Stock Data:

| Ticker | NSE: APOLLOHOSP |

| Exchange | NSE |

| Industry | HEALTHCARE |

Price Performance:

| Last 5 Days | +0.10 % |

| YTD | +12.73 % |

| Last 12 Months | +13.41% |

Company Description:

Apollo Health Care Ltd (AHCL) is a leading player in the healthcare industry, committed to delivering high-quality medical services and products. With a diverse portfolio that includes hospitals, diagnostics, pharmacies, and digital healthcare solutions, AHCL focuses on providing accessible and comprehensive healthcare to individuals and communities.

Critical Success Factors:

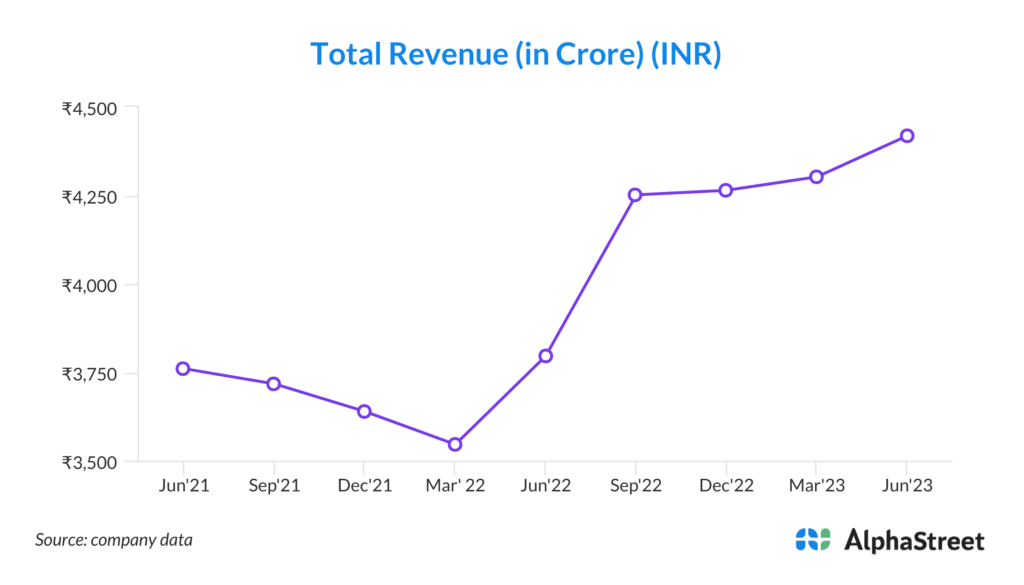

1. Steady Revenue Growth

AHCL’s Healthcare Services segment achieved a remarkable 13% year-on-year revenue growth in Q1 FY24. This steady revenue growth demonstrates the company’s resilience and its ability to maintain positive momentum in its core business.

2. Diverse Revenue Streams

The company’s revenue streams are diversified across multiple segments, including Healthcare Services, Apollo Health Co, and Apollo Health and Lifestyle. This diversification helps AHCL mitigate risks associated with reliance on a single revenue source and ensures a balanced revenue mix.

3. Growing Contribution of Insurance Revenues

AHCL’s insurance revenues now contribute 44% of its total IP (In-Patient) revenues. This increasing contribution from insurance revenues indicates the company’s success in attracting insured patients, which typically have higher revenue potential and lower credit risk compared to self-pay patients.

4. Strong EBITDA and Margins

The company’s consolidated EBITDA reached INR 509 crore, marking a 4% year-on-year increase. Healthcare Services’ EBITDA grew by an impressive 12%, while healthcare margins remained healthy at 23.6%. This demonstrates AHCL’s ability to maintain strong profitability in its core business.

5. Strategic Investments for Future Growth

AHCL’s new hospitals, despite a slight drop in margins, reflect strategic investments aimed at expanding the company’s footprint and ensuring future growth. The focus on increasing surgical discharges and investing in clinical talent positions AHCL for sustainable expansion.

6. Improving Operational Efficiency

The pharmacy distribution business within AHCL recorded an EBITDA of INR 125 crore, reflecting a 13% year-on-year growth. The company’s commitment to reducing costs and improving operational efficiency is evident in its efforts to achieve operational breakeven in Q4 FY24.

7. Strong Digital Platform Growth

AHCL’s digital platform “24/7” added 2 million new users in Q1 FY24, achieving a Gross Merchandise Value (GMV) of INR 623 crore, with a remarkable 189% year-on-year growth. This digital platform’s growth trajectory aligns with AHCL’s commitment to innovation and providing convenient access to healthcare services.

Key Challenges:

1. Regulatory Changes and Compliance Risks

The healthcare industry is subject to evolving regulatory requirements, including licensing, quality standards, and pricing controls. Any changes in regulations or non-compliance with existing ones can result in legal and financial consequences for AHCL.

2. Competitive Market Dynamics

The healthcare sector is highly competitive, with the presence of established players and new entrants. AHCL may face challenges in maintaining its market share and profitability due to intense competition, pricing pressures, and the emergence of disruptive technologies.

3. Economic and Macroeconomic Factors

Economic downturns, inflation, currency fluctuations, and changes in consumer spending patterns can affect AHCL’s financial performance. Reduced consumer disposable income may lead to decreased demand for healthcare services and products, impacting revenues.

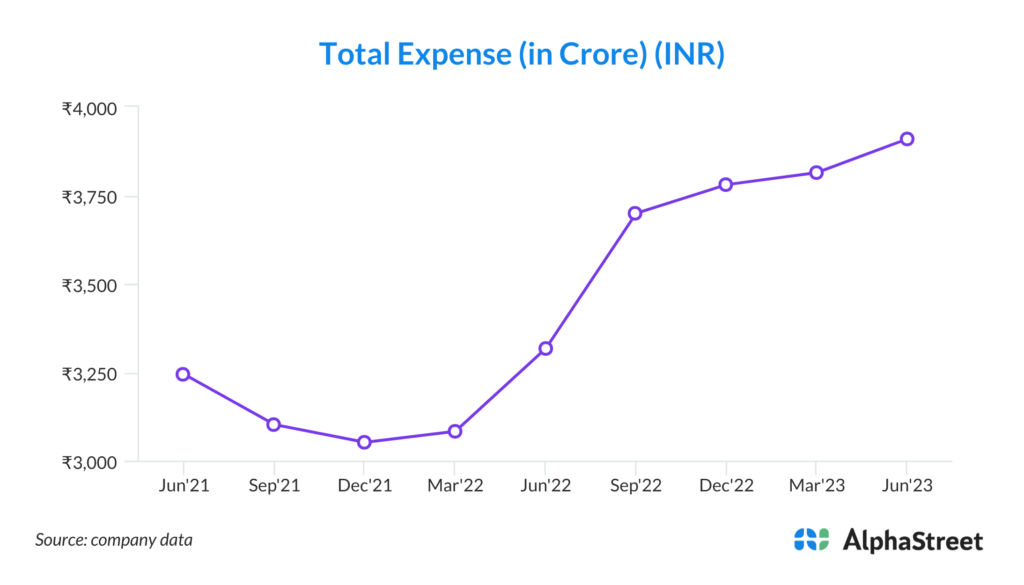

4. Rising Healthcare Costs

Escalating healthcare costs, including those related to medical equipment, pharmaceuticals, and labor, can strain AHCL’s profitability. The company may face difficulties in passing on these increased costs to patients or insurance providers.

5. Operational Challenges in New Hospitals

While AHCL is expanding by opening new hospitals, there are inherent risks associated with the operationalization of these facilities. New hospitals may face teething issues, lower margins during the initial stages, and increased operational expenses, impacting overall profitability.

6. Dependency on Insurance Revenues

While the increasing contribution of insurance revenues is a strength, it also poses a risk. AHCL may become overly dependent on insurance reimbursements, which are subject to delays, disputes, and changes in insurance policies. Any adverse developments in the insurance sector could affect AHCL’s financial stability.

7. Technological and Cybersecurity Risks

As AHCL continues to invest in digital platforms, it becomes vulnerable to technological and cybersecurity risks. Data breaches, system failures, or cyberattacks could compromise patient information, damage the company’s reputation, and result in legal liabilities.