DCM Shriram Limited (NSE: DCMSHRIRAM) is a conglomerate company based in India. It operates in various sectors such as sugar, chemicals, rayon, and agriculture. The company was founded in 1948 and is headquartered in New Delhi. It is known for its sugar and chemical manufacturing operations, as well as its rayon and textiles business. DCM Shriram also has a significant presence in the agri-business sector, with operations in the areas of seeds, fertilizers, and crop protection

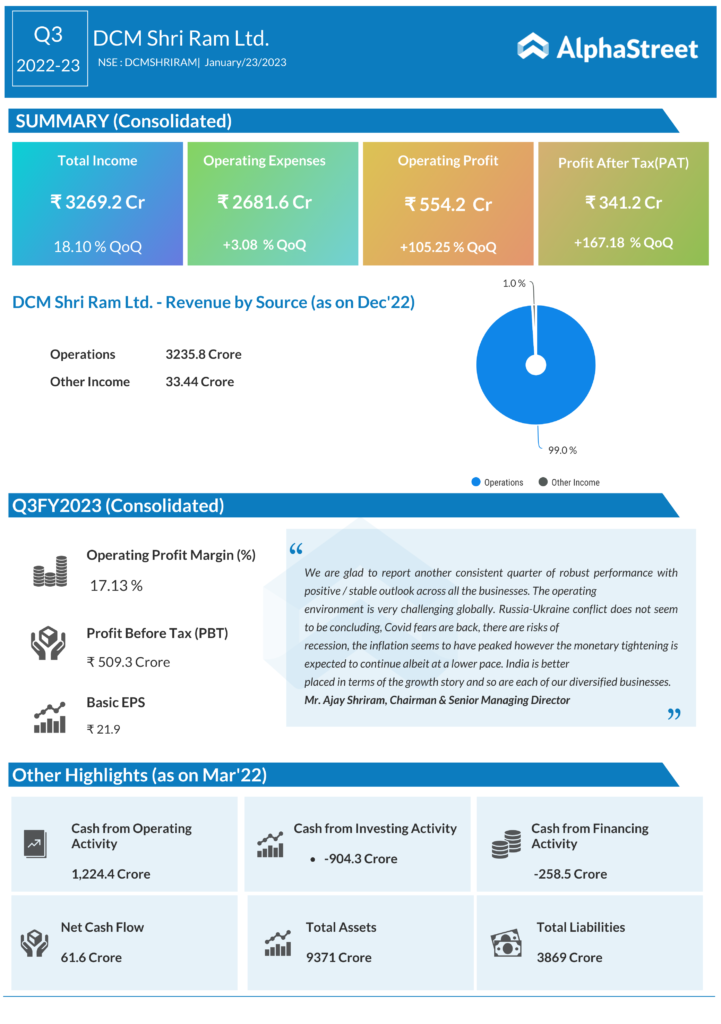

The company declared a 2nd interim dividend of 290% (₹5.80 per equity share) for the financial year 2022-23, with a record date fixed as 1.2.2023. In comparison to the ₹2,730 Cr reported in Q3FY22, the company recorded a net revenue of ₹3,236 Cr in Q3FY23, a growth of 19% YoY. The company reported a net profit of ₹342 Cr in Q3FY23 compared to ₹350 Cr reported in the year-ago quarter, representing a YoY fall of 2%.

The company reported a surplus net of debt as of 31st December 2022 of ₹101 Cr vs net debt of ₹4 Cr as of 31st March 2022. ROCE for the period reached 34%.

The company’s leaders stated that they are glad to report another consistent quarter of robust performance with positive and stable outlook across all the businesses. They also pointed out that the operating environment is very challenging globally and India is better placed in terms of the growth story and so are each of their diversified businesses.