Time Technoplast is a multinational conglomerate involved in the manufacturing of technology and innovation driven polymer & composite products.

Financial Results:

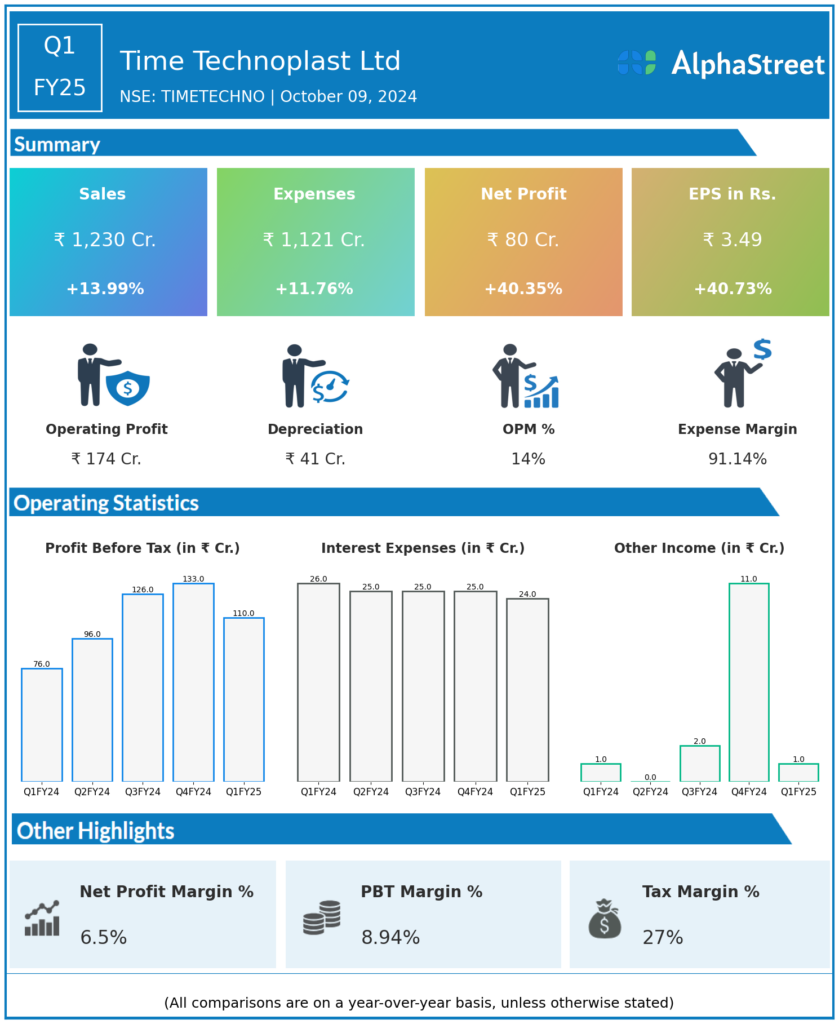

Time Technoplast Ltd reported Revenues for Q1FY25 of ₹1,230.00 Crores up from ₹1,079.00 Crore year on year, a rise of 13.99%.

Total Expenses for Q1FY25 of ₹1,121.00 Crores up from ₹1,003.00 Crores year on year, a rise of 11.76%.

Consolidated Net Profit of ₹80.00 Crores up 40.35% from ₹57.00 Crores in the same quarter of the previous year.

The Earnings per Share is ₹3.49, up 40.73% from ₹2.48 in the same quarter of the previous year.

*It is important to note that the way the results have been accounted for are slightly different than the ones the companies may choose to publish.

*The presented data is automatically generated. It may occasionally generate incorrect information.