Founded in 1977, V-Guard Industries Ltd. (‘V-Guard’) is a reputed Indian company manufacturing innovative and experiential products in the categories of Electronics, Electricals and Consumer Durables. It has grown from being a brand synonymous with voltage stabilizers across South India, to a brand offering a wide array of thoughtfully engineered products to consumers across the length and breadth of the country. Underpinned by its continuous quest to enrich consumer lives and power a stronger tomorrow.

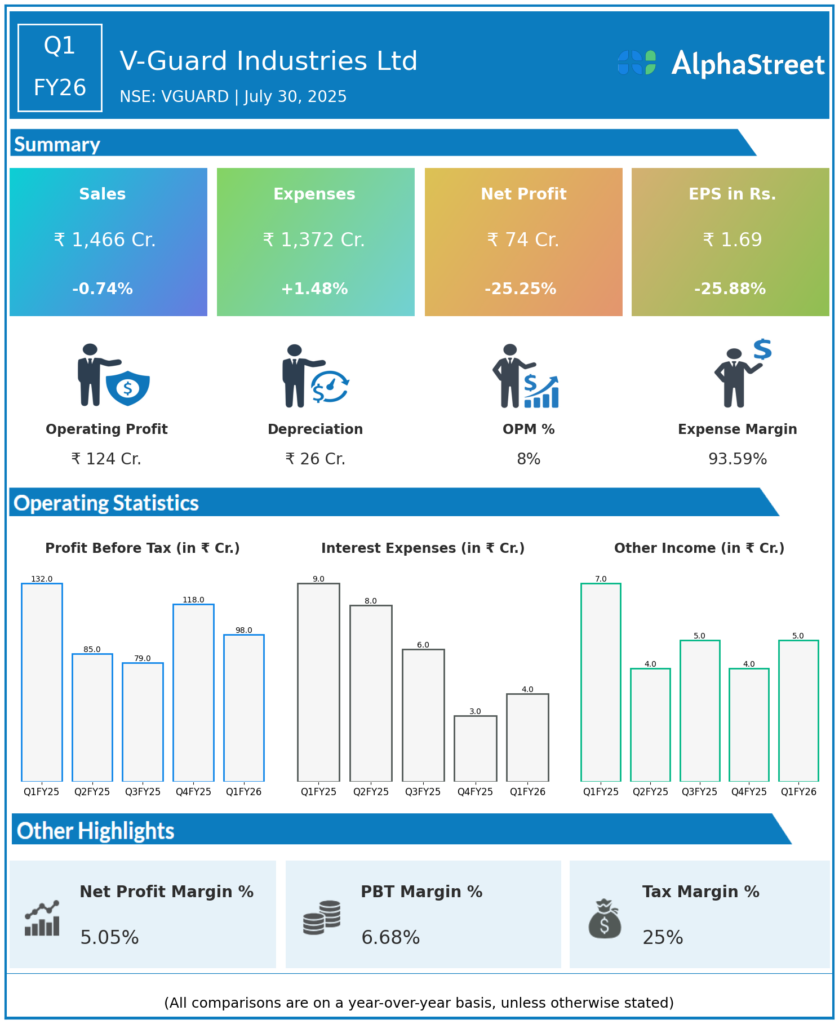

Q1 FY26 Earnings Summary (Apr–Jun 2025)

-

Consolidated Net Revenue: ₹1,466.08 crore, down 0.7% YoY from ₹1,477.10 crore in Q1 FY25.

-

Cost of Goods Sold (COGS): ₹925.41 crore.

-

Gross Margin: 36.9%.

-

EBITDA (excluding other income): ₹123.59 crore, 8.4% margin.

-

Other Income: ₹5.25 crore.

-

EBITDA after other income: ₹128.84 crore, 8.8% margin.

-

Profit Before Tax (PBT): ₹98.26 crore, 6.7% margin.

-

Profit After Tax (PAT): ₹73.85 crore, down 25.4% YoY from ₹98.97 crore in Q1 FY25.

-

PAT Margin: 5.0%.

-

Total Expenses: Increased marginally by 1.6% to ₹1,373.07 crore.

-

Business Segments: Electronics and electricals segments showed moderate growth, while the durables segment declined due to weak demand for summer categories.

-

Sales: Affected by a subdued summer season and a high base in the previous year.

Key Management Commentary & Strategic Highlights

-

Managing Director Mithun K. Chittilappilly stated that the subdued topline growth in Q1 FY26 was primarily due to a weak summer season and last year’s strong base effect.

-

Electronics and electrical segments witnessed moderate growth, but the durables segment faced demand softness, mainly for summer-related products.

-

Gross margins remained healthy despite the revenue pressures.

-

The company plans to normalize demand in the coming quarters and will continue investing in brand building and capacity enhancement.

-

Actions have been initiated to merge Sunflame operations with V-Guard to fast-track synergy realization. The Sunflame acquisition from FY23 is expected to create operational efficiencies.

-

Overall focus on sustaining operational efficiencies and driving growth through portfolio and capacity expansion.

Q4 FY25 Earnings Summary (Jan–Mar 2025)

-

Consolidated Net Revenue: ₹1,538.08 crore, up 14.5% YoY.

-

Profit After Tax (PAT): ₹91.13 crore, up 44.5% YoY.

-

EBITDA: ₹134.36 crore.

-

Earnings Per Share (EPS): Around ₹1.7 for the quarter.

-

Expenses: Rose 16.5% YoY.

-

The quarter showed robust revenue growth aided by better consumer demand, especially in electricals and electronics categories.

-

Profit growth driven by improved operational efficiencies and cost control.

-

The management highlighted a positive business environment supporting growth and profitability improvements.