Bhansali Engineering Polymers Ltd is engaged in manufacturing and sale of ABS Resins, AES Resins, ASA resins, SAN resins and their alloys with other plastics in the Indian market.

Its customers include leading companies dealing in Automobiles, Home Appliances, Electronics, Healthcare and Kitchenware.

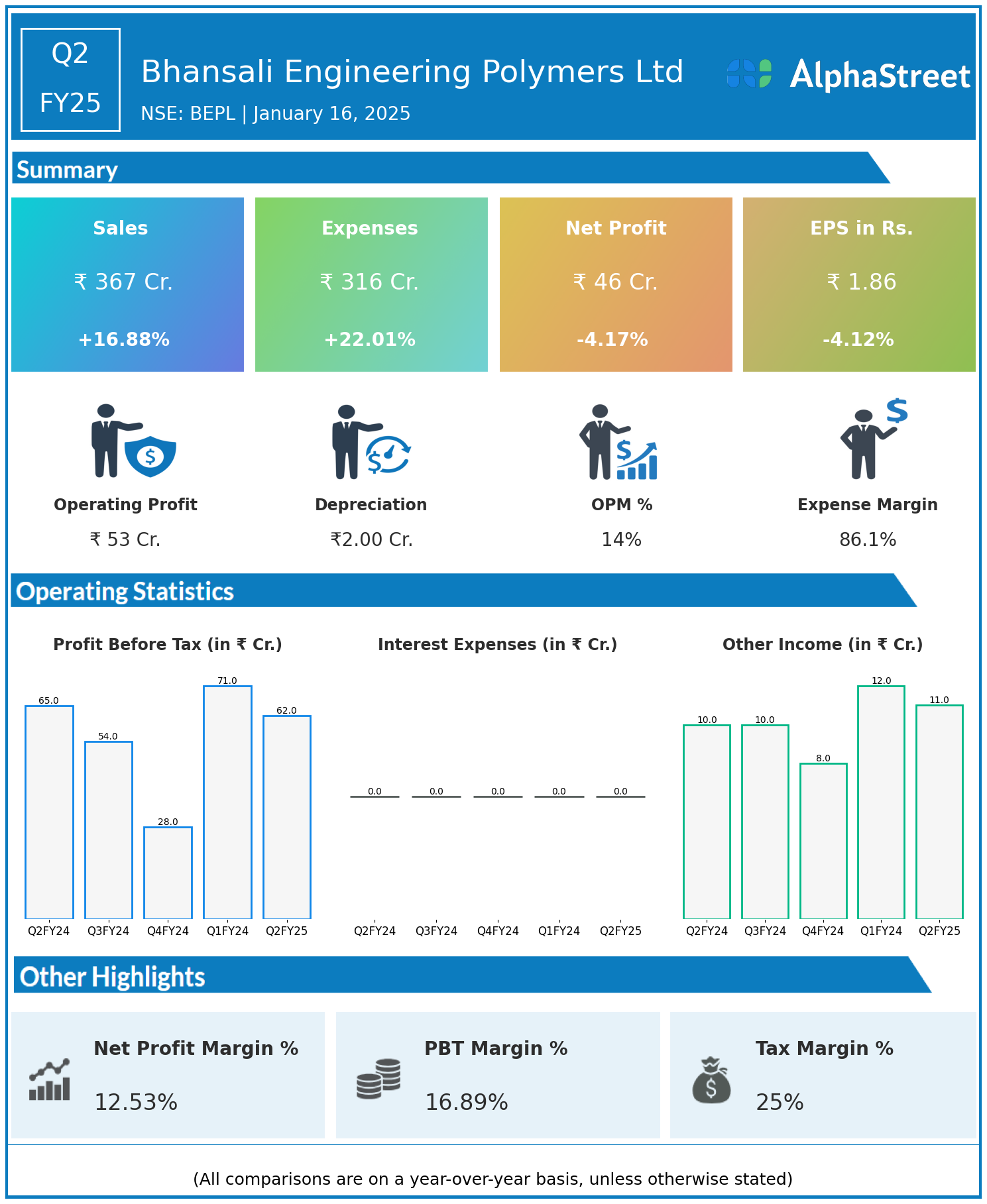

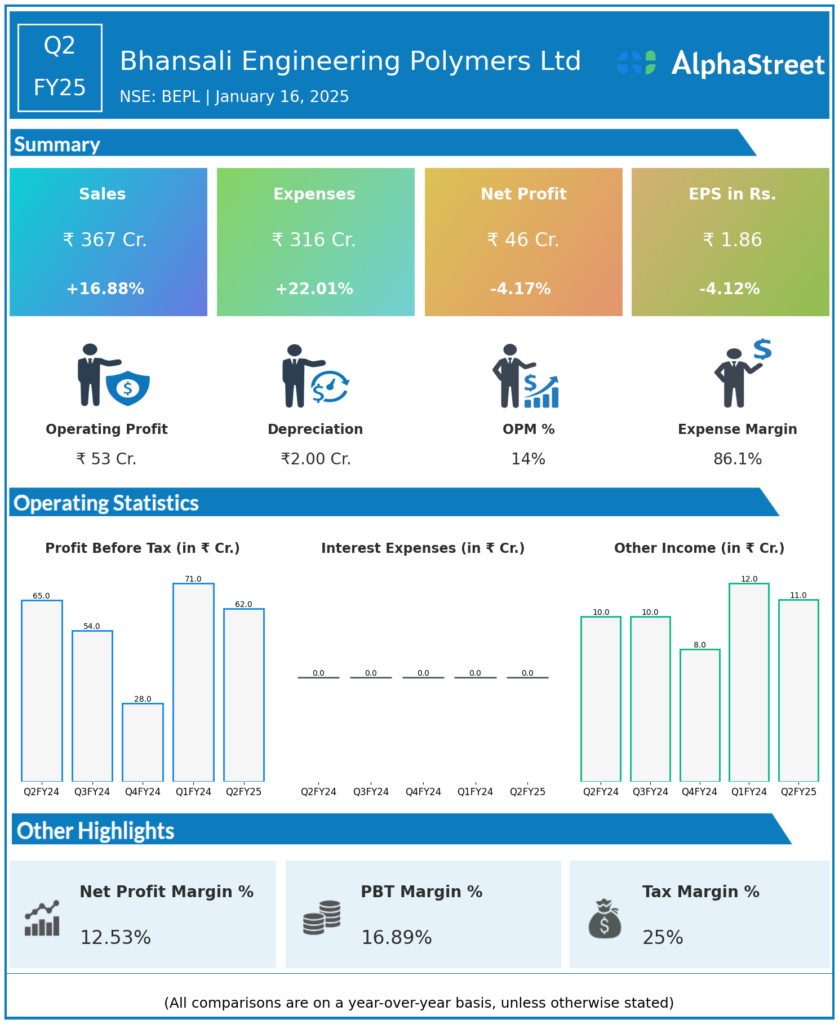

Financial Results:

Bhansali Engineering Polymers Ltd reported Revenues for Q2FY25 of ₹367.00 Crores up from ₹314.00 Crore year on year, a rise of 16.88%.

Total Expenses for Q2FY25 of ₹316.00 Crores up from ₹259.00 Crores year on year, a rise of 22.01%.

Consolidated Net Profit of ₹46.00 Crores down 4.17% from ₹48.00 Crores in the same quarter of the previous year.

The Earnings per Share is ₹1.86, down 4.12% from ₹1.94 in the same quarter of the previous year.