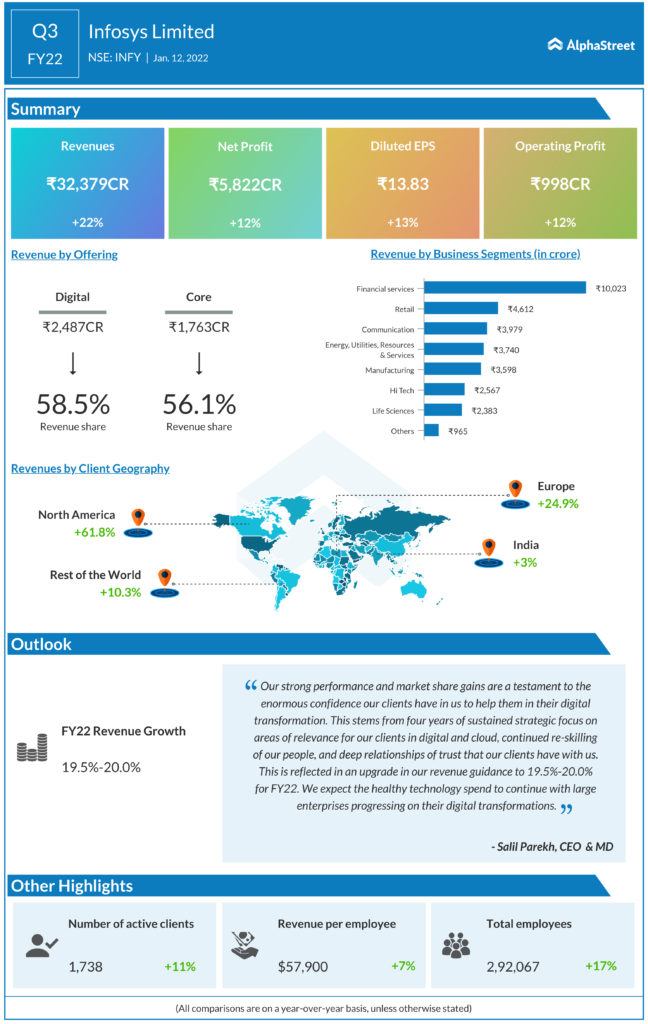

Infosys Limited (NSE: INFY) today reported its third-quarter financial results for the period of December 31, 2021.

The company reported a 22% increase in revenue at ₹32,379 crores compared to the previous year.

The net profit jumped to 12% to ₹5,822 crores compared to INR 5,215 crore in the same quarter of the previous year.