In 1995, the group was restructured and thus was formed Cadila Healthcare under the aegis of the Zydus group. From a humble turnover Rs. 250 crores in 1995 the group witnessed a significant financial growth and registered a turnover of over Rs. 14,253 crores in FY20. Adhering to its brand promise of being dedicated to life in all its dimensions, Zydus continues to innovate with an unswerving focus to address the unmet healthcare needs. Simultaneously it rededicates itself to its mission of creating healthier, happier communities across the globe.

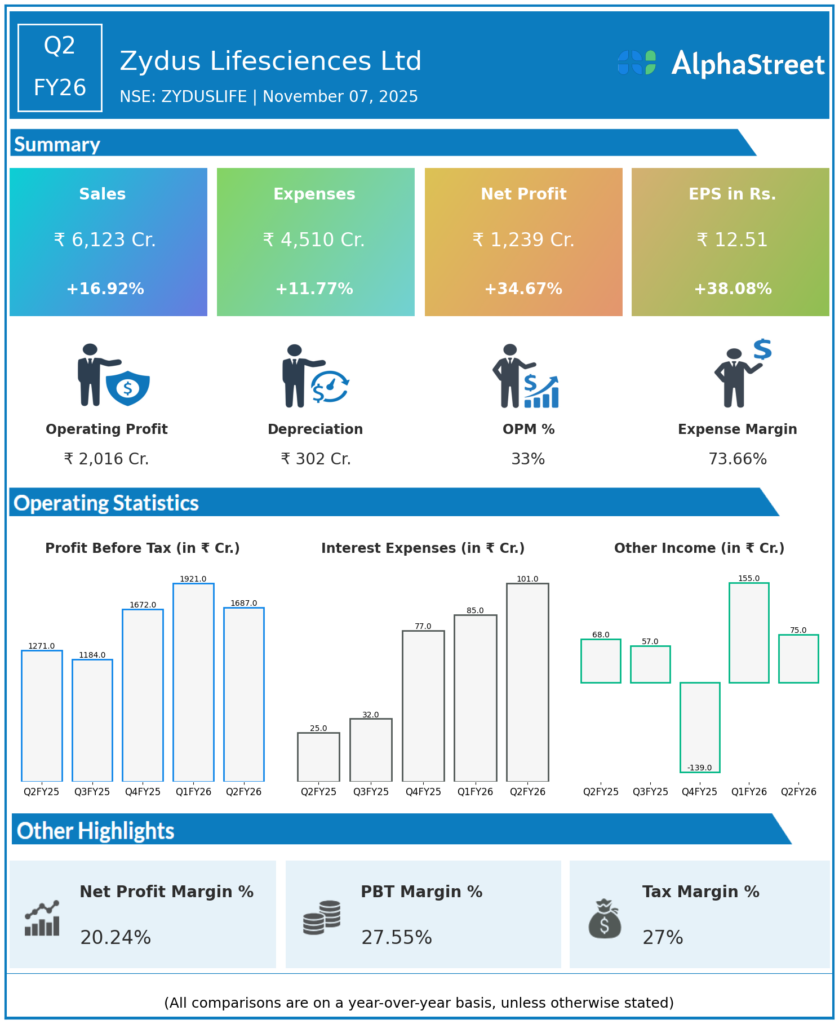

Q2 FY26 Earnings Results

-

Revenue from Operations: ₹6,484 crore, up 14% YoY.

-

EBITDA: ₹1,550 crore, with margin contraction due to cost pressures.

-

Profit Before Tax (PBT): ₹1,430 crore, up around 12% YoY.

-

Profit After Tax (PAT): ₹1,239 crore, up 35% YoY.

-

PAT margin: Approximately 19.4%.

-

Domestic formulations and biosimilars segments showed healthy growth, while margins experienced some pressure due to inflation and raw material costs.

Management Commentary & Strategic Decisions

-

Management highlighted solid performance driven by robust domestic formulations and biosimilars businesses.

-

Margin pressure is attributed to rising input costs and inflationary conditions impacting raw materials.

-

The company is focused on scaling biosimilars pipeline, launching new specialty products, and targeting international markets for growth.

-

Ongoing investments in R&D and capacity expansion to support pipeline and future growth.

-

Management maintains FY26 revenue and margin guidance, indicating confidence in sustaining growth momentum despite near-term margin pressure.

-

Plans to raise capital via equity to support pipeline and acquisitions are in progress.

Q1 FY26 Earnings Results

-

Revenue from Operations: ₹5,695 crore, up 12% YoY.

-

EBITDA and PAT saw moderate growth compared to previous year, with PAT at approximately ₹908 crore, up about 3-5% YoY.

-

Continued progression in biosimilar launches and specialty therapies contributed to growth.

-

Management noted improving market conditions and balanced growth across key segments.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.