FSN E-commerce Ventures Ltd. (FSNEV) popularly known as “Nykaa” is a digitally native consumer technology platform, delivering a content-led, lifestyle retail experience to consumers. The company has a diverse portfolio of beauty, personal care, and fashion products, including owned brand products manufactured by it.

Financial Results:

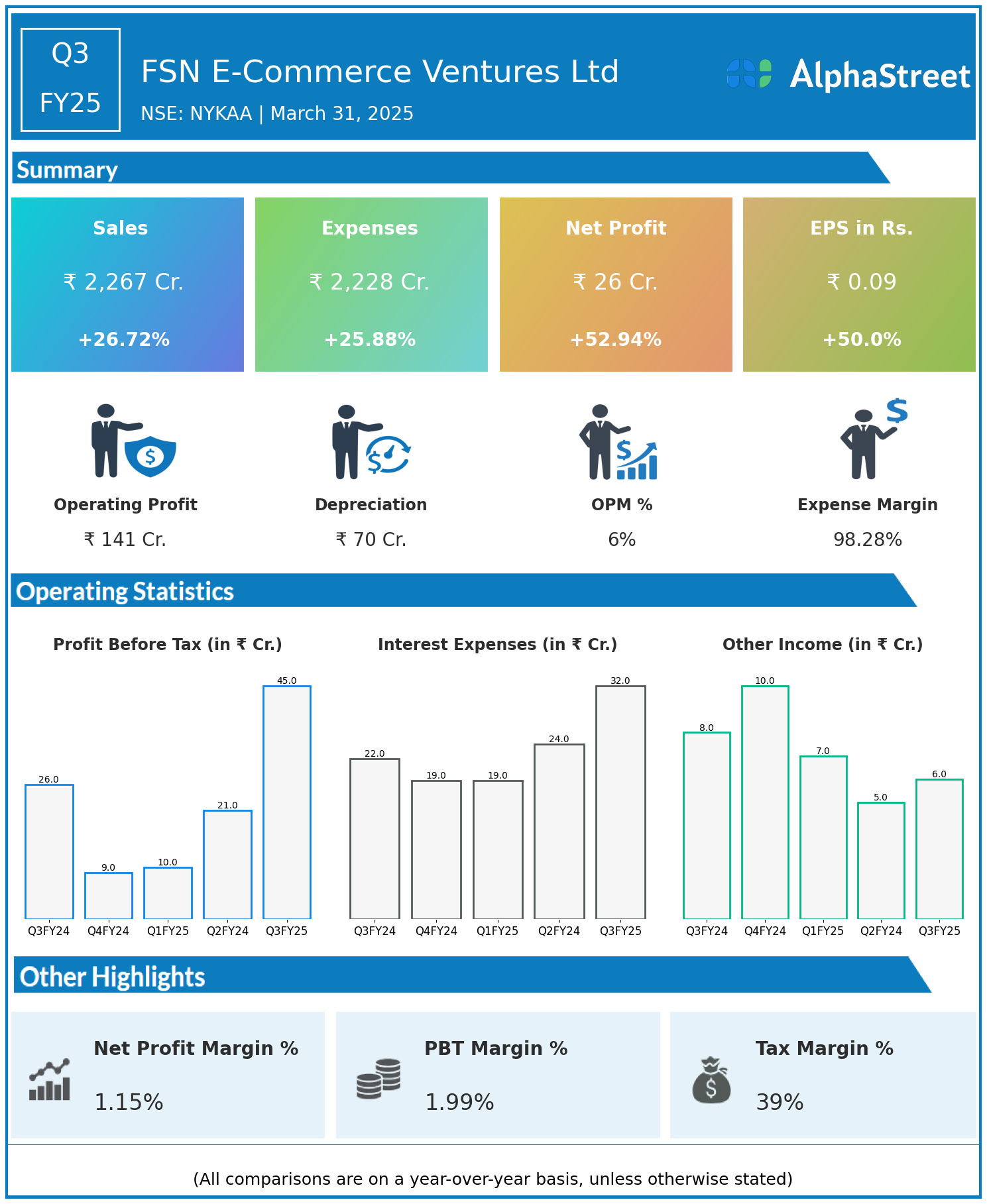

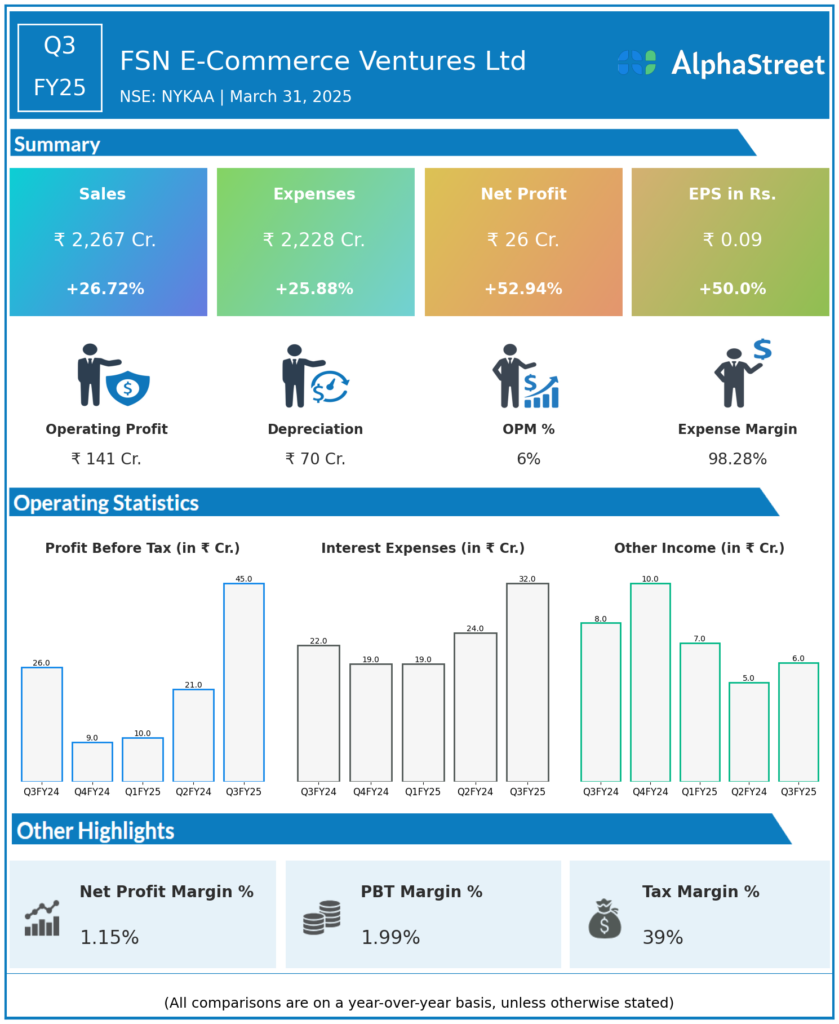

FSN E-Commerce Ventures Ltd reported Revenues for Q3FY25 of ₹2,267.00 Crores up from ₹1,789.00 Crore year on year, a rise of 26.72%.

Total Expenses for Q3FY25 of ₹2,228.00 Crores up from ₹1,770.00 Crores year on year, a rise of 25.88%.

Consolidated Net Profit of ₹26.00 Crores up 52.94% from ₹17.00 Crores in the same quarter of the previous year.

The Earnings per Share is ₹0.09, up 50.00% from ₹0.06 in the same quarter of the previous year.