The Story

Last month, we missed the Black Friday Sale and our golden chance to purchase the PC peripherals like RAM or Hard Disk for cheap. Now, building your own PC is not a herculean task, you could have done the same thing last year, buying all the parts on Amazon. So we shot up the e-commerce site and hit the search results. But the moment the page loaded, we stopped cold.

The prices had shot through the roof.

The 1TB SSD plus enclosure combo that cost us around ₹6,000 in 2024 was now selling for anywhere between ₹10,000 and ₹14,000 and mind you, its the same brand, same product, nothing upgraded. It felt eerily similar to the GPU madness during the crypto mining boom, when every PC user resigned themselves to overpriced hardware.

And it’s not just SSDs. RAM prices have doubled in just a few months. Some Japanese retailers have even imposed “one-per-person” limits to stop hoarding. Meanwhile, the big three memory manufacturers: Samsung, SK Hynix, and Micron have all raised prices by at least 30% recently.

You’re essentially paying a premium for identical hardware. So how did we get here? Lets dive deeper with Alphastreet’s Research Desk.

The AI Build-Out That Started It All

Zoom out, and you’ll see this year’s real disruptor – AI. Every tech giant you can think of Google, Meta, OpenAI is building monster-sized data centres. And they’re popping up everywhere, from Google’s billion-dollar hub in Visakhapatnam to OpenAI’s Stargate-linked facility in Norway.

Massive data centres mean massive hardware shopping lists: GPUs, cooling systems, and more importantly, memory both DRAM and NAND.

(Quick refresher: DRAM powers your system’s active memory. NAND is the long-term storage used in SSDs.)

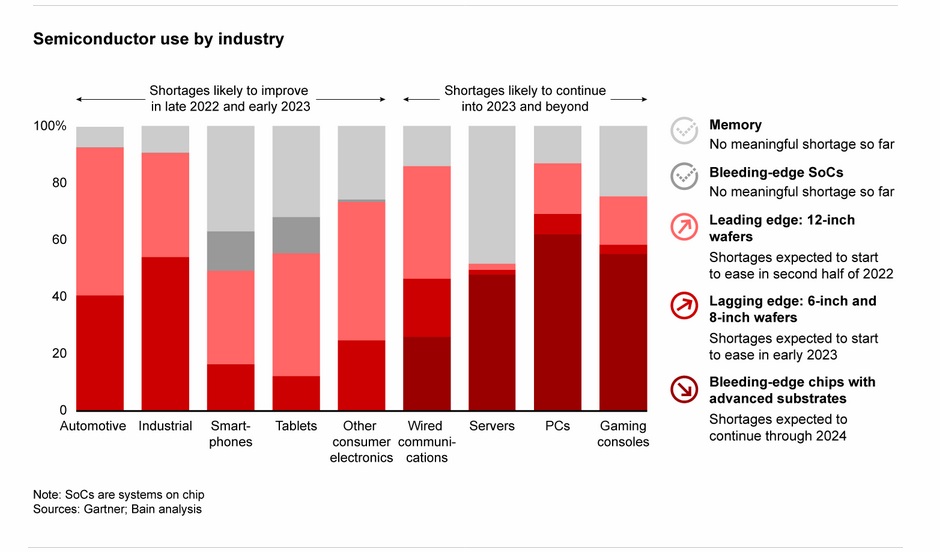

The demand surge has been unlike anything the industry has seen in decades. Supply just can’t keep up.

But AI Uses HBM… So Why Are Our SSDs Expensive?

Here’s where it gets interesting. AI companies primarily rely on HBM (High Bandwidth Memory), a super-fast, specialised type of DRAM used in AI accelerators. HBM isn’t what you or I buy for our laptops.

But even then, consumer hardware is feeling the heat. Why?

Because the same trio: Samsung, SK Hynix, and Micron, manufacture both consumer memory and the high-end chips AI giants are bulk-ordering. And right now, almost every available wafer is being diverted toward AI-grade components.

Some analysts call this the first major global memory squeeze in three decades. Server demand is swallowing up capacity long before consumer products even get a chance.

Factories Are Coming… But Not Anytime Soon

Memory manufacturers are trying to scale, but building a fab isn’t like opening a store. Micron, for instance, has announced a ₹9.6 billion facility in Hiroshima. Sounds great, except construction begins next year and the first chips will roll out only around 2028.

Chipmaking is slow, expensive, and insanely complex and the industry is already behind.

So, when does this end?

The Hard Truth: Not Soon

Prices have been climbing for several quarters, and analysts expect both DRAM and NAND costs to keep rising through 2025. Some predictions are downright gloomy. Phison’s CEO, whose company builds NAND controllers found inside SSDs believes the shortage could last up to a decade, worsening by 2026 if demand continues at this pace.

And there’s another curveball.

Microsoft is ending Windows 10 support. Millions of older PCs will need upgrades or replacements to move to Windows 11. That means more RAM and more SSDs, exactly the components in short supply.

The Power of Three

Ultimately, the future of memory prices lies with the three companies that control almost the entire global supply: Samsung, SK Hynix, and Micron. How they allocate wafer capacity will decide whether things improve or stay expensive.

One move already shows where the winds are blowing, Micron is exiting the consumer SSD and RAM market altogether. Its Crucial brand, a 29-year staple is being phased out so the company can focus exclusively on enterprise and AI storage.

When a major supplier walks away from consumer products, you know where the money is.

When Will the Relief Arrive?

Stability will return only when AI demand plateaus and new fabs dedicated to AI-grade memory take some pressure off existing lines. Over the next 12–18 months, as these new facilities ramp up, manufacturers are expected to reallocate some capacity back to consumer DRAM and NAND.

Until then, shortages stay. Prices stay high. And anyone building or upgrading a PC has to brace for a more expensive bill.

For now, all we can do is wait for the wave to settle.