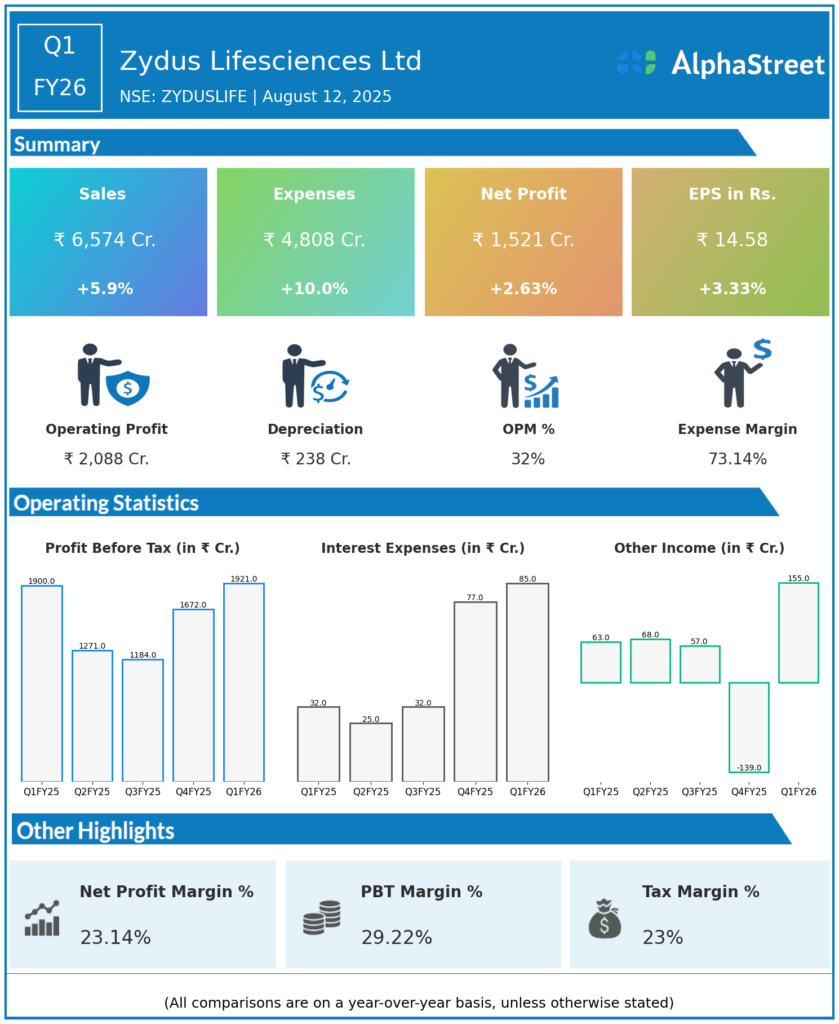

In 1995, the group was restructured and thus was formed Cadila Healthcare under the aegis of the Zydus group. From a humble turnover Rs. 250 crores in 1995 the group witnessed a significant financial growth and registered a turnover of over Rs. 14,253 crores in FY20. Adhering to its brand promise of being dedicated to life in all its dimensions, Zydus continues to innovate with an unswerving focus to address the unmet healthcare needs. Simultaneously it rededicates itself to its mission of creating healthier, happier communities across the globe. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

Revenue from Operations: ₹6,574 crore, up 5.9% year-over-year (YoY) from ₹6,207 crore in Q1 FY25, and slightly up 0.7% quarter-on-quarter (QoQ) from ₹6,527 crore.

-

Net Profit (PAT): ₹1,521 crore, a 2.6% increase YoY from ₹1,420 crore in Q1 FY25, and a strong 25.3% rise QoQ from ₹1,170 crore in Q4 FY25.

-

EBITDA: ₹2,089 crore, nearly flat YoY; EBITDA margin contracted to 31.8% from 33.6% YoY.

-

Research & Development (R&D): ₹486 crore, representing 7.4% of revenues.

-

Capital Expenditure (Capex): ₹402 crore (organic).

-

Earnings Per Share (EPS): ₹14.5, up by 3.3% on the YoY basis.

Business Segment Performance

-

India Geography (Formulations + Consumer Wellness): ₹2,374 crore, up 6% YoY.

-

Formulations grew 8% YoY to ₹1,520 crore, driven by strong branded formulations with 9% growth led by chronic segment therapies like cardiology, respiratory, anti-infectives, pain management, and oncology.

-

Consumer Wellness rose 2% YoY to ₹855 crore, showing strong double-digit growth excluding seasonal brands.

-

-

US Formulations: ₹3,182 crore, up 2.9% YoY, with continued launches and approvals supporting growth.

-

International Markets Formulations: ₹727 crore, surged 36.8% YoY, boosted by market expansions.

-

APIs (Active Pharmaceutical Ingredients): ₹158 crore, up 11.3% YoY.

-

Alliances & Others: Declined 27.9% YoY to ₹27 crore.

Key Management Commentary & Strategic Highlights

-

Sharvil Patel, Managing Director: Highlighted that the quarter reflected disciplined execution with most key businesses meeting expectations.

-

The company remains on track for FY26 aspirations and is optimistic about innovation-driven growth opportunities.

-

Focus continues on expanding presence in specialty segments, enhancing product portfolios, and improving operational efficiencies.

-

R&D investments remain a priority for sustainable future growth, with recent product launches in key markets.

-

The company maintains high compliance standards while building pillars for long-term global growth.

Q4 FY25 Earnings Results

- Zydus Lifesciences Ltd reported Revenues for Q4FY25 of ₹6,528.00 Crores up from ₹5,534.00 Crore year on year, a rise of 17.96%.

- Total Expenses for Q4FY25 of ₹4,717.00 Crores up from ₹4,143.00 Crores year on year, a rise of 13.85%.

- Consolidated Net Profit of ₹1,244.00 Crores down 0.16% from ₹1,246.00 Crores in the same quarter of the previous year.

- The Earnings per Share is ₹11.64, down 0.94% from ₹11.75 in the same quarter of the previous year.

-

EBITDA Margin: 32.6%.

-

The sequential growth in Q1 FY26 PAT by 25.3% reflects operational improvement and strategic execution.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.