Zensar Technologies is a leading digital solutions and technology services company. It is a part of the Mumbai-based RPG group and is headquartered in Pune, India. It operates in two segments: Application Management Service and Infrastructure management service. It is focused on industry verticals, such as Hitech & manufacturing, consumer services, and banking, financial services, and insurance. They have offices located in India, the USA, UK, Europe, and Africa.

Q2 FY26 Earnings Results:

-

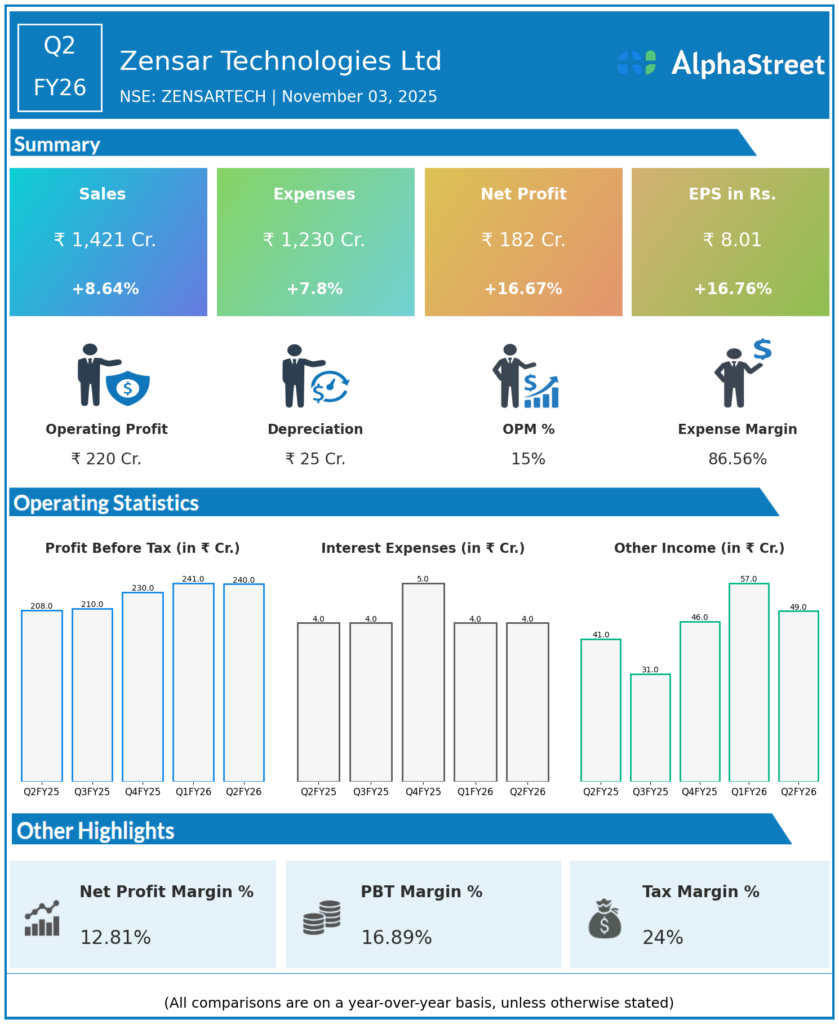

Revenue from Operations: ₹1,421.3 crore, up 2.62% QoQ and 8.66% YoY.

-

Net Profit (PAT): ₹182.2 crore, up 0.1% QoQ and 17.0% YoY.

-

Operating Profit (EBITDA): ₹220 crore, margin at 15.48%, a 27 bps QoQ increase but below March 2024’s 16.5%.

-

PAT Margin: 12.82%, down modestly from 13.14% in Q1 FY26.

-

Other income: ₹49.1 crore, 20.4% of PBT.

-

Employee costs: ₹925.2 crore, up 5.6% QoQ.

-

Consolidated revenue: ₹2,350 crore; consolidated net profit: ₹244 crore.

-

Utilization reached 84.8%; order book at $158.7 million with AI-driven deals contributing 28% of new bookings.

-

Headcount: 10,550; attrition: 9.8%.

Management Commentary & Strategic Insights:

-

CEO Manish Tandon emphasized AI-driven transformation as a core focus, with ZenseAI gaining traction.

-

Banking & Financial Services and Healthcare verticals drove growth, TMT segment saw headwinds and de-emphasized.

-

Discipline in execution, higher utilization, and operational efficiency remain top priorities.

-

Company expanding in Latin America with new Brazilian subsidiary, scaling GenAI-led digital engineering.

-

Healthy order pipeline and strong cash reserves (~₹3,741 crore); investments continue in GenAI platforms.

Q1 FY26 Earnings Results:

-

Revenue from Operations: ₹1,385 crore, up 1.9% QoQ and 7.5% YoY.

-

Net Profit (PAT): ₹182 crore, up 3.2% QoQ and 15.1% YoY.

-

EBITDA: ₹267.3 crore, margin at 18.5%.

-

Order bookings: $172 million, up 11.7% YoY; major wins in GenAI and AI-focused projects.

-

CFO highlighted order growth despite external macro headwinds and continued AI investments.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.