Incorporated in 1984, GAIL, a Government of India undertaking, is an integrated natural gas company in India. It owns over 11,500 km of natural gas pipelines, over 2300 km of LPG pipelines, six LPG gas-processing units and a petrochemicals facility. It also has a joint-venture interest in Petronet LNG Ltd, Ratnagiri Gas and Power Pvt Ltd, and in the CGD business in several cities. GAIL has wholly owned subsidiaries in Singapore and the US for expanding its presence outside India in the segments of LNG, petrochemical trading and shale gas assets.

Financial Results:

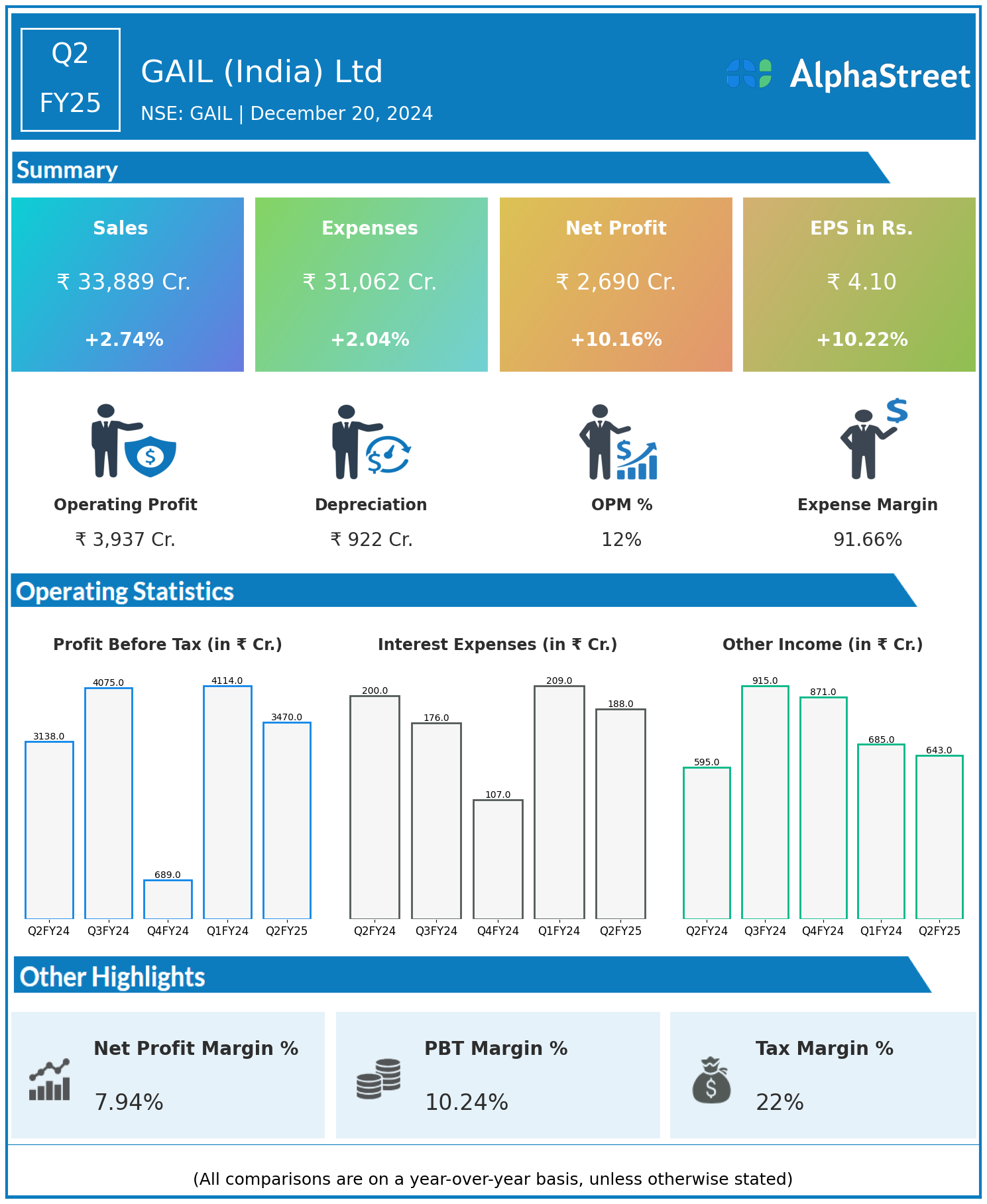

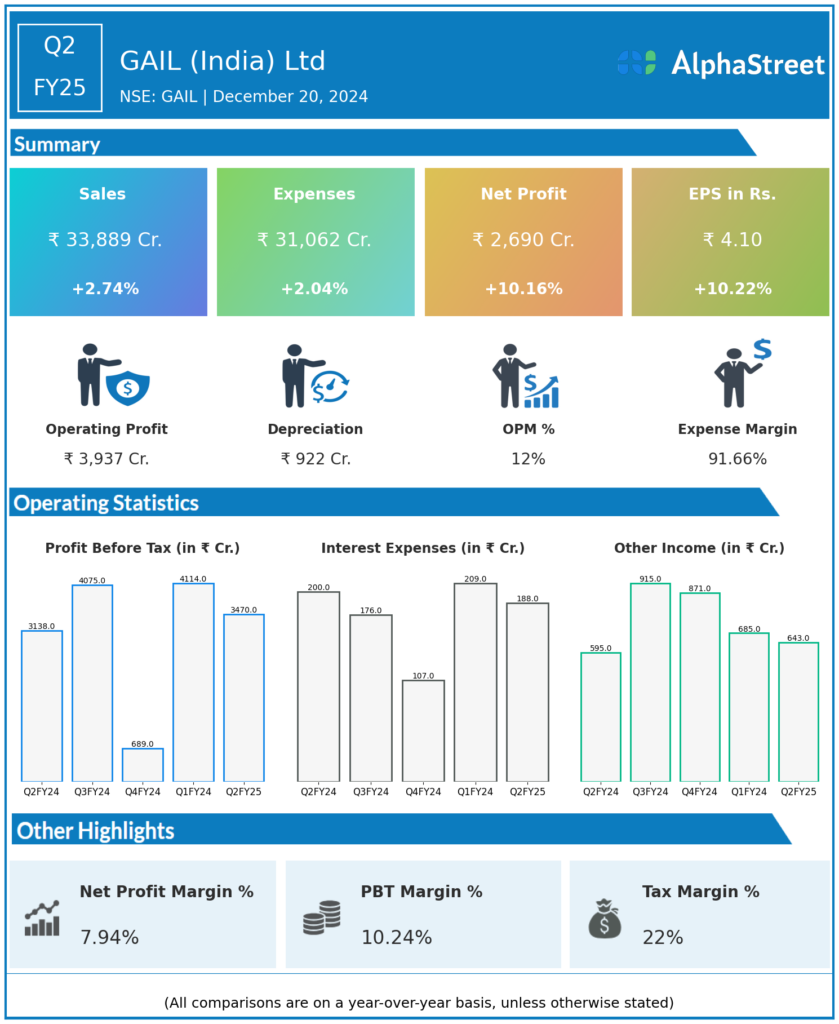

GAIL (India) Ltd reported Revenues for Q2FY25 of ₹33,889.00 Crores up from ₹32,986.00 Crore year on year, a rise of 2.74%.

Total Expenses for Q2FY25 of ₹31,062.00 Crores up from ₹30,442.00 Crores year on year, a rise of 2.04%.

Consolidated Net Profit of ₹2,690.00 Crores up 10.16% from ₹2,442.00 Crores in the same quarter of the previous year.

The Earnings per Share is ₹4.10, up 10.22% from ₹3.72 in the same quarter of the previous year.