Larsen & Toubro Ltd is a multinational conglomerate which is primarily engaged in providing engineering, procurement and construction (EPC) solutions in key sectors such as Infrastructure, Hydrocarbon, Power, Process Industries and Defence, Information Technology and Financial Services in domestic and international markets.

Financial Results:

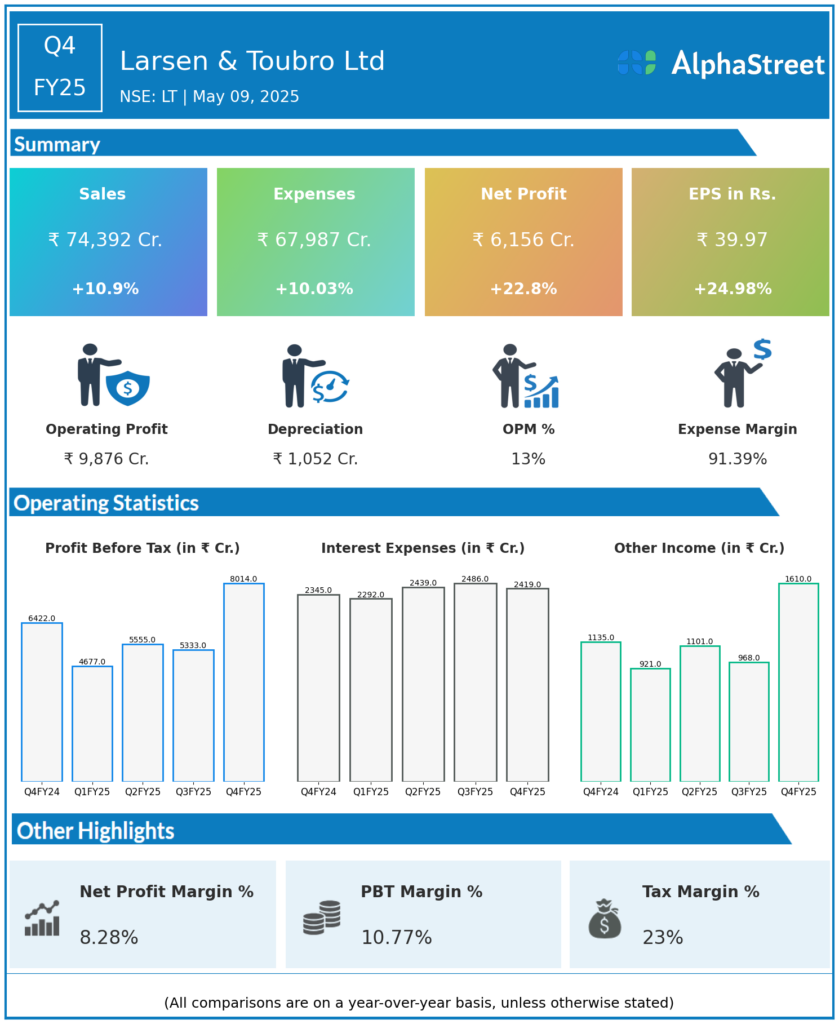

Larsen & Toubro Ltd reported Revenues for Q4FY25 of ₹74,392.00 Crores up from ₹67,079.00 Crore year on year, a rise of 10.9%.

Total Expenses for Q4FY25 of ₹67,987.00 Crores up from ₹61,792.00 Crores year on year, a rise of 10.03%.

Consolidated Net Profit of ₹6,156.00 Crores up 22.8% from ₹5,013.00 Crores in the same quarter of the previous year.

The Earnings per Share is ₹39.97, up 24.98% from ₹31.98 in the same quarter of the previous year.