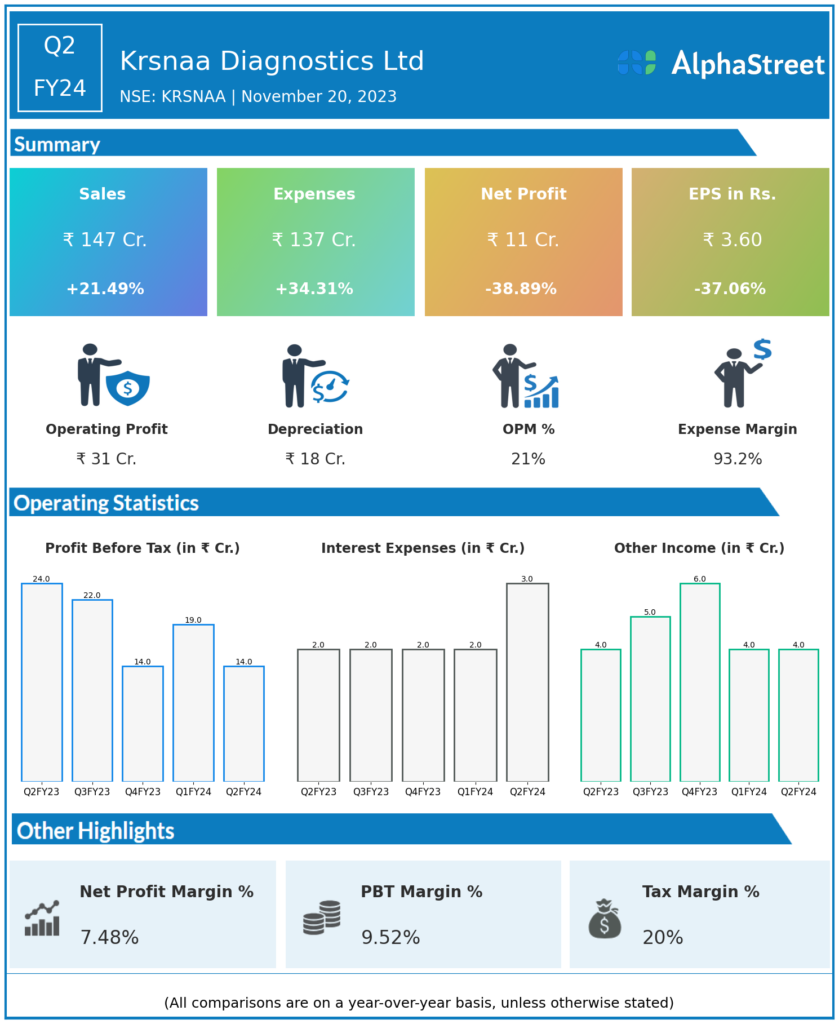

Krsnaa Diagnostics Ltd provides a range of technology-enabled diagnostic services such as imaging, clinical laboratory, and teleradiology services to hospitals, medical colleges, and community health centers across India with an extensive network across non-metro and lower-tier cities and towns.

Financial Results:

- Krsnaa Diagnostics Ltd reported Revenues for Q2FY24 of ₹147.00 Crores up from ₹121.00 Crore year on year, a rise of 21.49%.

- Total Expenses for Q2FY24 of ₹137.00 Crores up from ₹102.00 Crores year on year, a rise of 34.31%.

- Consolidated Net Profit of ₹11.00 Crores down 38.89% from ₹18.00 Crores in the same quarter of the previous year.

- The Earnings per Share is ₹3.60, down 37.06% from ₹5.72 in the same quarter of the previous year.