Wonderla Holidays is engaged in the business of Amusement Parks and Resort. Presenting below are its Q1 FY26 earnings.

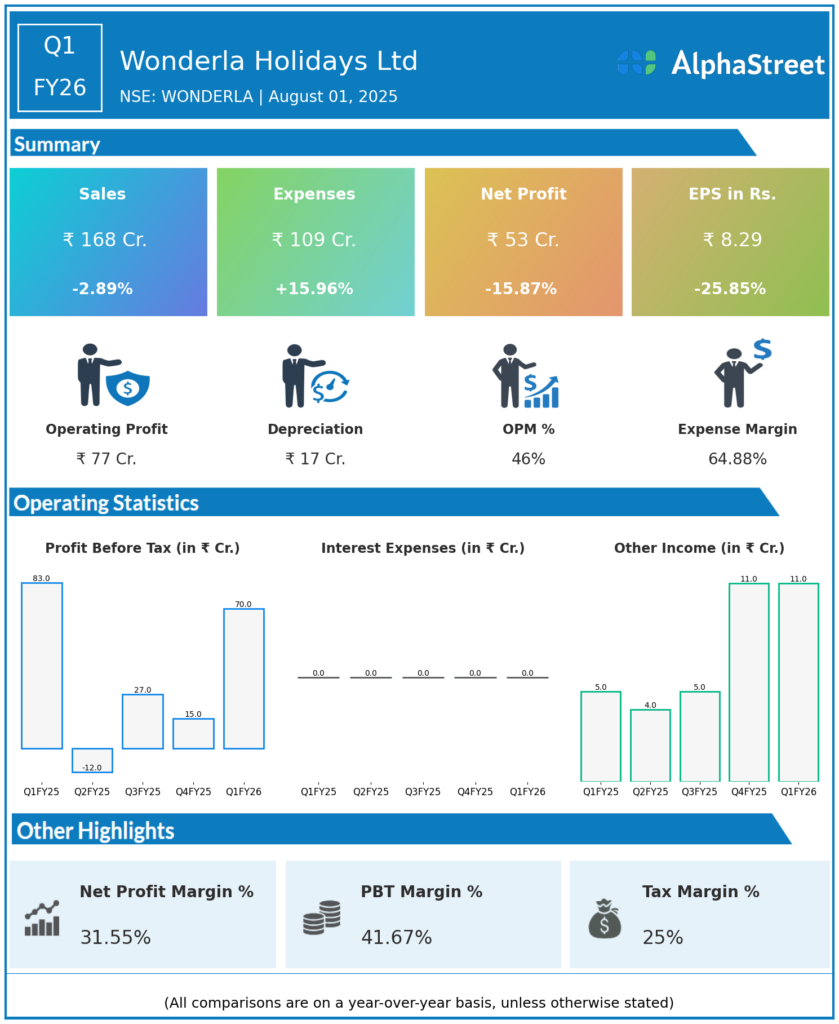

Q1 FY26 Earnings Summary (Apr–Jun 2025)

-

Total Income: ₹179.06 crore, up 1% year-over-year (YoY).

-

Revenue from Operations: ₹168.24 crore, a marginal decrease YoY but a strong 74% sequential increase from Q4 FY25.

-

EBITDA: ₹87.5 crore, down 9% YoY; EBITDA margin at 49% (vs 54% in Q1 FY25).

-

Profit After Tax (PAT): ₹52.57 crore, down 16% YoY.

-

PAT Margin: 29% (vs 36% YoY).

-

Footfalls: Surpassed 9.17 lakh during the quarter—a record for Q1—with key park-wise data: Bengaluru 3.22 lakh, Kochi 2.37 lakh, Hyderabad 2.62 lakh, Bhubaneshwar 0.96 lakh.

-

Operational Highlights: Official launch of premium “Isle” glamping pod in June 2025; Bhubaneshwar park completed its first full quarter of operations.

-

Segment Performance: Amusement Parks & Resort segment generated ₹129.37 crore; Others contributed ₹38.87 crore.

-

Other Notes: Strong operational momentum post slow Q4; improved footfall despite flat revenue indicates normalization of demand and improved guest engagement.

Key Management Commentary & Strategic Highlights

-

Leadership reported operational resilience and sustained brand strength, citing robust footfall and revenue stabilization despite continued margin pressure.

-

Chairman Arun Chittilappilly expressed confidence in scaling up through new park launches and expansion of attractions, anticipating a 5–10% footfall growth and 5–6% ARPU growth for FY26, driven by addition of new capacity, expansion in Tier II/III markets, and regular attraction upgrades.

-

Management highlighted the impact of macroeconomic and discretionary spending trends, noting a cautious but optimistic outlook on demand normalization through FY26.

-

The Bhubaneshwar park’s performance and premium hospitality offerings (Isle pods) are seen as key drivers for experience and revenue diversification.

-

Focus remains on improving operational efficiency, expanding the digital user experience, and reinforcing safety and quality at all parks.

-

Wonderla expects to pursue new locations, with the soft launch of its Chennai park targeted by end Q3 FY26. Low debt and strong internal accruals support expansion plans.

-

Commentary also noted a shift towards online bookings outpacing traditional channel sales, reflecting changing consumer behavior.

Q4 FY25 Earnings Summary (Jan–Mar 2025)

-

Total Income: ₹107.6 crore, up 2.6% YoY.

-

EBITDA: ₹30.54 crore, down 25% YoY; EBITDA margin reduced to 28% (from 39% in Q4 FY24).

-

PAT: ₹11 crore, down 51% YoY from ₹22.6 crore.

-

Footfalls: 6.78 lakh across all parks (Bengaluru 2.18 lakh; Kochi 2.08 lakh; Hyderabad 2.11 lakh; Bhubaneshwar 0.41 lakh).

-

Key Trends: Declining profit and margin trajectory attributed to higher operating expenses (notably from the new Odisha park), subdued discretionary spends, and some normalization following post-pandemic surges.

To view its previous earnings, please visit: Click Here