Wipro Ltd is a global Information technology, consulting and business process services (BPS) company. It is the 4th largest Indian player in the global IT services industry behind TCS, Infosys and HCL Technologies.

Q3 FY26 Earnings Results

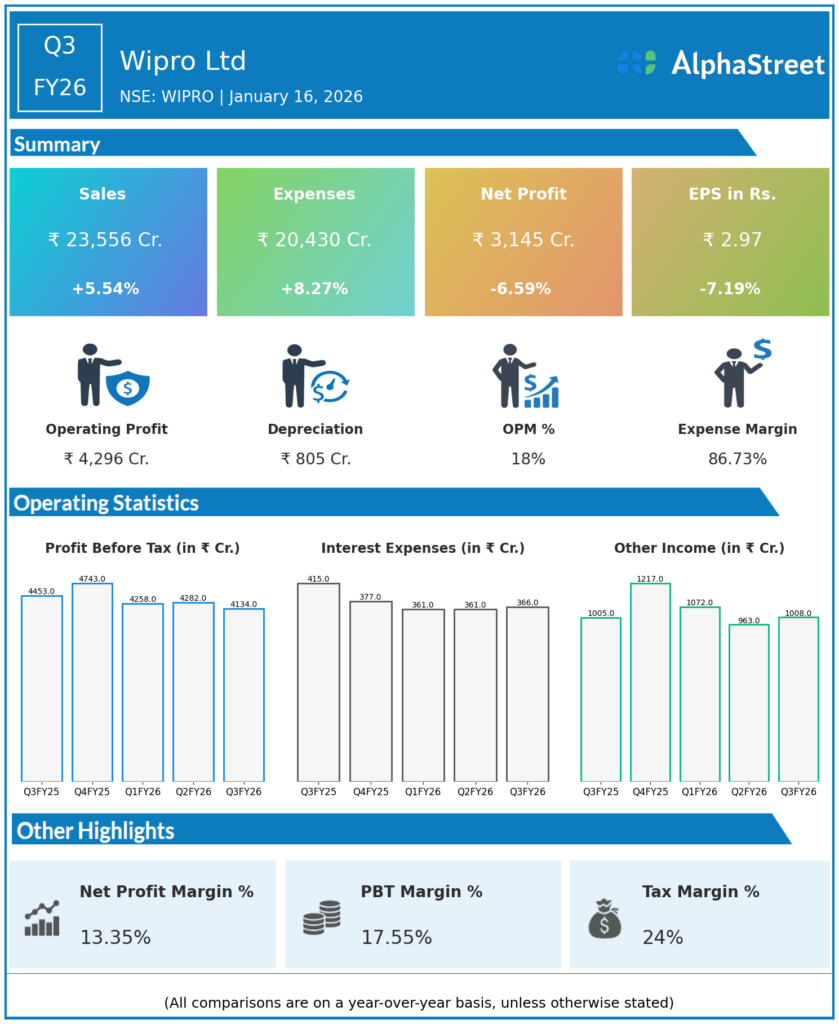

- Revenue from Operations (Consolidated): ₹23,560 crore, up ~3.8% QoQ from ~₹22,697 crore in Q2 FY26 and modestly up YoY (low single‑digit) versus Q3 FY25.

- IT Services Revenue: ₹23,378 crore, up 3.3% QoQ from ₹22,640 crore; in constant currency, IT services grew 1.4% QoQ and declined 1.2% YoY.

- IT Services EBIT: ₹3,573.5 crore, down 5.5% QoQ from ₹3,783 crore; reported IT services EBIT margin at 15.3% vs 16.7% in Q2 FY26.

- Operating Margin (IFRS basis): 17.6% for IT services, improving 90 bps QoQ and slightly YoY, on the company’s preferred reporting basis.

- Profit After Tax (Reported): ₹3,119 crore, down 4% QoQ from ~₹3,262 crore in Q2 FY26 and down 7% YoY from ~₹3,354 crore in Q3 FY25.

- Profit After Tax (Adjusted): ₹3,360 crore after excluding labor code related costs; this is up 3.6% QoQ and 0.3% YoY, indicating underlying profit growth.

- Deal bookings: Total bookings of about USD 3.3 billion; large deal TCV around USD 0.9 billion in the quarter.

- Cash generation: Operating cash flow ₹4,259 crore, about 135% of net income, reflecting strong cash conversion.

- Dividend: Interim dividend of ₹6 per share declared for FY26.

Management Commentary & Strategic Decisions

- Management acknowledged that reported profitability declined due to labour‑code related cost adjustments and some cost pressures, while underlying operating margin (IFRS basis) improved to 17.6% driven by execution discipline and cost optimisation.

- Demand environment was described as “cautious” with clients remaining selective on new projects, but deal activity stayed healthy with USD 3.3 billion in total bookings and USD 0.9 billion in large deals.

- Strategic focus areas highlighted:

- Scaling AI‑first and cloud‑led transformation offerings under the Wipro Intelligence positioning, aimed at driving higher‑value deals across verticals.

- Continued simplification of the operating model, pyramid optimisation, and onsite–offshore mix improvements to support margin resilience.

- Strong capital allocation via consistent dividends while maintaining balance‑sheet strength.

- Guidance: For Q4 FY26, Wipro guided IT services revenue to USD 2.64 billion, implying 0–2% QoQ growth in constant currency, signalling expectation of modest growth continuation.

Q2 FY26 Earnings Results

- Revenue from Operations (Consolidated): ₹22,697 crore, up 1.7% YoY from about ₹22,302 crore and up 2.5% QoQ from ₹22,135 crore in Q1 FY26.

- IT Services Revenue: USD 2,604.3 million, up 0.7% QoQ but down 2.1% YoY; in constant currency, IT services revenue was broadly flat QoQ and down 2.6% YoY.

- Net Profit (PAT / Net Income): ₹3,246 crore, up roughly 1–1.2% YoY from ₹3,208 crore, but down about 2.5% QoQ from ₹3,330 crore in Q1 FY26.

- Operating Margin (Reported): Around 16.7%; adjusted operating margin at 17.2%, up 40 bps YoY but down 10 bps QoQ, impacted by a one‑time ₹116.5 crore provision related to a customer bankruptcy.

- Large deal wins: USD 2.85 billion in Q2 FY26, up 6.7% QoQ and 90.5% YoY in constant currency, indicating strong momentum in large, multi‑year contracts.

- Bookings & cash flow: Total bookings USD 4.688 billion (down 6.1% QoQ, up 30.9% YoY); operating cash flow ₹3,390 crore, 103.8% of net income.finance.

- Attrition: Voluntary attrition at 14.9% (12‑month trailing), continuing to trend lower and stabilise.

Management Commentary & Strategic Directions

- Management described Q2 FY26 as a quarter of steady but muted top‑line growth, with revenue modestly up QoQ and YoY amid a tough macro and sluggish discretionary spending, particularly in some verticals.

- Margins were supported by disciplined cost control and operating efficiencies, but reported margins were impacted by the one‑time provision for a customer bankruptcy.

- Key strategic priorities discussed:

- Driving growth through large‑deal wins and deeper client mining, particularly in cloud, AI, and transformation programmes.

- Continuing to improve talent pyramid, utilisation, and delivery productivity to sustain margins while investing selectively in growth areas.

- Maintaining a balanced capital‑allocation policy with ongoing dividends and strong liquidity, while navigating an uncertain global demand backdrop.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.