Investors often note that consumer stocks have lagged behind investment-led stocks in recent years. But there’s a powerful pocket of consumer growth currently undergoing a consumption boom and that is none other than the alcohol industry.

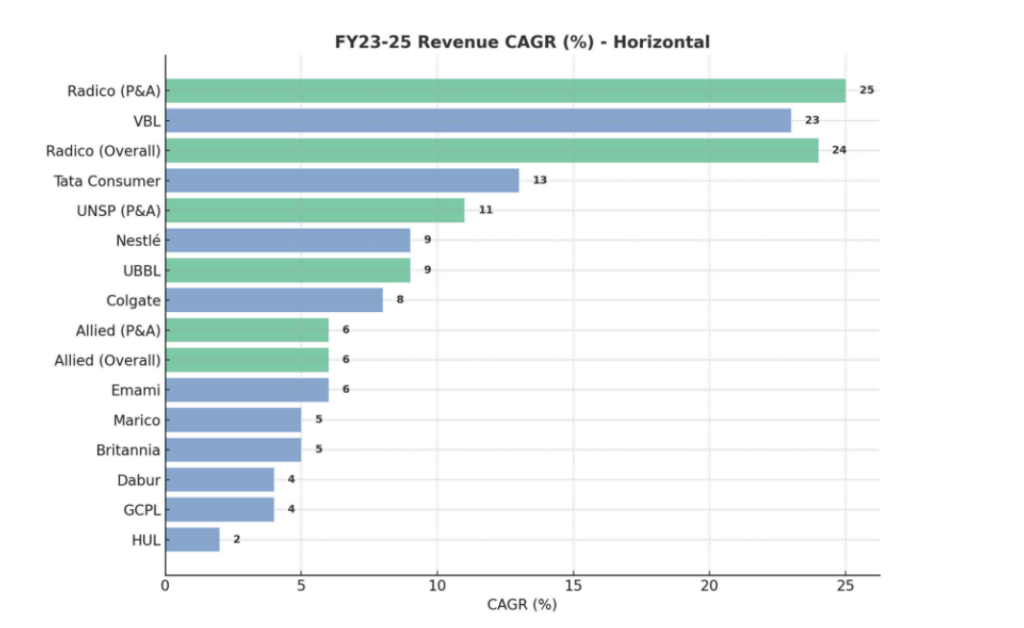

In fact, some of the fastest-growing companies in the consumer space recently have been alcohol-related. Between FY23 and FY25, Radico Khaitan saw the fastest revenue CAGR in the consumer space (specifically its Prestige and Above segment, P&A) at 25%. Following closely was Varun Beverages. This sector is highly relevant because when individuals gain more disposable income, they tend to spend heavily on discretionary and consumption goods, making alcohol a key beneficiary.

But this industry is notoriously complex. To understand where the success lies, we must first simplify the market.

FMCG Companies Vs Alcohol Industry

The $48 Billion Market: A Nation of Brown Spirits

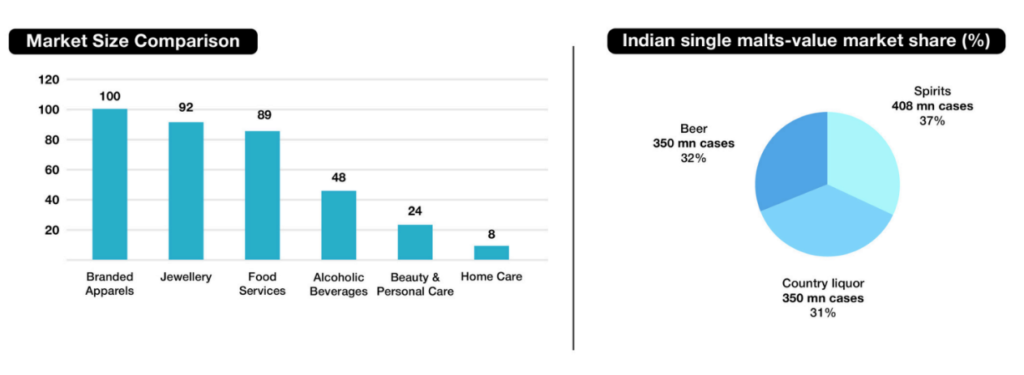

India’s total addressable market (TAM) for alcoholic beverages is massive, valued at $48 billion, corresponding to 420 million cases in 2025. While the overall market volume growth is modest, around 4% to 5% per annum and certain companies have managed to achieve PAT growth of 30%, 40%, or even 50%.

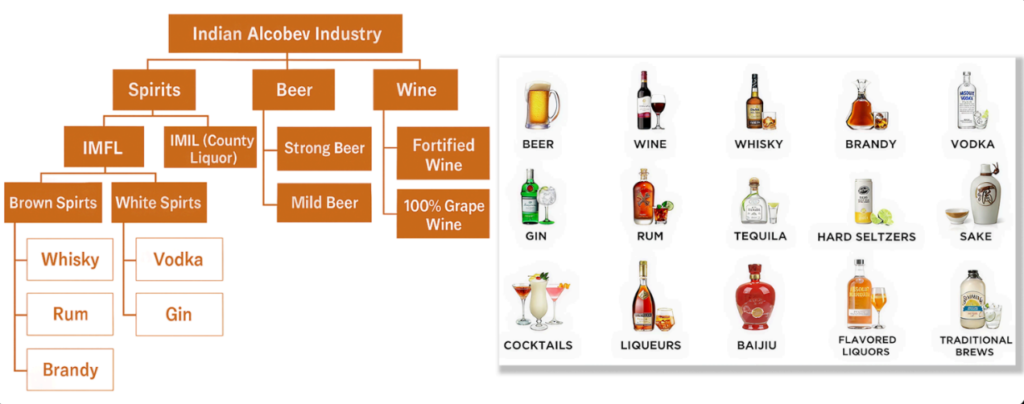

The Indian alcohol industry is categorized primarily into Spirits, Beer, and Wine.

1. Spirits (72% of the market): The dominant force. Spirits are further classified into Indian Made Foreign Liquor (IMFL) and Indian Made Indian Liquor (IMIL).

-

- IMFL includes Western-style spirits (Whiskey, Rum, Vodka, Gin, Brandy).

- IMIL refers to low-cost Desi Spirits.

- Country Liquor (like Toddy, Mahua, Feni) is also present, constituting 11% of total alcoholic beverages.

2. Beer (16% of the market): Includes Strong and Mild varieties.

3. Wine (1% of the market): Includes fortified wine and 100% grape wine.

Crucially, India is a brown spirits drinking nation. Whiskey alone contributes 70% of the total alcohol market. In contrast, only 1% of the alcohol-drinking population consumes wine.

Within spirits, we distinguish between Brown Spirits (Whiskey, Rum, Brandy) and White Spirits (Vodka, Gin). While the overall market growth is around 8%, White Spirits are seeing the fastest CAGR growth at 20%, followed by Rum at 10%, and Whiskey and Brandy at 6%.

Classification of Alcohol Industry

The Secret to Success: Premiumization

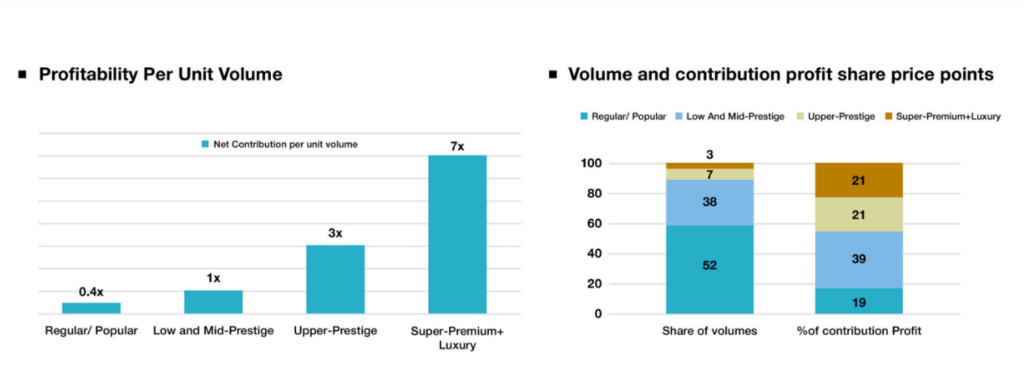

Why are certain companies achieving rapid profit growth despite moderate overall volume expansion? The answer lies in premiumization.

The stock market grants higher valuations to companies that possess their own brands, focus on higher IMFL sales, and sell more expensive alcohol. This phenomenon is driven by value growth (Sales = Volume × Value). For example, while Rum volume growth might be 4.5%, its overall value growth can reach 10.7%.

The key takeaway is that the bulk of profitability lies above the Regular and Popular segments.

| Price Segment | Price Range | Industry Volume Contribution | Profitability Contribution |

|---|---|---|---|

| Luxury & Ultra Premium | >₹3,500 | 1–2% | 21% |

| Upper Prestige | ₹1,750–₹3,500 | 8–10% | 21% |

| Low & Mid Prestige | ₹850–₹1,750 | 38% | 39% |

| Regular & Popular/Mass Premium | ₹350–₹800 | 52% | 19% |

The Super Premium segment (₹1,750 – ₹3,500) is particularly noteworthy, currently experiencing 17% to 20% volume growth.

Market size of Single Malt Industry

Indian single malt market size

The Regulatory Maze and the Winning Template

The alcohol business is challenging due to regulations. It is one of the most regulated industries, with approximately 65% of the bottle’s price going towards taxes. Furthermore, an advertising ban makes establishing new brands extremely difficult. Every state operates almost like a different country regarding alcohol regulations, demanding significant effort to establish pan-India distribution.

For instance, state actions like the Telangana government delaying dues or Maharashtra implementing a tax hike greater than 50% on IMFL illustrate the regulatory headwinds.

To succeed in this environment, top players follow a clear mental model:

- Cost Control & Backward Integration: Companies that control costs by integrating backward into ENA (Extra Neutral Alcohol) production or packaging (which makes up roughly 50% of the cost) maintain stable margins.

- Premiumization Focus: Consistently launching brands in higher-value segments.

- Export Scaling: Establishing export-oriented brands offers strong validation.

- Strategic Focus: Concentrating on IMFL products or Indian Single Malts. Beer is often a low-ROE/ROC market, while wine is slow growth.

Profitability of Alcohol Categories

Deep Dive: Assessing Key Players

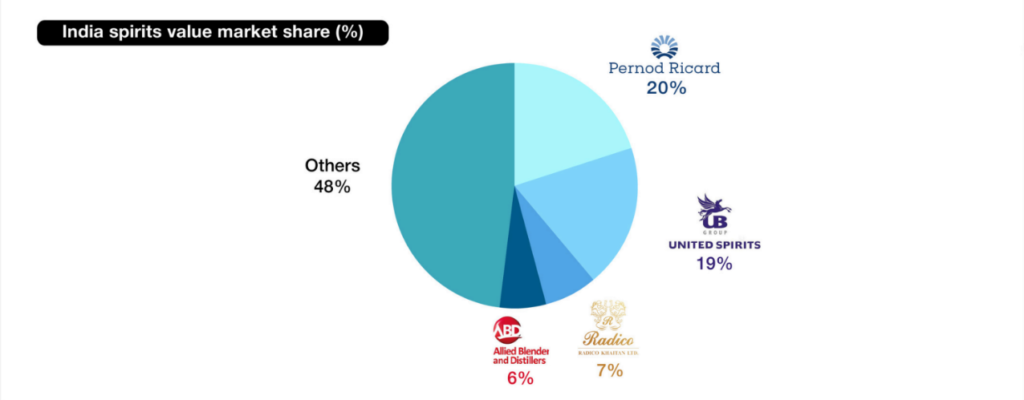

Several companies are employing this winning template, albeit at different stages:

1. Allied Blenders and Distilleries (ABDL)

ABDL is touted as a “self-help story”. They are actively improving capital allocation, reducing debt (interest expense dropped from ₹173 crore to ₹118 crore), and enhancing margins through a better premiumization mix.

- Premiumization Drive: ABDL’s focus on Mass Premium (Officer’s Choice) is shifting. Mass Premium used to be 75% of sales; it is now 53%, while Prestige and above accounts for 46%. Their fastest-growing brand is Iconic White Whiskey (Prestige/Semi-Premium).

- Triggers: ABDL, the largest importer of bulk scotch in India, expects significant cost savings if the India-UK FTA (Free Trade Agreement) is signed, potentially cutting their ₹150 crore duty in half. They are also undergoing a significant capital expenditure plan, integrating backward into ENA (targeting 65-70% integration by FY27, up from 33%) and starting their own packaging facilities, which should boost margins.

- Guidance: ABDL aims for mid-teens volume/revenue growth and a target of 17%+ EBITDA margins by FY28 (up from 12.7%).

2. Piccadily Agro Industries

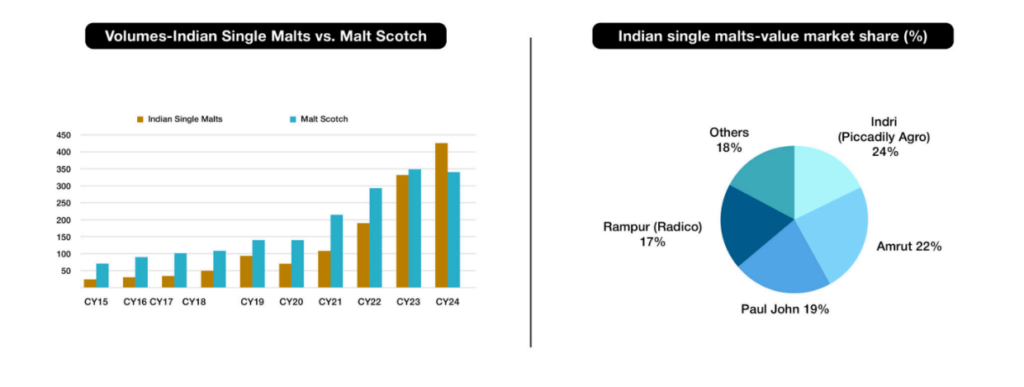

This company is the central player in the booming Indian Single Malt segment with its brand Indri.

- Transformation: Piccadily’s business has pivoted dramatically: the Sugar business fell from 52% to 28% of sales, while IMFL (single malt) sales now account for 43% of revenue (up from just 1.7%). This luxury focus yields high margins, with their premium spirits portfolio seeing 22-23% EBITDA margins.

- Growth Triggers: The company is increasing its distillery capacity by 2.5 times, expected to go live in Q1 FY26, suggesting rapid volume growth potential.

- Risk: It is important to be aware of the promoter’s past criminal history, although the promoter has since been released from jail and successfully built this company.

3. Radico Khaitan

Radico Khaitan represents the “classic template” for success in this industry. Their Prestige and Above volumes have more than doubled recently.

- Portfolio Strength: Radico boasts millionaire brands like Magic Moments, 8 PM Black, and Morpheus Brandy. They have heavily driven premiumization by launching high-end single malts like Rampur (priced up to ₹2,000+).

- Strategic Advantage: Radico is nearly 100% integrated backward in ENA. Their template—backward integration, high premiumization, and export scaling—is what other companies are attempting to replicate.

4. United Spirits (USL)

USL is recognized for having possibly the best Prestige and Above portfolio in the industry, with an 89-90% P&A mix. Their Net Sales Value per case has already improved significantly (from ₹1,351 to ₹1,800).

- Challenge: Because USL is already highly premiumized, there is less room for incremental “alpha” or margin improvement from mix changes.

- Risk: The recent tax hike (>50%) on IMFL by the Maharashtra government poses a significant risk, as 15% to 20% of USL’s revenue comes from the state, potentially causing flat or degrowth for the next 6-9 months.

5. Tilaknagar Industries

Known primarily for its brandy business (Mansion House), Tilaknagar is a market leader in Andhra Pradesh.

- Acquisition: Tilaknagar recently acquired the Imperial Blue brand from Pernod Ricard. This is a strategic move, as Imperial Blue is a Whiskey brand (a high TAM category), and its ₹3,000 crore revenue will more than double Tilaknagar’s stand-alone revenue of ₹1,500 crore, making the resulting entity a ₹4,400 crore company.

- Near-Term Risk: The Imperial Blue brand has lower EBITDA margins (10-11%) compared to Tilaknagar’s current 18-19%, which will cause near-term margin dilution. Furthermore, the company’s tax rate is expected to return to 25-30% soon, as zero/negative taxation driven by carry-forward losses will cease.

6. Associated Alcohols

A smaller player, Associated Alcohols (EBITDA 11-13%), recently saw its growth largely driven by Ethanol capacity scale-up (revenue increased from ₹43 crore to ₹247 crore in one year).

- Key Tracker: The company needs to focus on brand creation, as proprietary IMFL brands yield much higher margins (15-18%) than licensed brands (12-15%) or IMIL (9-11%). Currently, proprietary IMFL revenue is only about 13% of its total revenue, and investors should track how quickly it moves toward the 25-30% mark.

Market Share of Alcohol Companies

Global Headwinds and Long-Term Risks

While the Indian market is dynamic, global peers like Diageo and Pernod Ricard have seen their stock charts decline by 30-36% over the last five years.

A significant long-term risk to be aware of is the potential for volume degrowth driven by pharmaceutical trends, such as the increasing availability of GLP-1 (obesity drugs). If these drugs reduce the demand for frequent consumption (as has occurred in the US), it could pose a risk to the industry 5, 10, or 15 years down the line.

Conclusion

The alcohol industry in India presents a compelling case study in discretionary consumption. For investors, the mental model is clear: seek out companies demonstrating double-digit volume growth in the Prestige and Above categories, coupled with strategic moves toward backward integration and margin improvement. While valuation multiples are often high (FMCG valuations of 40x to 60x are common), the returns generated by companies like Radico Khaitan highlight the potential payoff for successfully navigating this highly regulated, yet profitable, landscape.