India isn’t a market where you routinely find stocks trading at deep discounts. It’s even rarer to find companies where the cash sitting on the balance sheet is worth more than the entire enterprise value.

Kiri Industries is one of those rare exceptions.

At today’s prices, Kiri Industries has a market capitalisation of roughly ₹3,300 crore. Yet, thanks to a long running arbitration victory against Senda International, the company is expected to receive close to ₹5,000 crore in post tax cash over the coming months. In other words, the market is valuing the operating business at less than zero.

That alone makes Kiri worth paying attention to.

But the story doesn’t end with a legal windfall. To understand whether this discount is justified or temporary, we need to look at three things: the DyStar joint venture and arbitration, Kiri’s legacy chemicals business, and what management plans to do with the cash once it finally arrives.

Kiri Industries: A Brief Background

Founded in 1998 and headquartered in Ahmedabad, Kiri Industries is a manufacturer and exporter of dyes, dye intermediates, and basic chemicals. It operates three manufacturing facilities across India and began exporting as early as 1999, primarily to China and Taiwan.

By the early 2000s, Kiri had earned a two-star export house status and converted its facility into an Export Oriented Unit. Over the next decade, the company focused on backward integration, moving into key intermediates such as Vinyl Sulphone and H-Acid. In 2010, it acquired assets from DyStar, investing roughly ₹100 crore, a decision that would later reshape the company’s entire valuation story.

Today, a significant portion of Kiri’s perceived value comes not from its operating business, but from its stake in DyStar and the outcome of a legal battle that spanned nearly a decade.

The DyStar Joint Venture and Arbitration

DyStar Group is a global leader in dyes and specialty chemicals, with 16 manufacturing plants and a combined capacity of around 176,000 tonnes per annum. It commands over 21% market share globally and serves customers across textiles, leather, performance chemicals, and custom dye manufacturing.

The company itself was formed in 1995 as a joint venture between Hoechst AG and Bayer’s textile dyes business, with BASF’s dyes unit added later. Kiri acquired a 37.57% stake in DyStar in 2010, at an adjusted acquisition cost of about ₹100 crore.

What followed was a slowb urn conflict.

In 2015, Kiri filed a minority oppression suit in Singapore against Senda and DyStar, alleging unfair treatment. Over the years, the case wound its way through multiple courts and appeals. The turning point came in 2018, when the Singapore court ruled in Kiri’s favour, ordering a buyout of its stake.

From there, the numbers kept moving upward.

In 2021, the Singapore International Commercial Court valued Kiri’s stake at USD 481.6 million. Kiri successfully appealed this valuation. In 2023, the Singapore Supreme Court revised the value upward to USD 603.8 million. In 2024, the court ordered an en bloc sale of DyStar through a court appointed receiver, with priority payment to Kiri.

In early 2025, the Supreme Court of Singapore added interest of 5.33% on the USD 603.8 million from September 2023 until payment, along with reimbursement of legal costs of roughly USD 10 million.

All told, the expected post-tax payout works out to approximately ₹5,074 crore.

The court has indicated December 2025 as a hard deadline, though the sale process is expected to conclude earlier. Even today, Kiri’s market capitalisation remains well below the cash it is set to receive.

Kiri’s Core Chemicals Business

Stripping out the DyStar value, Kiri’s standalone operations revolve around dyes, dye intermediates, sulphur, and bulk chemicals.

The company operates across four major dye categories: reactive dyes, disperse dyes, acid dyes, and direct dyes, along with backward-integrated dye intermediates.

Reactive dyes are Kiri’s most versatile offering, widely used in textiles due to their strong bonding with fibres and excellent wash fastness. Disperse dyes cater primarily to synthetic fibres like polyester, offering high resistance to sunlight and heat. Acid dyes, an area Kiri has been developing for over a decade, are valued for their ease of application and bright shades. Direct dyes are water-soluble and prized for their simplicity and adaptability across dyeing equipment.

On the intermediates side, Kiri is backward integrated into key compounds such as Vinyl Sulphone and H-Acid. These intermediates trace their origins back to petrochemical inputs like naphtha and natural gas, giving Kiri better control over supply chains and margins.

While this business has historically been cyclical and competitive, it provides a stable operating base beneath the arbitration-led upside.

What Happens After the Cash Arrives?

The real debate around Kiri isn’t whether value exists today, it clearly does. The question is what management does with the capital once it hits the balance sheet.

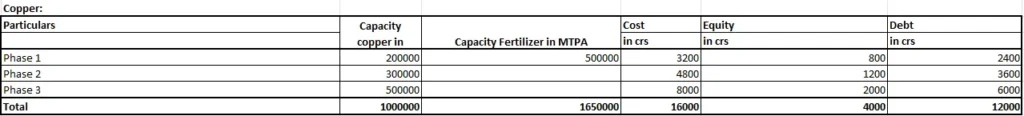

Kiri plans to invest aggressively into new sectors, most notably copper smelting and fertilizers. Management has outlined plans to build a one million tonne copper plant and a 1.65 million tonne per annum fertilizer facility, both to be located in Gujarat.

The total capital outlay over the next five to six years is estimated at around ₹12,000 crore, of which roughly ₹4,000 crore would be equity funded. Phase one and phase two of the projects are expected to come online between FY28 and FY29, with full capacity targeted by 2030.

Environmental clearances for both projects have already been secured. The copper project will include forward integration into copper products, and the business will be led by Mr. Sarkar, a former Birla Copper executive with board-level experience at Hindalco.

With LME copper prices hovering near USD 9,500 per tonne, the opportunity is large but so is the execution risk.

The Capital Allocation Question

This is where Kiri’s story becomes nuanced.

Historically, the company hasn’t been known as a flawless allocator of capital. Diversifying into capital intensive businesses like copper and fertilizers raises legitimate concerns, especially given the scale, cyclicality, and regulatory sensitivity of these sectors.

That said, management has indicated that a reasonable portion of the arbitration proceeds will be returned to shareholders. The promoter has also infused roughly ₹100 crore of personal capital into the company, signalling confidence at a critical juncture.

As the DyStar payout becomes final and clarity emerges around capital redistribution, Kiri’s valuation framework is likely to change materially by year end.

Final Thoughts

Kiri Industries sits at a rare intersection in Indian markets: a company trading below its imminent cash inflow, with optionality layered on top through future projects.

The downside appears protected by hard cash. The upside depends entirely on capital allocation discipline.

If management executes prudently, the current valuation gap may close quickly. If not, the discount may persist despite the windfall. Either way, the next few months will be decisive.

For investors, Kiri isn’t a clean compounder story. It’s a special situation, one where patience, scepticism, and close monitoring matter just as much as the numbers.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.