Zomato is an Indian food delivery company. It was incorporated in the year 2008. The founders are Deepinder Goyal and Pankaj Chaddah. The service is delivered in 24 countries and in more than 10,000 cities. Zomato was initially named as FoodieBay. But due to some confusion with the name it was finally named as Zomato. The company has its operations in Delhi NCR, Mumbai, Bangalore, Chennai, Pune, and Ahmedabad. It has even spread its operations internationally like the United Arab Emirates, Sri Lanka, Qatar, the United Kingdom, the Philippines, South Africa, New Zealand ,Turkey, Brazil and Indonesia.

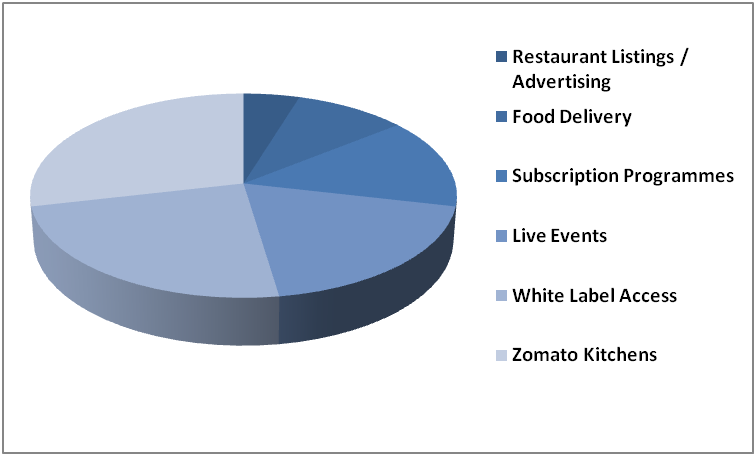

Business model

Restaurant Listings/Advertising: Initially Zomato was a listing platform and a restaurant directory. They generate advertisement revenue from it. Now Zomato charges commissions from restaurants to be placed prominently on the list.

Food Delivery- On the basis of food delivery Zomato charges commissions to restaurants. The commission depends on whether Zomato is fulfilling the delivery or the restaurant uses its own riders.

Subscription Programmes- This channel offers different subscription programme for the customers. The customers pay a subscription fee to access the Zomato Gold loyalty programme, similarly restaurants also pay a monthly fee to be part of Zomato’s bouquet of offers.

Live Events– Zomato has entered into a partnership with Zomaland which is a branded live event market. Other than food, they can also witness live musical performances and other acts.

White Label Access – Here Zomato gives the facility to develop a customized food delivery app. This facility helps the restaurants to expand with a minimal fixed cost.

Zomato Kitchen- Zomato has entered in a partnership with entrepreneurs to set up Zomato Kitchens under different labels. This will helpentrepreneurs to fund restaurants with an investment of INR 35 Lakh and more and in the right location.

Business Outlook

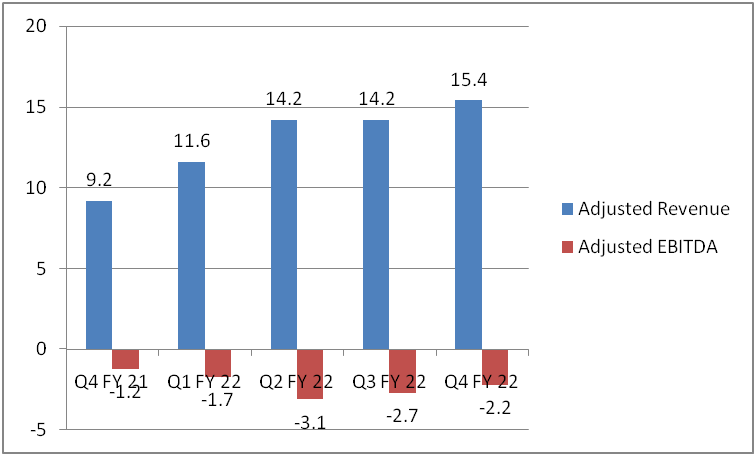

The company anticipates a double digit contribution margin in the long term. It further expects the Adjusted Revenue growth to accelerate to double digits in the next quarter and the Adjusted EBITDA losses to also come down meaningfully. The main mission of the company is to ensure that nobody has a bad meal. Zomato is the best option to search for and discover great places to eat.

Financial Snapshot (Figures Rs Billion)

For FY 2022 the Net loss of the company has increased to Rs 359 crores. Adjusted Revenue grew 8% Q-O-Q and 67% Y-O-Y to Rs15.4 billion. The Adjusted EBITDA loss reduced to Rs 2.2 Billion. The Gross Order Value (“GOV”) grew by 6% QoQ and 77% YoY to a record high of Rs58.5 billion. Employee Benefit expenses have increased 112% Y-O-Y to Rs 406 crores. Hyperpure revenue grew 24% Q-O-Q and 160% Y-O-Y to Rs 1900 crores. The Earning Per share has reduced to Rs -0.47.

SWOT Analysis

Strength-Zomato is a very fast service provider which has helped to build a strong customer base. It has a very good and customer friendly app which has bagged several awards for its fantastic design. It is well connected with a number of restaurants. The company has a brilliant marketing strategy.

Weakness- Zomato has faced the challenge of security issues a number of times. The app has been hacked several times and the data of at least 17 million users were being put at risk. In the last 10 years the company has only expanded itself in 24 countries.

Opportunity –To survive in this industry the company needs to do more expansion. Zomato can enter into a partnership with several competitors and at the same time keep an eye on the latest technologies and trends.

Threats- Entry of new competitors is creating a threat for the company. Government policies on identity theft, cybersecurity, and data privacy have also reduced the number of online customers.

Comparative Analysis of Swiggy & Zomato

Let’s make a comparative study between Swiggy and Zomato. Swiggy was established in 2014. It has its headquarters located in Bangalore. On the other hand Zomato was established in 2014. The headquarters is situated in Gurugram. Swiggy is a private company while Zomato is a publicly-traded company. The estimated revenue of Swiggy’s is around Rs 2,776 crore, while Zomato’s revenue is Rs 1,994 crore. Swiggy offers service only in India while Zomato provides services in India as well as internationally. The app of Swiggy only provides language in English while the app of Zomato provides 30 languages. Zomato has partnered with more than 4500+ restaurants across 125 cities to deliver quality food. On the other hand Swiggy has partnered with 15000 restaurants across 17 cities to bring the best local cuisine right to the doorstep. In terms of orders, Swiggy has delivered 25 million, while Zomato has only delivered 11 million orders.

Industry Analysis

To understand the Industry Analysis of Zomato we should consider that the business runs on a technological platform. Due to the emergence of Smartphones the online platform business has doubled. If we analyse the food market of India we will see that the online food delivery users in India are just 9% compared to other countries like the U.S. or China. So for Zomato it is really a challenging position. It has to face a tough competition from QSR chains like Domino’s Pizza, Magdi (McDonald’s), etc. Moreover, another major player has already entered in this food delivery market that is Amazon. It started operation in Bangalore in May 2020. Hence it is evident that there would be a war in the food delivery business between the major players.

Major Highlights

Zomato came under CCI Investigation.

Zomato for work is a corporate catering vertical where it provides meals to corporate clients.

Zomato Pro provides an additional discount on dine-in, up to 40% off on the total bill, and there are no daily, weekly, or monthly limits.

Zomato Hyperpure provides groceries to restaurants. It has opened a new avenue for a B2C company.