Zydus Wellness operates as an integrated consumer Company with business encompassing the entire value chain in the development, production, marketing and distribution of health and wellness products. The product portfolio of the Company includes brands like Sugar free, Everyuth and Nutralite. Presenting below are its Q1 FY26 earnings results.

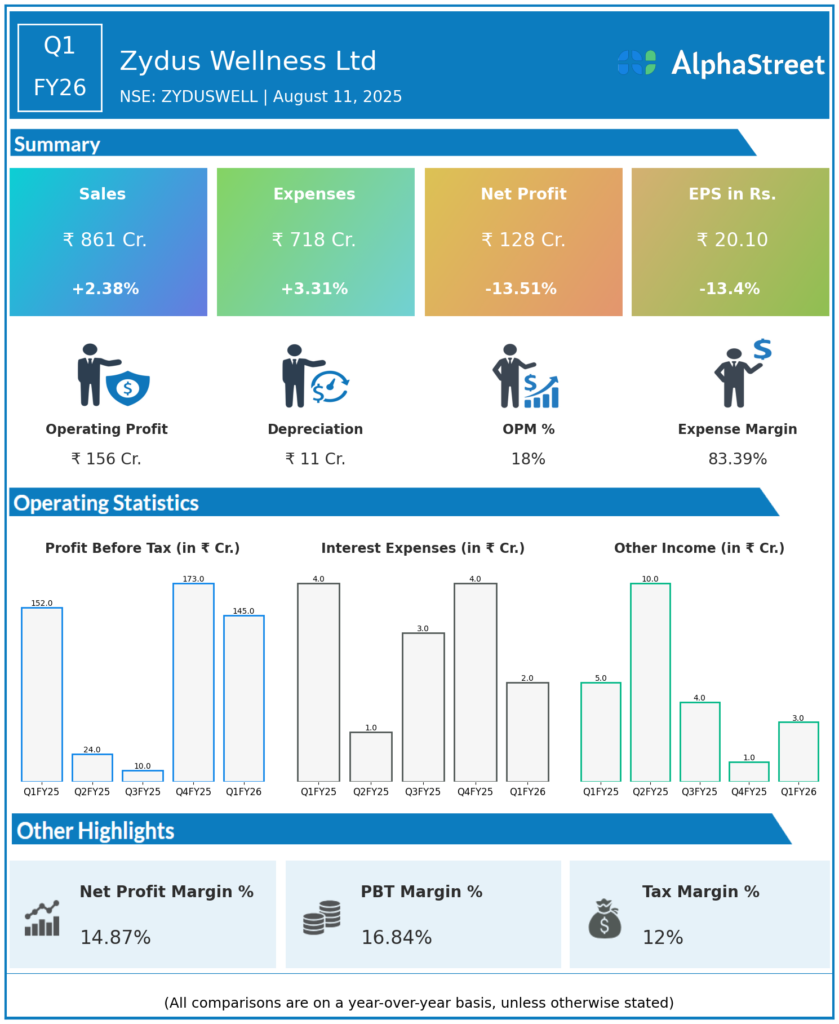

Q1 FY26 Earnings Results

-

Consolidated Revenue: ₹861 crore, up 2.4% year-over-year (YoY) from ₹841 crore in Q1 FY25. Revenue is down 5.7% quarter-on-quarter (QoQ) due to shorter summers and adverse weather.

-

Net Profit (PAT): ₹128 crore, down 13.51% YoY from ₹148 crore last year, and sharply lower by 14.9% QoQ.

-

EBITDA: ₹156 crore, nearly flat YoY (up 0.2%), with EBITDA margin declining to 18.1% from 18.5% in Q1 FY25 (down 39 basis points).

-

EPS: ₹20.10, down from ₹23.20 in Q1 FY25 and ₹23.60 in Q4 FY25.

-

Gross Margin: 55%, down 66 basis points YoY, but up slightly QoQ as input cost pressure began to ease.

-

Organised Trade Saliency: Improved to 30.9% (from 23.3% YoY), driven by e-commerce (14.5%) and modern trade (16.4%). The Naturell (Max Protein) acquisition contributed to growth in nutrition bars/snacks.

-

Key Brands and Market Leadership:

-

Sugar Free: 96.1% market share in sugar substitutes, category reported MAT growth of 4.9%.

-

Glucon-D: No.1 position at 58.9% market share, category up 2.8% MAT.

-

Complan: Maintains a 4% market share; good performance in the foods segment.

-

Nycil: Leader at 33.3% market share in talcum powders.

-

Everyuth: Market leader in the peel-off and scrub category.

-

-

Segment Breakdown: Food & Nutrition segment grew 1.6% YoY; Personal Care grew 3.8% YoY.

-

PAT Margin: At 14.9% (down 271 bps YoY), mainly impacted by non-cash items (deferred tax, amortisation from acquisition).

-

Dividend: Board recommended final dividend of ₹6 per equity share of ₹10, subject to AGM approval.

-

Stock Split: Board approved 1:5 split (₹10 face value to ₹2 each).

Key Management Commentary & Strategic Highlights

-

Management noted that performance was subdued due to seasonal impacts which included short summers and rains but double-digit growth was seen in non-seasonal brands.

-

Focus remains on margin resilience, product innovation, and cost efficiency. Management expects margin recovery, with input costs starting to ease and operational levers becoming effective in upcoming quarters.

-

Emphasis on expanding product portfolio, with launches in probiotics (Nutralite), vitamin-fortified foods, and new cheese offerings.

-

Rural markets continued to outperform urban; however, urban demand is recovering with a stable consumption trend.

-

International expansion is a strategic priority, aiming for 8–10% of revenue from overseas in the next 4–5 years.

-

Long-term outlook: Management targets double-digit revenue growth and improved margin profile for FY26, leveraging brand strength, channel expansion, and operational discipline.

Q4 FY25 Earnings Results

-

Revenue: ₹913 crore, up 16.7% YoY and 97.7% QoQ, supported by 13% volume growth (especially in small pack sizes). Food & beverages and personal care segments grew by 15.4% and 22.5% YoY, respectively.

-

Net Profit (PAT): ₹172 crore, up 14.4% YoY; PAT margin at 18.8%.

-

EBITDA: ₹190 crore, up 17% YoY; EBITDA margin at 20.8%.

-

Gross Margin: 54.9%.

-

Product/Brand Highlights: Nycil (33.8% share), Everyuth (leadership in masks and scrubs), Glucon-D (dominance at 58.8%), Sugar-Free (95.9%).

-

Dividend: ₹6/share declared; 1:5 stock split recommended.

-

Strategic Launches: Entry into sheet masks category with three new variants.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.