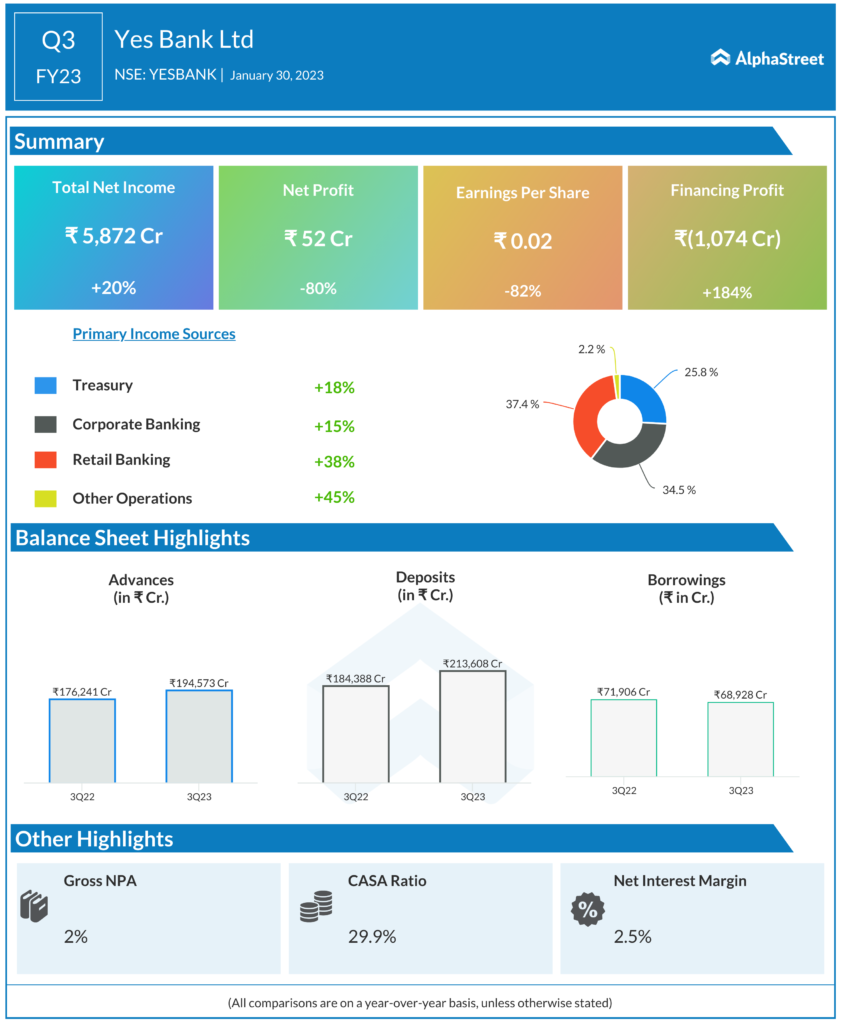

Private sector lender YES Bank today reported 80.66% on-year drop in its standalone December quarter net profit at INR 51.52 crore due to ageing related provisions. Its net interest income improved 11.7% YoY at INR 1,971 crore in Q3.

Its net interest margin (NIM) in Q3 stood at 2.5% up nearly 10 bps YoY and down 10 bps QoQ. Provisions rose 45% QoQ to INR 845 crore. While net advances rose 10.4% YoY to INR 194,573 crore, total deposits increased 15.9% YoY to INR 213,608 crore.

“During the quarter, the bank successfully closed two deals which are strategic and transformational in this new journey of the bank. The successful capital raise has aided in significant expansion in our capital base, and post full consummation, our CETI Ratio will reach an extremely comfortable level,” YES Bank NSE -2.57 % CEO and MD Prashant Kumar said.

He said with the successful transfer of stressed assets to JC Flowers ARC, GNPA and NNPA ratios have now declined to 2% and 1%, respectively, which is the lowest since Q3 of FY19. At the same time, the operational momentum continues with further step-up in disbursements across segments and highest operating profit in the last eight quarters.

Its CASA ratio in Q3 stood at 29.9% and CET 1 ratio was at 13%. YES Bank said its total assets rose 13% YoY to INR 343,798 crore while non-interest income rose 56% to INR 1,143 crore. The size of the total balance sheet grew 12.9% YoY and 2.8% QoQ to INR 343,798 crore.

During the quarter, the bank recorded strong growth of 44% in retail advances at INR 83,769 crore, which was the highest ever. The bank said it saw a steady growth in new card acquisition leading to 31% YoY growth in customer base to reach 1.4 million base.