Whirlpool of India Ltd is one of the leading manufacturers and marketers of major home appliances in the country.

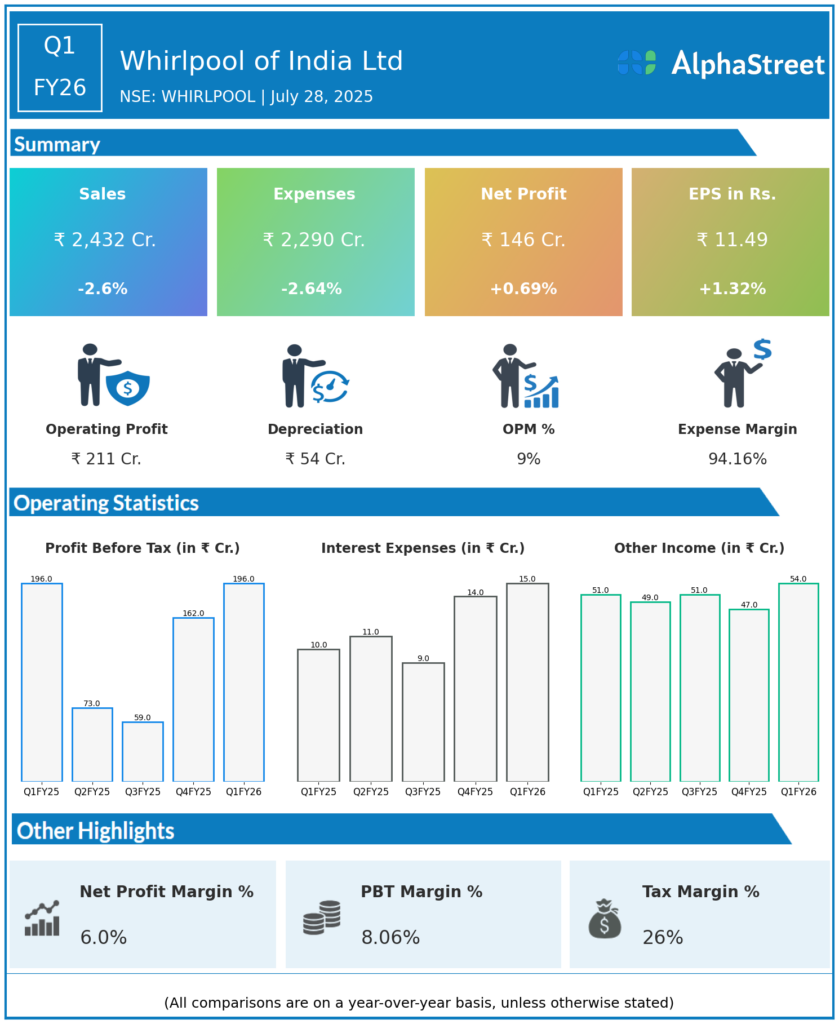

Q1 FY26 Earnings Summary (Apr–Jun 2025)

-

Revenue: ₹2,432.32 crore, down 2.6% YoY.

-

Net Profit (PAT): ₹146.08 crore, nearly flat with a marginal increase from ₹145.25 crore in Q1 FY25.

-

EPS: ₹11.49, up from ₹11.34 in Q1 FY25.

-

Profit Margin: Improved slightly to 6.0% from 5.8% YoY due to lower expenses.

-

Despite a revenue dip, profit growth was supported by cost control and market share gains in refrigerators and washing machines.

-

The company maintained volume despite a weak summer and early monsoon impacting industry demand.

Key Management & Strategic Decisions

-

The company focused on gaining market share in key product categories like refrigerators and washers.

-

Cost discipline and operational efficiencies helped offset adverse industry demand conditions.

-

The management highlighted resilience against seasonal and market headwinds by minimizing volume declines.

-

Recommended final dividend and continued focus on shareholder returns.

-

Outlook anticipates strengthening market position amid consumer durables demand fluctuations.

This performance indicates Whirlpool of India’s ability to sustain profit growth through cost management and market share gains despite revenue pressures and challenging seasonal conditions.

Q4 FY25 Earnings Summary (Jan–Mar 2025)

-

Revenue: ₹2,004.7 crore, up 15.6% YoY.

-

Profit Before Tax (PBT): ₹114.22 crore, up 42.7% YoY and 93% QoQ.

-

Profit After Tax (PAT): ₹79.45 crore, up 24.7% YoY and 78.4% QoQ.

-

Earnings Per Share (EPS): ₹6.10, up 24.5% YoY and 74.3% QoQ.

-

Expenses: ₹1,660.39 crore, up 2.2% YoY but down 2.1% QoQ.

-

The strong profit growth was aided by increased revenue and a gain from an insurance settlement.

-

The Board recommended a final dividend of ₹5 per equity share for FY25.

-

Total expenses rose moderately but were controlled amid revenue growth.