Key highlights from Wipro (WIPRO) Q3 FY22 Earnings Concall

Management Update:

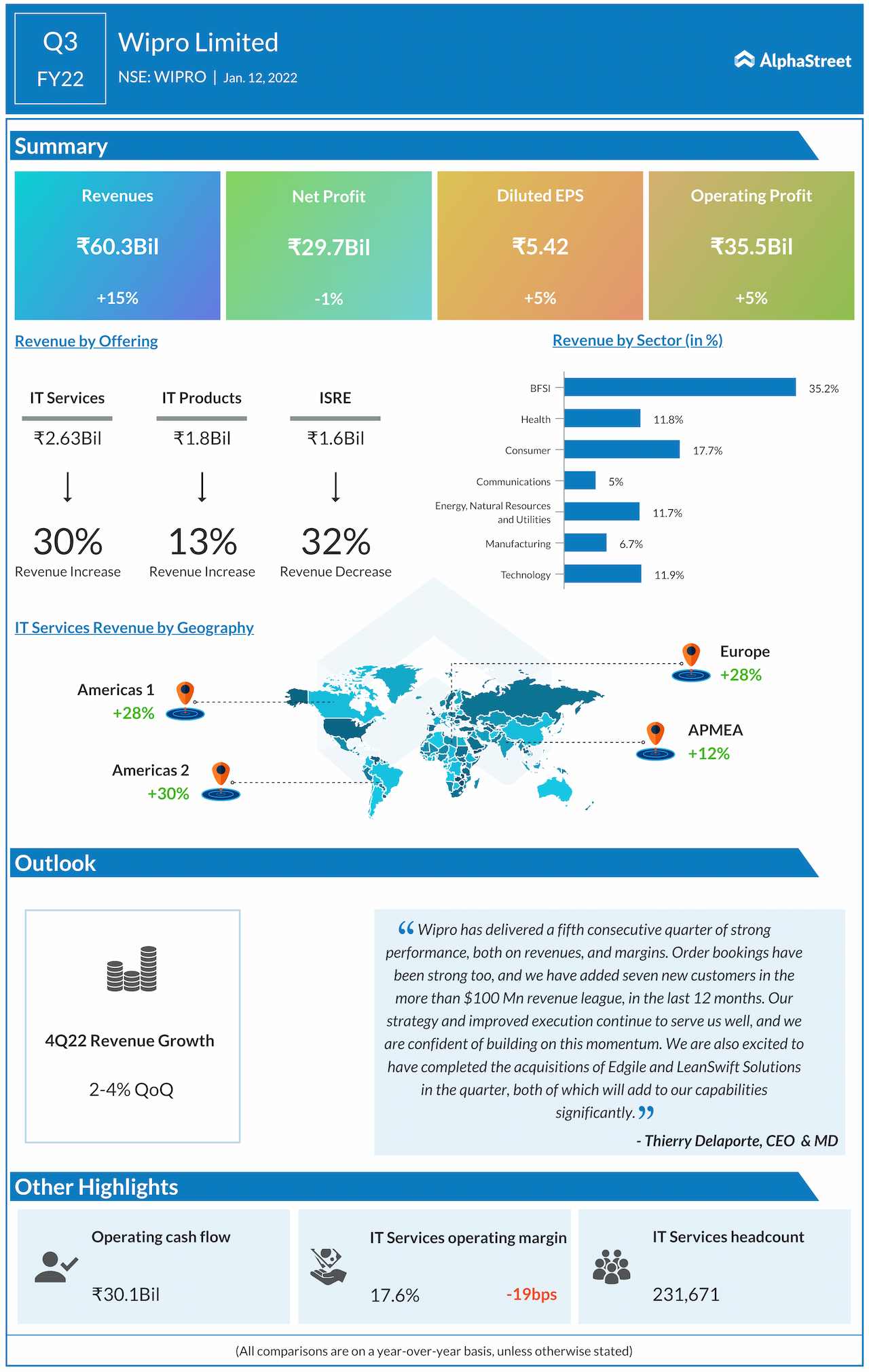

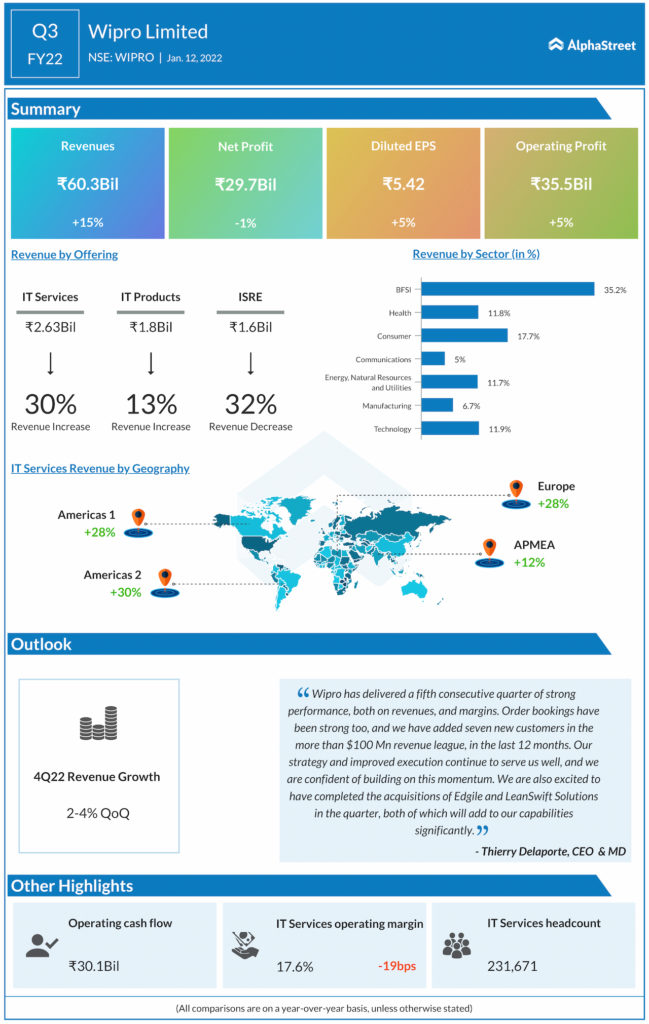

- WIPRO said its order books grew 27% on a YTD basis in terms of annual contract value and its bookings were the highest ever.

- The company also mentioned that its win rate expanded 300 basis point in Q3. And completed two acquisitions, namely Edgile and LeanSwift, developing WIPRO’s capability in cybersecurity and cloud services respectively.

- WIPRO’s margins remained constant or stable between Q2 and Q3 in a narrow range.

Q&A Highlights:

- Sandeep Shah of Equirus Securities asks about the deceleration of growth in current quarter compared to last two quarters. CEO, Thierry explains the company is not seeing any deceleration of growth and had their best quarter ever in terms of bookings and there have been no lost clients or terminated deals.

- On Sandeeps question about organic growth and M&A, Thierry said, the company does not see M&A as a way to compensate organic growth.

- Sandeep also asks about margin outlook continuing in the band of 17%, 17.5% in the medium term (4-6 quarters). CFO Jatin, said there could be variations but that’s the range the margins are sustainable for its business.

- Vibhor Singhal of Phillip Capital enquired about outlook of enhancing shareholder returns by dividends or share buyback. Jatin said, the company will continue to return 50% of its net income to shareholders.

- Moshe Katri of Wedbush Securities asked a question about new client additions versus client renewals. Stephanie Trautman, Chief Growth Officer said they are seeing a mix of renewals and new client additions, but it’s not one that’s contributing higher to the growth.

- On Diviya Nagarajan of UBS’ question about WIPRO’s peers reporting surprise numbers on the demand front for Q3, CEO Thierry said, that it’s due to mega deals of peers that they see surprises and that WIPRO has a strong performance in sales and has had recurring type of deals every quarter.

- Diviya Nagarajan of UBS’ also asked about attrition and whether it will be manageable by the company. CEO Thierry said, they are expecting the level of attrition to moderate in Q4.

- Sumeet Jain of Goldman Sachs asked about D&A expense as a percentage of sales declining sharply over the last two quarters. CFO Jatin Dalal said it’s due to some of the amortization lines that are coming to an end of its tenure. The number should accelerate a bit in Q4, as the company has two acquisitions to be integrated from 1st Jan, 2022.