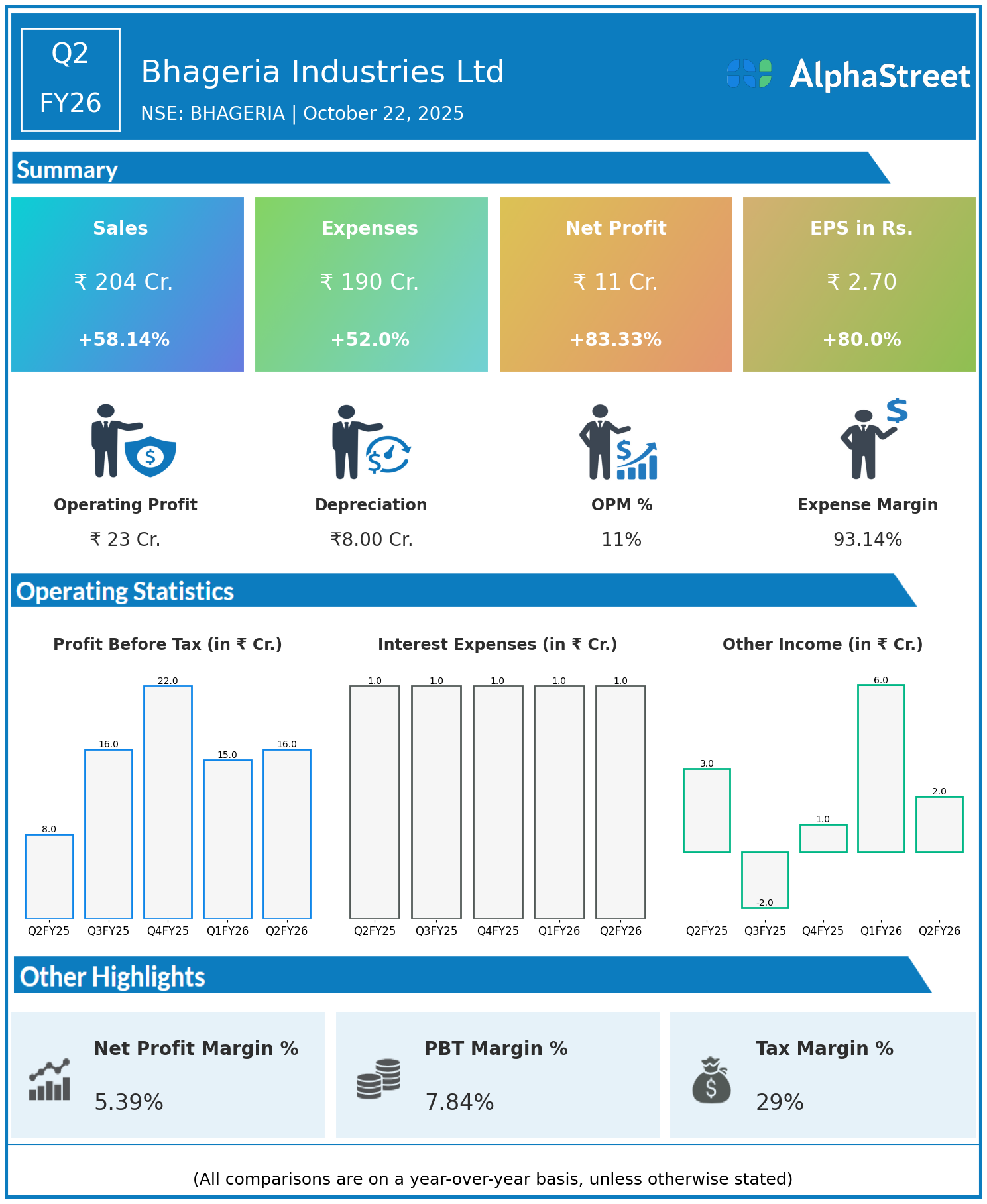

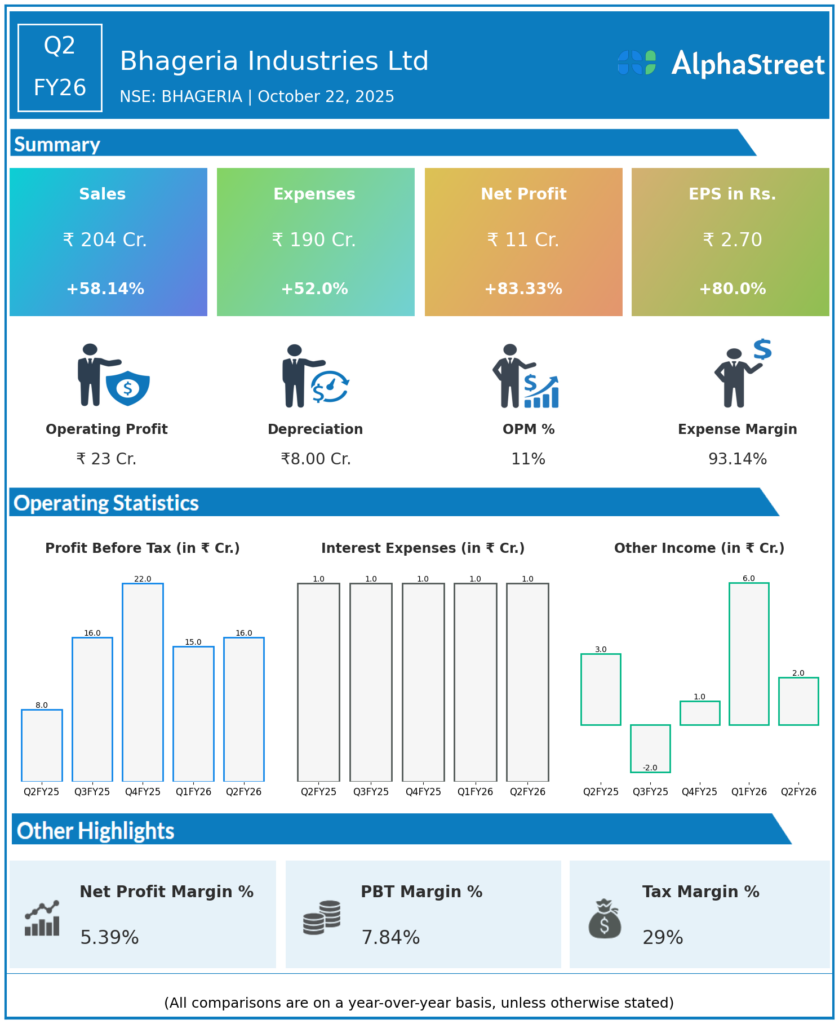

Q2 FY26 Earnings Summary

Consolidated revenue increased 58.14% year on year to ₹204 crore from ₹129 crore.

Total expenses rose 52.0% to ₹190 crore from ₹125 crore in the prior year.

Consolidated net profit surged 83.33% to ₹11 crore from ₹6 crore in Q2 FY25.

Earnings Per Share (EPS) rose 80.0% to ₹2.70 from ₹1.50 year on year.

EBITDA improved significantly, reflecting strong operational performance and margin expansion.

Operational and Business Highlights

The chemicals segment was the primary growth driver, supported by increased demand and higher sales volumes.

The solar power generation division reported positive traction contributing to overall revenue growth and profitability.

Business diversification and focus on high-margin specialties helped maintain stability amid market fluctuations.

Financial Position and Outlook

Bhageria Industries maintains a robust balance sheet with total assets exceeding ₹7,477 crore and shareholders’ equity of ₹5,745 crore as of September 2025.

The company’s strategic investments in solar power and specialty chemicals position it well for sustainable growth.

Management expressed confidence in continuing the growth trajectory through focused operational efficiencies and expanding market opportunities.

Bhageria Industries Ltd is poised to leverage its diversified business model and strong financials to sustain momentum through FY26 and beyond.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.