Zensar Technologies is a leading digital solutions and technology services company. It is a part of the Mumbai-based RPG group and is headquartered in Pune, India. It operates in two segments: Application Management Service and Infrastructure management service. It is focused on industry verticals, such as Hitech & manufacturing, consumer services, and banking, financial services, and insurance. They have offices located in India, the USA, UK, Europe, and Africa. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

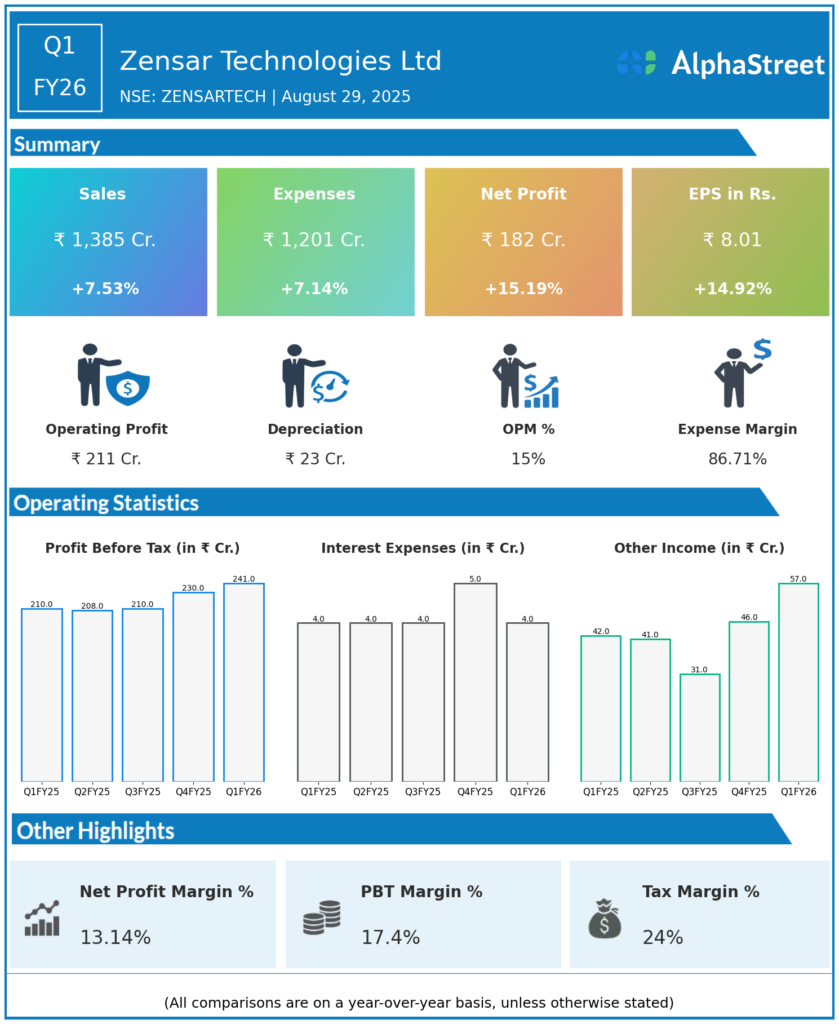

Revenue: ₹1,385 crores, up 1.9% QoQ (Q4 FY25: ₹1,359 crores) and up 7.5% YoY (Q1 FY25: ₹1,330–1,291 crores).

-

Total Income: ₹1,441.7 crores, up 12.5% QoQ and 8.4% YoY.

-

Net Profit (PAT): ₹182 crores, up 3.2% QoQ (Q4 FY25: ₹176 crores) and up 15.1% YoY (Q1 FY25: ₹158 crores).

-

EBITDA: ₹267.3 crores, margin at 18.5%.

-

EBIT: ₹188 crores, margin at 13.5% (Q4 FY25: 13.9%).

-

EPS: ₹8.01, up 3.9% QoQ (Q4 FY25: ₹7.60), up 14.9% YoY (Q1 FY25: ₹6.90).

-

Order Bookings: $172 million for the quarter, up 11.7% YoY; longer average deal tenures and increased AI/GenAI deal share.

-

Profit Margin: 13% (in line with YoY).

-

Gross Margin: 30.5%, up 20bps QoQ.

Management Commentary & Strategic Highlights

-

CFO Pulkit Bhandari emphasized robust revenue and order wins despite political unrest and macro uncertainty; continued investment in AI, operational efficiencies, and client satisfaction.

-

Significant GenAI and AI project wins across sports betting, pharma, ratings, entertainment, and financial services; more than 50% workforce trained in AI tools.

-

Management remains focused on sequential growth and mid-teens margins, noting Q2 wage hikes may impact margins but aims to compensate with scale and cost focus.

-

Strong cash reserves (₹2,630 crores/$315.7M) support flexibility for future growth initiatives and investments.

Q4 FY25 Earnings Results

-

Revenue: ₹1,359 crores.

-

Net Profit (PAT): ₹176 crores.

-

EBIT: ₹189 crores.

-

EPS: ₹7.77.

-

Gross margin: 30.3%.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.