Welspun Enterprises Limited (WEL) , formerly known as Welspun Projects Ltd., is a part of the USD 2.7 billion Welspun Group. The Company operates in the infrastructure space with investments in oil & gas. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

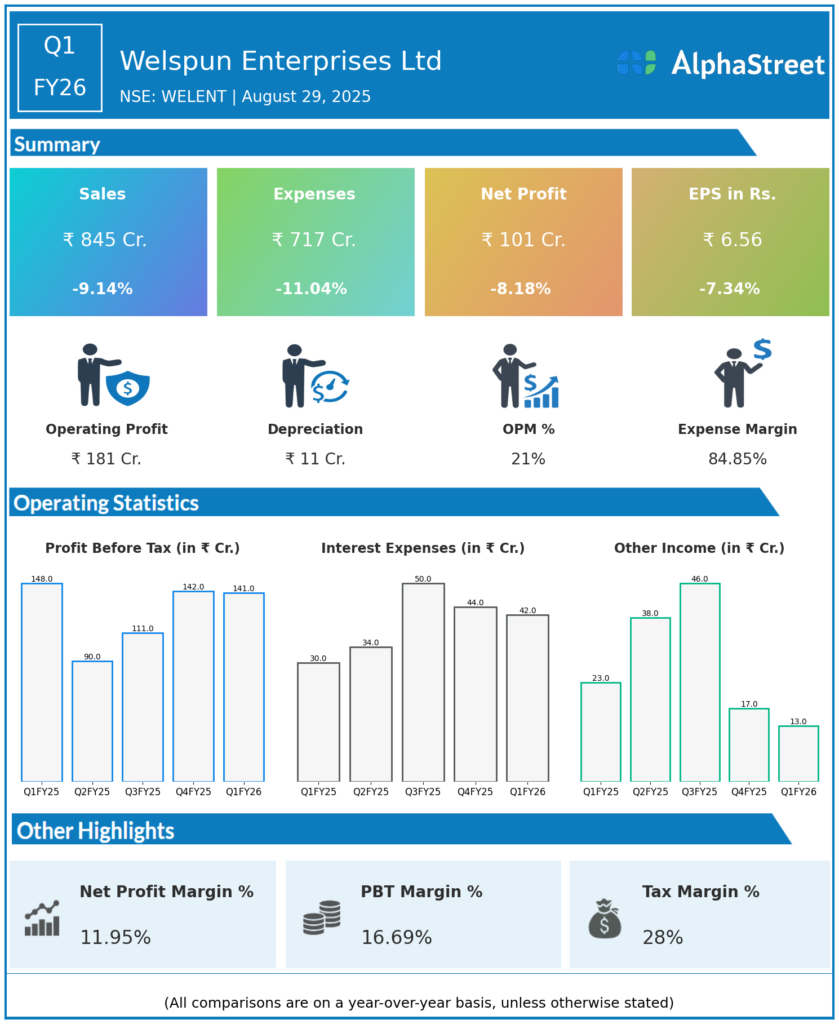

Consolidated Revenue: ₹845 crores, down 9.1% YoY (Q1 FY25: ₹929.96 crores) but stable QoQ (Q4 FY25: ₹866.70 crores).

-

Total Expenses: ₹717 crores, down 11.04% YoY.

-

EBITDA: ₹182.18 crores, up 12% YoY (Q1 FY25: ₹162.99 crores); margin expanded to 21.6% (Q1 FY25: 17.5%).

-

Operating Profit (EBIT): ₹154.75 crores, nearly flat YoY.

-

Profit After Tax (PAT): ₹101.17 crores, down 8.18% YoY.

-

Earnings Per Share (EPS): ₹6.56, down 7.34% YoY (Q1 FY25: ₹7.10), but up 32% QoQ (Q4 FY25: ₹5.00).

-

Tax Expense: ₹40.09 crores, up 6.1% YoY.

-

Segment Revenue (Q1 FY26): Transport ₹316 crores (down 43% YoY), Water ₹310 crores (up 38% YoY), Tunneling & Rehabilitation ₹218 crores (up 53% YoY).

-

Standalone Revenue: ₹604 crores, down 19% YoY; Standalone PAT: ₹117 crores, down 2% YoY. Standalone EBITDA: ₹124 crores, margin 19.5% (up 29bps YoY).

-

Net Worth: ₹2,811 crores; Net Debt: ₹378 crores as of Q1 FY26 (standalone net cash position: ₹988 crores).

-

Order Pipeline: Strong visibility for new water and transport projects guiding optimism for H2 FY26 execution ramp-up.

Management Commentary & Strategic Highlights

-

Management attributed top-line weakness to early monsoon, back-ended revenue guidance (major water project starts post-monsoon), and absence of a one-time claim that lifted Q1 FY25.

-

Strong margin expansion is from better project mix and disciplined cost optimization, especially in water/tunneling segments.

-

Guidance maintained for EBITDA margins in current range, with expectations of accelerated revenue and profit in H2 supported by robust client order outlook.

-

Balance sheet remains resilient, supporting future growth, asset monetization (notably Aunta-Simaria project targeted for 2x return), and ongoing bid pipeline for infrastructure opportunities.

-

Digital initiatives and capability-building efforts contributing to operational improvements and cost efficiencies.

Q4 FY25 Earnings Results

-

Consolidated Revenue: ₹1,054 crores.

-

Profit After Tax (PAT): ₹105 crores.

-

EPS: ₹6.83.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.