Aster DM Healthcare Limited is one of the largest integrated private healthcare service providers operating in GCC (Gulf Cooperation Council) countries and an emerging player in India. With an inherent emphasis on clinical excellence, it is one of the few entities in the world with a strong presence across primary, secondary, tertiary and quaternary healthcare.

Financial Results:

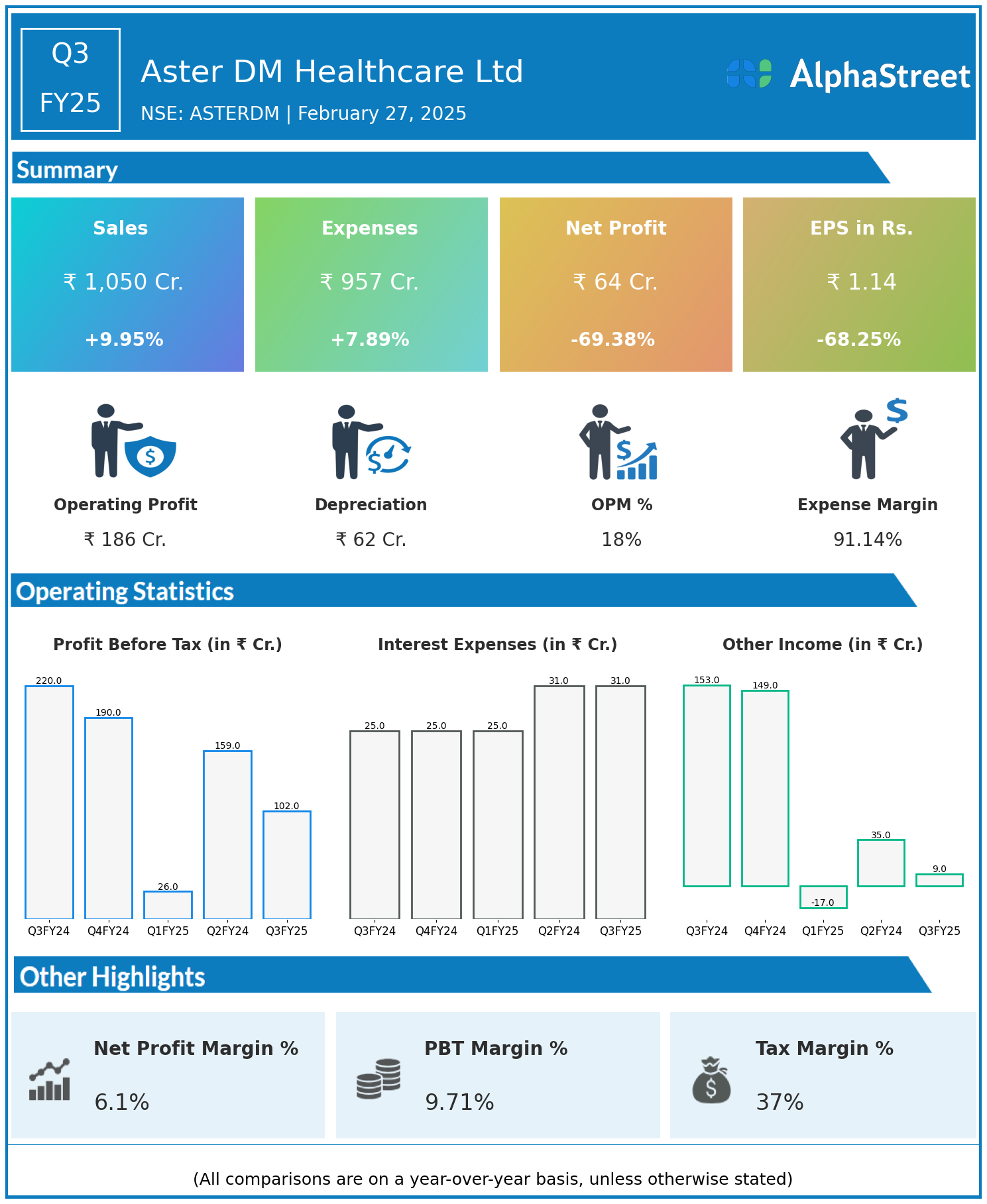

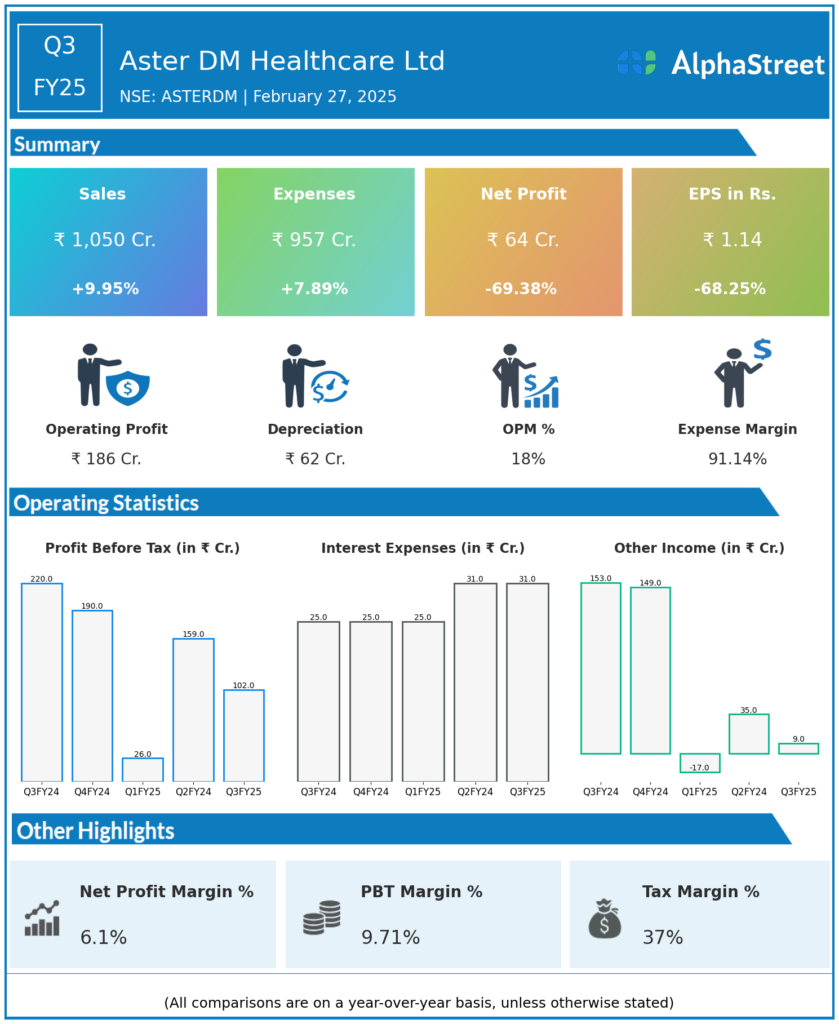

Aster DM Healthcare Ltd reported Revenues for Q3FY25 of ₹1,050.00 Crores up from ₹955.00 Crore year on year, a rise of 9.95%.

Total Expenses for Q3FY25 of ₹957.00 Crores up from ₹887.00 Crores year on year, a rise of 7.89%.

Consolidated Net Profit of ₹64.00 Crores down 69.38% from ₹209.00 Crores in the same quarter of the previous year.

The Earnings per Share is ₹1.14, down 68.25% from ₹3.59 in the same quarter of the previous year.