Wockhardt is a global pharmaceutical and biotechnology organization engaged in manufacturing finished dosage formulations, injectables, biopharmaceuticals, orals and topicals (creams and ointments).

Q2 FY26 Earnings Results

-

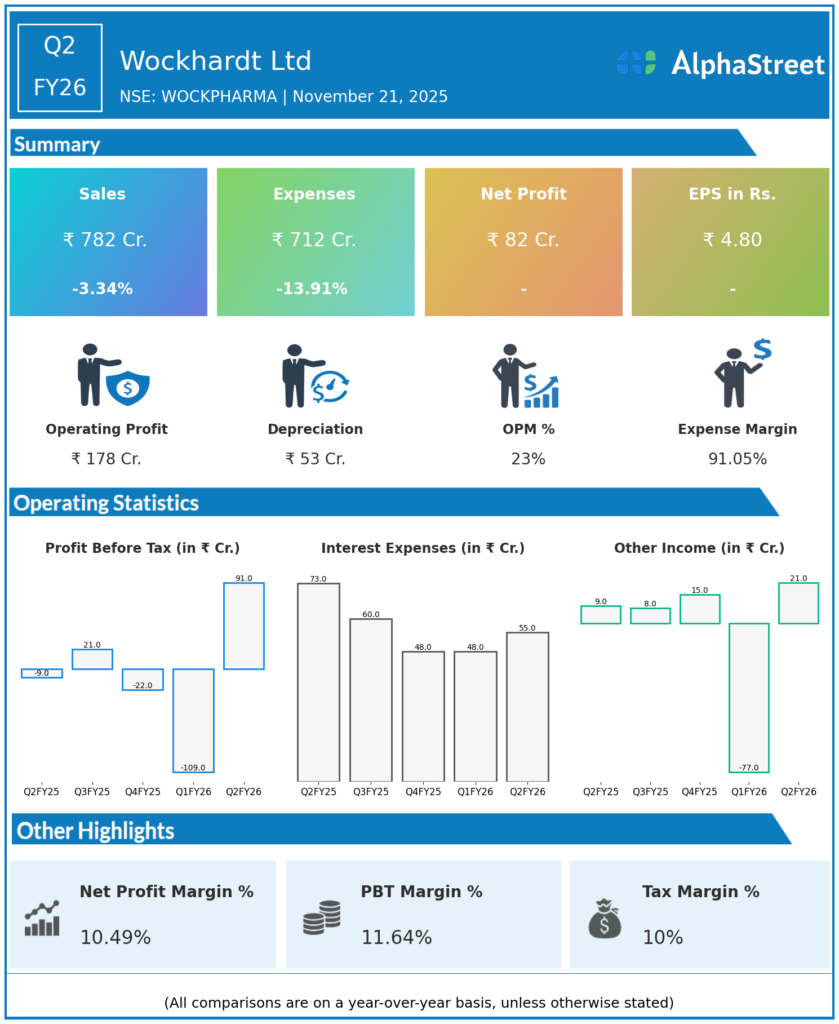

Revenue from Operations: ₹782 crore, up 6% QoQ from ₹738 crore in Q1 FY26 but down 3.5% YoY from ₹810 crore in Q2 FY25.

-

Profit Before Tax (PBT): ₹91 crore, a sharp turnaround from a loss of ₹109 crore in Q1 FY26, supported by operational improvements and exit from US generic pharma business.

-

EBITDA: ₹160 crore, up 58% QoQ from ₹101 crore in Q1 FY26, with margin expansion to 20.5% due to better product mix and cost controls.

-

Profit After Tax (PAT): ₹82 crore, up sharply from a loss in the previous quarter and a significant improvement from previous year losses.

-

Business segments: Growth driven by India, UK, and Irish businesses; notable progress in novel antibiotics and biotech with NDA submissions and product launches ongoing.

-

Debt reduction and strong cash flow generation reported with improving balance sheet.

Management Commentary & Strategic Insights

-

Management attributed strong Q2 performance to successful turnaround efforts including divestiture of US generic pharma units and focus on innovation-led product segments.

-

Operational efficiency, supply chain optimization, and cost discipline helped rebound profitability amid challenging market conditions.

-

The company is advancing its novel antibiotic portfolio (ZAYNICH® NDA submission) and expanding biotech footprint.

-

Management remains focused on sustainable growth, margin improvement, and product pipeline development.

-

Positive outlook maintained for continued recovery and value creation in the pharmaceutical and biotechnology segments.

Q1 FY26 Earnings Results

-

Revenue from Operations: ₹738 crore, virtually flat YoY from ₹739 crore, slight QoQ growth.

-

Profit Before Tax (PBT): Loss of ₹109 crore, impacted by exceptional charging primarily linked to US business restructuring.

-

Profit After Tax (PAT): Loss of ₹90 crore, a significant decline from previous quarters.

-

EBITDA: ₹101 crore, margin at 13.7%, reflecting operational challenges.

-

Management focused on restructuring and turnaround efforts with expectations for profit recovery from Q2 onwards

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.