Skillcast Group (LSE: SKL)

Last Traded Price – GBP23.50

Sector: Software and Computer Services

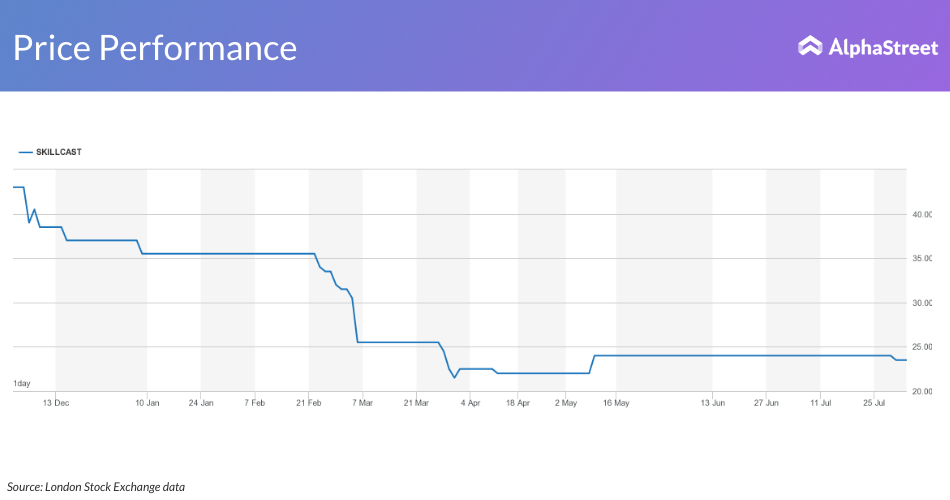

Price Performance:

Last 5 days: up 2.3%

YTD: down 39.19%

Since Listing in Dec 2021: down 47.7%

Skillcast Group shares gained momentum after the AIM-listed software-and-subscriptions company provided a trading update on July 27. The company expects revenue to increase 20% on year to GBP4.5 million for the first half of 2022, driven by a 32% rise in recurring subscription sales.

However, the company expects to report a small adjusted loss before interest, taxes, depreciation and amortization for the first half. Notably, the company had reported Adjusted EBITDA of GBP1.1 million for 2021.

“We are confident that our non-discretionary corporate compliance and e-learning offer is well placed to weather the heightened political and economic uncertainty we face,” Chief Executive Officer Vivek Dodd said.

Events To Watch Out For:

*Interim earnings release on September 28

Company Description:

Founded in 2006, Skillcast provides content and technology to help companies digitize their compliance process. Headquartered in London with offices in Malta, the company got listed in the Alternative Investment Market (AIM), a sub-segment of the London Stock Exchange in December 2021.

In its initial public offering, the company raised about GBP3.5 million at a valuation of GBP33 million. These funds will be used to intensify its technology development and marketing efforts. The management of the group retains approximately 72.8% of the total issued ordinary share capital.

Investment Thesis:-

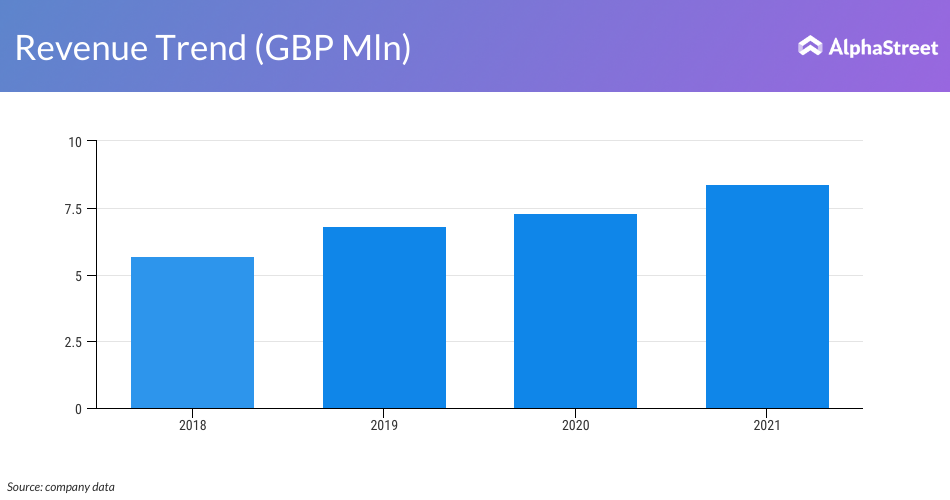

Strong Client Base Driving Revenue: The company has a strong base of over 800 clients and has been adding 20 accounts per month. Its revenue has shown a steady pace of increase since 2018. Last year revenue jumped 15% on year to GBP8.4 million driven by net retention and new client wins.

The company’s listing has also added to its credibility and boosted client confidence. It has helped the company to win clients and strengthen its leadership in the field of digital compliance transformation.

Debt Free: With the Bank of England slated for its likely biggest interest rate hike in 27 years of 50 basis points to combat inflation pressures, many debt-heavy firms’ profits may dip owing to falling sales and payment of fixed interest. The country’s inflation hit a new 40-year high of 9.4% in June as food and energy prices continued to rise. BOE decision is due on Aug. 4. A half-point increase in the BOE’s benchmark rate will push the borrowing cost to 1.75%, the highest since the global financial crisis in 2009.

In such a scenario, Skillcast with no debt and strong cash position of GBP7.5 million on Jun. 30, 2022, looks attractive to potential investors. The company intrinsically has low interest rate risk. Also leaves room for additional fund raising though leverage.

ESG Trends: Skillcast, which works towards helping companies to create compliance awareness and inspire their employees to act with integrity, stands to gain more clients as the environmental, social and governance (ESG) trend picks up. With the popularity of ESG investing rising, more companies are seeking to lower their energy footprints and address their governance issues. Regulators and authorities across the world have shown over the first six months of the year increasing interest in curbing greenwashing. The U.K. Treasury plans to implementing sustainability disclosure requirements and will proceed with the necessary legislation in due course, though it dropped its near term plans.

Skillcast is currently trading at a deep discount to its IPO price, offering cheap valuations. It could act as a proxy for investors seeking to bet on ESG investing, which has immense untapped potential. The global market for compliance management technologies currently stands at $744 million and is growing at 15% to 20% rate as per GRC 20/20 data.