Wendt India is a leading manufacturer of Super Abrasives, Machining Tools, and Precision Components. It is a preferred supplier for many of the automobile, auto component, engineering, aerospace, defense ceramics customers for their Super Abrasive Tooling solutions, Grinding & Honing Machines, and Precision components. The company is JV between 3M (via Wendt GmbH) and Carborundum Universal (Murugappa Group). Both the companies hold 37.5% shares in the company. Founded in 1980 as a joint venture between Wendt GmbH and The House of Khataus, Wendt is a market leader in super abrasives and high-precision grinding solutions. Their major shareholders include Wendt GmbH (37.5%), and Carborundum Universal Ltd. (37.5%). Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

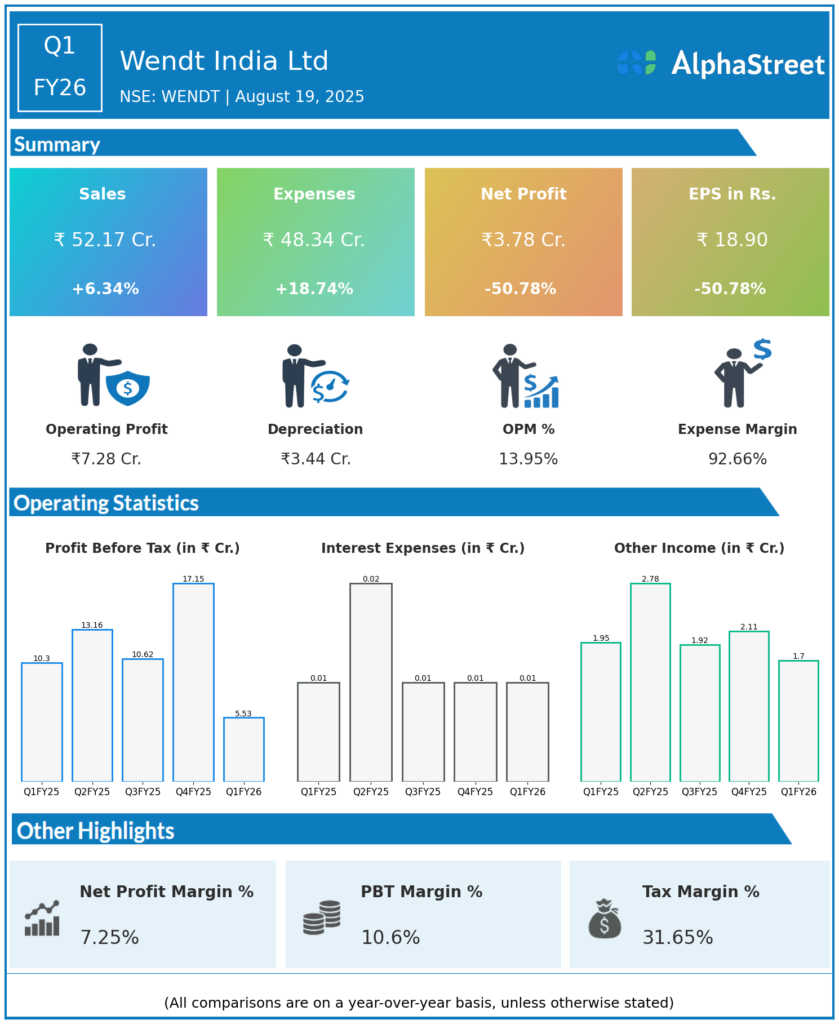

Total Income (Consolidated): ₹52.17 crore, up 6.34% year-over-year (YoY) but down 31% quarter-on-quarter (QoQ).

-

Total Expenses: ₹48.34 crore, up 18.7% YoY and down 11.8% QoQ.

-

Profit Before Tax (PBT): ₹5.53 crore, down 46.3% YoY and 67.6% QoQ.

-

Profit After Tax (PAT): ₹3.78 crore, down 50.8% YoY and 70.6% QoQ.

-

EBIT: ₹5.54 crore; EBIT margin 10.3% (down from 20.2% YoY).

-

EPS: ₹18.9, compared to ₹66.9 in Q1 FY25 and ₹64.45 in Q4 FY25.

-

Net Profit Margin: 7.0% (down from 15.1% YoY).

-

Other Income: ₹1.70 crore, less than Q1 FY25 and Q4 FY25.

-

Standalone Net Sales: ₹47.12 crore, up 6.01% YoY.

-

Consolidated Net Sales: ₹52.17 crore, up 6.34% YoY.

Management Commentary & Strategic Highlights

-

Q1 FY26 profitability was sharply down primarily due to increased expenses and a lower other income base, despite modest YoY sales growth.

-

Management is focusing on cost controls and operational efficiency for margin recovery in coming quarters.

-

No major operational or strategic challenges disclosed for the quarter.

Q4 FY25 Earnings Results

-

Total Income: ₹75.6 crore, up 7.89 percent on the YoY basis

-

PAT: ₹12.89 crore depicting a decline of 4 percent during the same quarter, last year

-

EPS: ₹64.45 vs ₹66.9 during the same quarter last year

-

Sequential trends showed higher income and profitability, highlighting Q1 FY26’s weaker start.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.