Wendt India is a leading manufacturer of Super Abrasives, Machining Tools, and Precision Components. It is a preferred supplier for many of the automobile, auto component, engineering, aerospace, defense ceramics customers for their Super Abrasive Tooling solutions, Grinding & Honing Machines, and Precision components. Presenting below are its Q2 FY26 earnings results.

Q2 FY26 Earnings Results

-

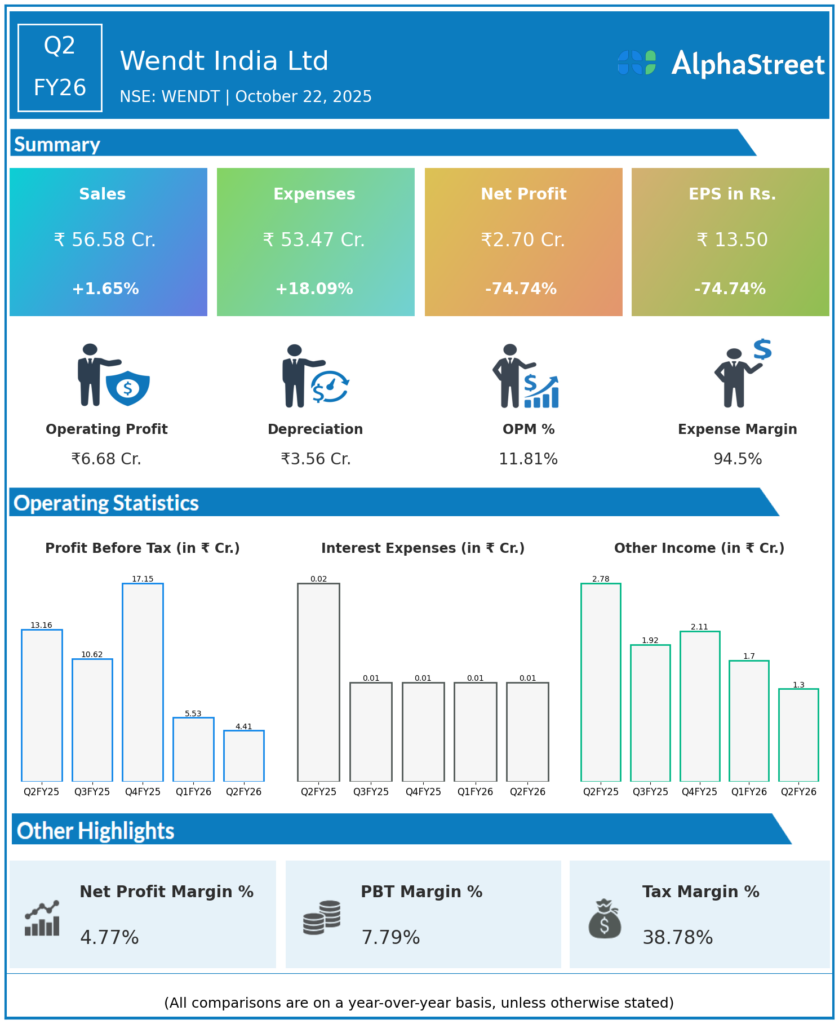

Revenue from Operations: ₹56.6 crore, up 1.6% YoY from ₹55.66 crore and 8.4% QoQ from ₹52.17 crore, reflecting modest topline improvement amid global headwinds.

-

Total Income: ₹57.88 crore vs ₹58.44 crore YoY, largely stable.

-

Operating Profit (EBITDA): ₹6.7 crore, down 63% YoY from ₹18.07 crore, leading to an operating margin of 11.8% versus 22.8% in Q2 FY25, lowest in the last twelve quarters.

-

Profit After Tax (PAT): ₹2.7 crore, down 74.7% YoY from ₹10.69 crore, and down 28.5% QoQ from ₹3.78 crore in Q1 FY26, indicating sharp profitability contraction.

-

PAT Margin: 4.8%, down 1,442 bps YoY from 19.2%, showing severe margin erosion.

-

Standalone Performance: ₹49.86 crore revenue; ₹4.55 crore PAT (down 57% YoY).

-

Consolidated EPS: ₹13.47 vs ₹53.45 YoY.

-

Employee Costs: Up 24.3% YoY, outpacing revenue growth and compressing profitability.

-

Exports: Declined 5% YoY, with weaker demand from Indonesia, the UK, and Eastern Europe amid geopolitical disruptions.

Management Commentary & Strategic Insights

-

Wendt India attributed the weak performance to a lower margin mix of products, lower export off-take, and continued input inflation.

-

CEO’s commentary (media call excerpt):

“Our profitability was impacted due to declining machine tool demand globally and a higher amortization cost for the Wendt brand. Operational expansion and restructuring of product lines are underway to mitigate short-term margin pressures.”. -

The management retained focus on R&D-driven abrasives and super precision segment growth, with new customer engagement pipelines in aerospace and automotive machining.

-

Cost-Control Efforts:

-

Working on supply chain rationalization and automation to drive cost recovery.

-

Planning efficiency initiatives across Coimbatore and Hosur plants to enhance throughput and improve EBITDA from Q3 FY26 onward.

-

-

Balance Sheet: The company remained debt-free, with consolidated cash and equivalents of ₹19.34 crore as of Sept 30, 2025.

-

Outlook: Management expects gradual revenue recovery in H2 FY26 supported by export rebound and normalization in industrial abrasives demand.

Q1 FY26 Earnings Results

-

Revenue: ₹52.17 crore, down 31% QoQ from Q4 FY25’s ₹75.6 crore, indicating seasonal weakness post high base.

-

EBITDA: ₹7.3 crore; margin 13.9%.

-

PAT: ₹3.78 crore, down 51% YoY and 71% QoQ.

-

EPS: ₹18.93 vs ₹53.45 in Q4 FY25.

-

Highlights: Stable domestic sales of ₹38.8 crore offset export softness. Management initiated cost-control actions post Q1 decline

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.