Wendt India is a leading manufacturer of Super Abrasives, Machining Tools, and Precision Components. It is a preferred supplier for many of the automobile, auto component, engineering, aerospace, defense ceramics customers for their Super Abrasive Tooling solutions, Grinding & Honing Machines, and Precision components.

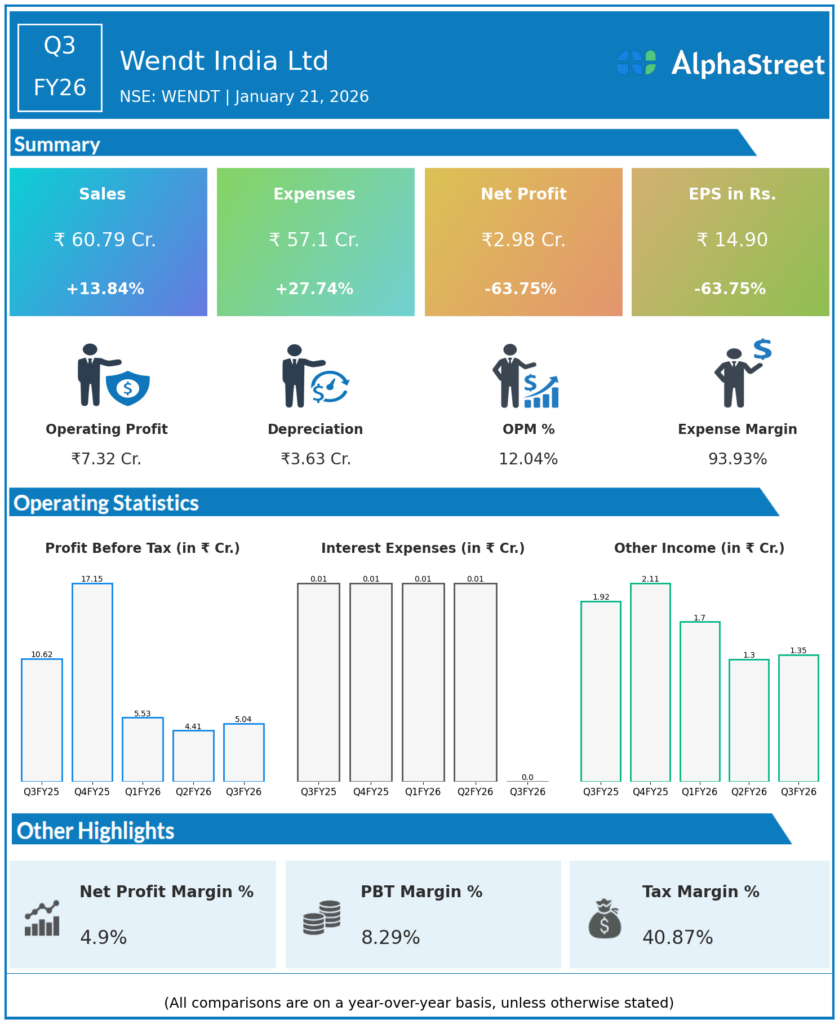

Q3 FY26 Earnings Results

- Revenue from Operations: ₹60.8 crore, up 13.9% YoY from ₹53.4 crore in Q3 FY25; up 17.8% QoQ from ₹51.6 crore in Q2 FY26.

- Total Income: ₹62.3 crore.

- Total Expenditure: ₹55.5 crore.

- Profit Before Tax (PBT): ₹6.8 crore.

- Profit After Tax (PAT): ₹2.98 crore.

- Dividend: Board declared interim dividend of ₹20 per share (200% on face value), reflecting strong underlying performance and confidence in future cash flows.

Management Commentary & Strategic Decisions – Q3 FY26

- Management highlighted robust 13.9% YoY revenue growth driven by strong demand from key sectors including automotive, aerospace, and engineering, with the company’s precision grinding wheels and tools maintaining leadership in high‑margin applications.

- The 17.8% sequential revenue growth demonstrates effective execution amid global manufacturing recovery, with exports remaining a key growth driver.

- Strategic initiatives include continued investment in R&D for specialised abrasives and expansion of international distribution to capture emerging opportunities in EV manufacturing and precision engineering.

- The substantial interim dividend reflects the company’s strong balance sheet, healthy cash generation, and commitment to shareholder returns.

Q2 FY26 Earnings Results

- Revenue from Operations: ₹56.17 crore, up 1.96% YoY from ₹55.09 crore in Q2 FY25; up 8.45% QoQ from ₹51.63 crore in Q1 FY26.

- Total Income: ₹58.44 crore.

- Total Expenditure: ₹55.09 crore.

- Profit Before Tax (PBT): ₹3.35 crore.

- Profit After Tax (PAT): ₹2.70 crore, down 74.74% YoY from ₹10.69 crore; down 28.57% QoQ from ₹3.78 crore in Q1 FY26.

- PAT Margin: 4.8%, down significantly from 19.2% YoY, reflecting severe margin erosion.

- Employee Costs: Up 24.3% YoY, outpacing revenue growth and compressing profitability.

- Exports: Declined 5% YoY, impacted by weaker demand from Indonesia, UK, and Eastern Europe.

Management Commentary & Strategic Directions – Q2 FY26

- Management acknowledged operational headwinds leading to sharp profitability decline, with modest revenue growth unable to offset elevated employee costs and export softness.

- Strategic focus remains on capacity utilisation, product innovation in precision abrasives, and strengthening presence in high‑growth sectors like EV manufacturing and aerospace.

- The company continues to leverage its technology leadership and global distribution network to navigate cyclical challenges in the grinding and tooling industry.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.