Zee Entertainment Enterprises is mainly in the following businesses: Broadcasting of Satellite Television Channels, Space Selling agent for other satellite television channels, and Sale of Media Content i.e. programs / film rights / feeds /music rights.

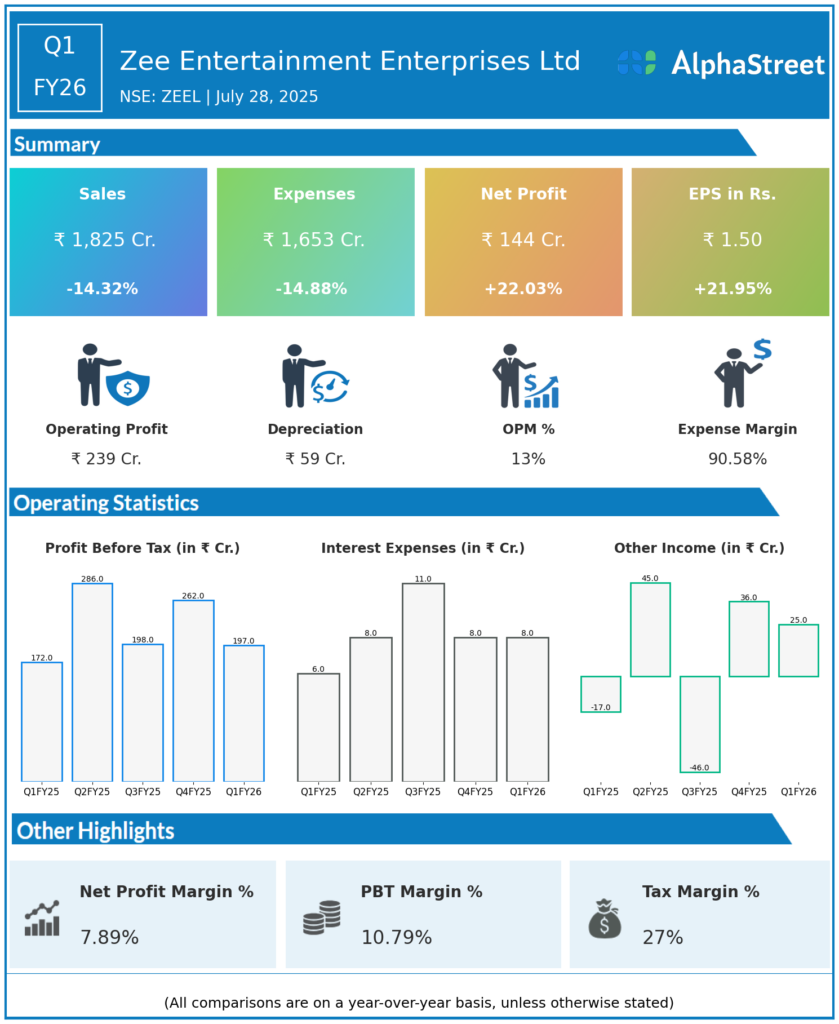

Q1 FY26 Earnings Summary (Apr–Jun 2025)

-

Revenue & Profitability:

-

Total Income: ₹1,849.8crore, down 13.9% YoY and 15.4% QoQ as advertising trends remained weak.

-

Net Profit: ₹143.7crore, up 21.7% YoY, highlighting solid cost control despite revenue pressure.

-

EPS: ₹1.50, a strong rebound from ₹0.10 in Q4 FY25.

-

Advertisement Revenue: Declined further by 16.7% YoY to ₹758.5crore, mainly due to an extended sports calendar and slowdown in FMCG ad spends.

-

Subscription Revenue: Slight dip YoY, sitting at ₹982crore digital revenue increased, but Pay TV subs dropped.

-

Other Sales & Services: Moderated from Q4 due to reduced big releases.

-

-

Operating Metrics:

-

EBITDA: ₹228–239crore, margin improved to 13.1% (from 12.7% YoY) due to reductions in employee and publicity expenses.

-

Cost Management: Continued tight cost control, with employee expenses and operational costs trimmed.

-

Key Management & Strategic Decisions

-

Ad Revenue Strategy: Management acknowledged the muted ad environment, focusing on weathering short-term headwinds and expecting a recovery with festive demand and a healthy monsoon.

-

Digital Focus: Increased emphasis on growing ZEE5 and digital platforms, offsetting linear subscription pressure.

-

New Launches: ZEEL announced plans to launch new hybrid channels and expand audience reach as part of growth efforts.

-

Prudent Spending: Ongoing operational and marketing expense discipline to protect profitability in a soft market.

Q4 FY25 Earnings Summary (Jan–Mar 2025)

-

Revenue & Profitability:

-

Total Income: ₹2,220.3crore, up 1.6% YoY.

-

Net Profit: ₹188.4crore, a massive increase (1,305% YoY) from ₹13.4crore in Q4 FY24.

-

Earnings Per Share (EPS): ₹0.10, down from ₹1.70 in Q3 FY25 but a turnaround from negative EPS in Q4 FY2.

-

Advertisement Revenue: Fell sharply to ₹837.5crore, down 24.6% YoY due to a weak macro environment, postponement of award shows, and a crowded sports calendar.

-

Subscription Revenue: ₹986.5crore, up 3.9% YoY, driven by growth in both linear TV and ZEE5 digital subscribers.

-

Other Sales & Services: Surge to ₹360.1crore, attributed to more film releases and syndication revenue increases.

-

-

Expenses: Declined by 4.2% YoY, reflecting tight cost controls.

-

Operating Margins: Remained flat; EBITDA margin showed modest improvement with cost rationalisations

Key Management & Strategic Decisions

-

Portfolio Rationalisation: Deliberately exited or streamlined weaker operations, including discontinuing some segments (e.g., Margo Networks), boosting bottom line.

-

Cost Control: ZEEL stated that “not much meat is left to cut,” indicating most cost-cutting opportunities have been exhausted; future focus is on revenue expansion, especially via digital and content.

-

Content Investment: Increased movie and original series releases, expanding digital content programming to drive engagement and revenue.

Executive Summary

-

Q4FY25: Revenue grew modestly, profit soared on cost controls and portfolio rationalisation, despite a big ad revenue drop.

-

Q1FY26: Revenue declined but profit rose, reflecting strong expense management amid continued ad market slump; digital initiatives and new channel launches position ZEEL for future growth.